Recent crypto rally driven by 'retail impulse,' says JPMorgan

Like stocks, retail interest in crypto surged in February — potentially contributing to the rally — according to JPMorgan analysts.The analysts noted three primary catalysts for the surge — but said two are already largely factored into the market.

"Similar to equities, we find that the retail impulse into crypto rebounded in February, thus likely responsible for this month's strong crypto market rally," JPMorgan analysts led by Nikolaos Panigirtzoglou wrote in a note on Thursday.

The GMCI 30 Index — representing the performance of the top 30 cryptocurrencies — has risen over 13% year-to-date.

Retail impulse

The analysts said retail impulse is evident from analyzing on-chain cumulative bitcoin flows, distinguishing between small and large wallets, and adjusting for inflows into new spot bitcoin exchange-traded funds. "This adjustment is needed because retail investors' bitcoin holdings that have shifted to the new spot bitcoin ETFs are technically held in larger institutional wallets even if the end-investor is retail," they added.

Another indicator of retail interest in crypto can be seen from the rising popularity of AI and meme tokens, the analysts said. The share of AI and meme tokens in the overall crypto market cap rebounded in February, they added.

Retail interest in crypto also surged towards the end of last year, mirroring the momentum seen in equities during the fourth quarter of 2023, the analysts noted. That surge is corroborated by quarterly reports from traditional brokerage firms such as Block, PayPal, and Robinhood, which offer crypto trading and custody services to retail customers, they said. These platforms experienced increased trading activity and investor flow during the fourth quarter, and similarly, crypto exchanges like Coinbase also noted a rise in trading activity among retail investors during that period, the analysts added.

Three main catalysts

Recent retail impulse could be attributed to three main upcoming crypto catalysts — the Bitcoin BTC +0.34% halving event, the next major upgrade of the Ethereum ETH +2.20% network called Dencun, and the prospect of approval of spot Ethereum ETFs in the U.S. in May — the analysts said.

The first two catalysts, however, are " largely priced in ," while the chance of approval for Ethereum ETFs in May is only 50% , the analysts reiterated.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What's the 'Next Major Development' in AI? Here’s What Leaders from Nvidia and AMD Believe It Might Be

Solana Trader Turns $321 Into $2.18 Million as 114514 Token Skyrocketed

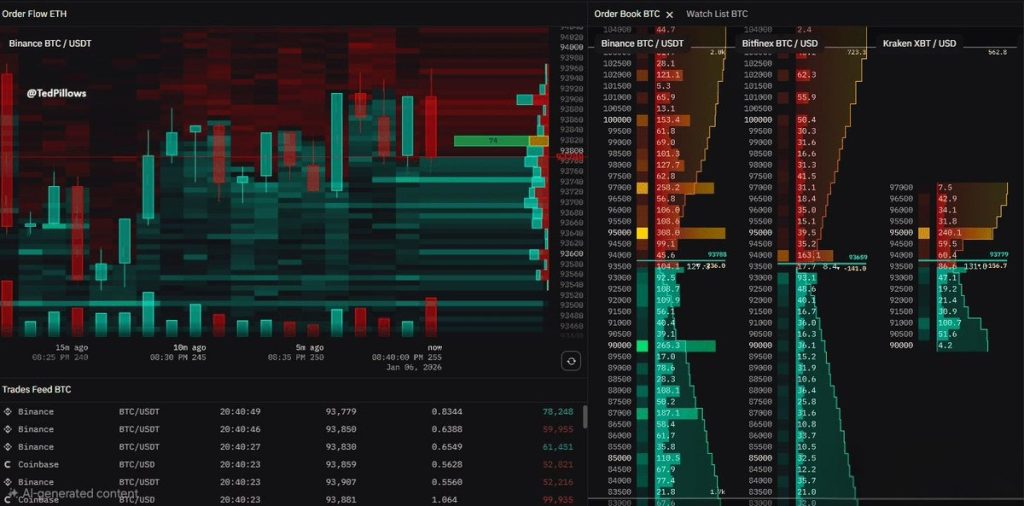

Bitcoin Price Faces Heavy Sell Pressure Near $94,000—Is the BTC Rally Losing Momentum?

China’s Digital Yuan Gets Major 2026 Upgrade: KEY DETAILS