Tap Protocol overtakes BRC20 in 24 hour Bitcoin Ordinals transaction activity

With 645 transactions, Tap Protocol leads the Ordinals network, hinting at a DeFi distruption on Bitcoin.

Tap Protocol, designed to support DeFi applications on Bitcoin Ordinals, has become the most active protocol on Bitcoin’s Ordinals network over the past 24 hours. Genii Data indicates Tap Protocol handled nearly double the transactions of BRC-20 or OrdDefi.

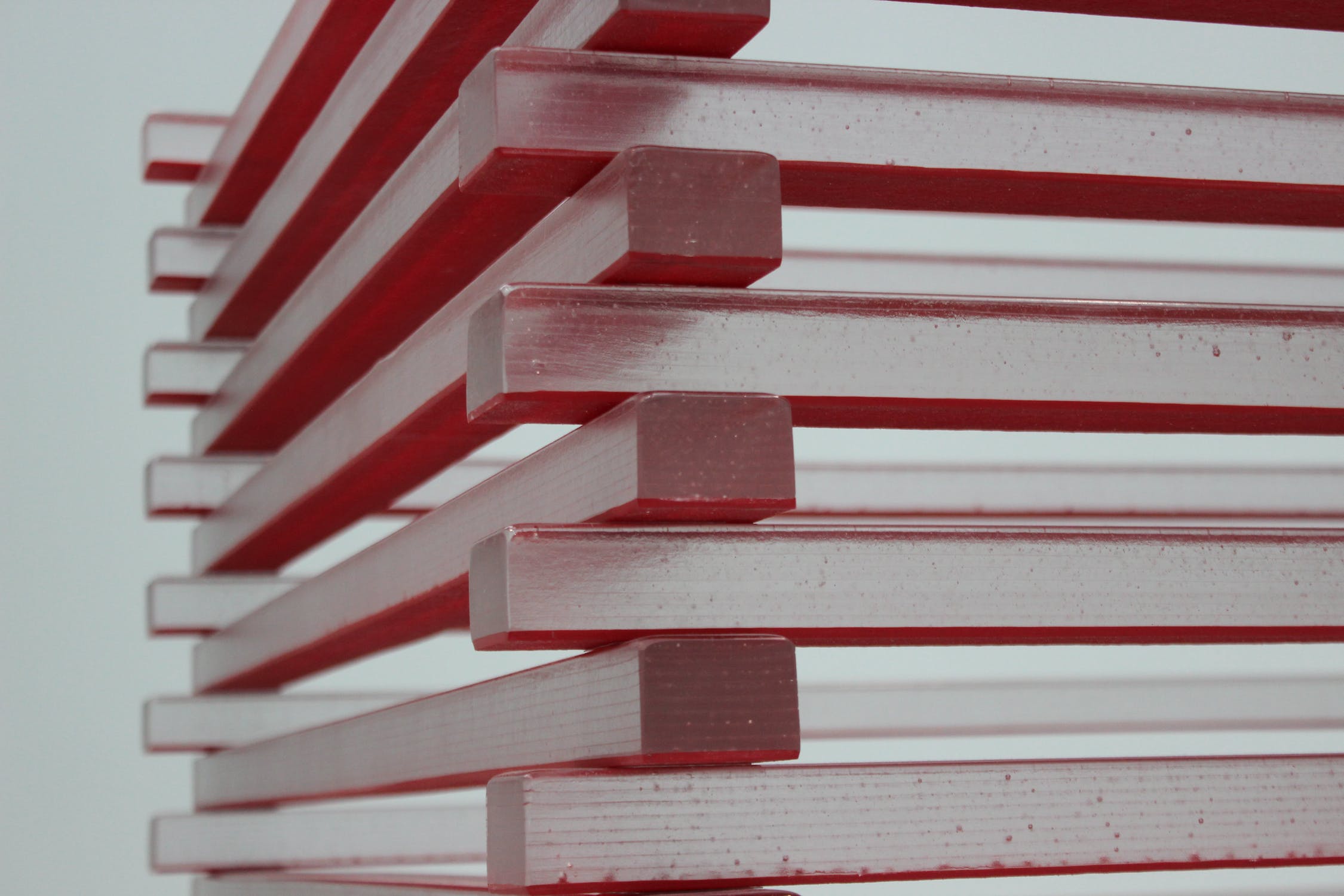

Ordinals activity (Source: GeniiData)

Ordinals activity (Source: GeniiData)

While Genii tracks BRC20 activity separately from other protocols, the total activity of all tokens over the past 24 hours comes to 297, while Tap saw 645 transactions.

Further, in terms of market cap, Tap Protocol’s native token, TRAC, is now just behind other Ordinals-related tokens with listings on major exchanges. A surge in user adoption is a sign of early success for Tap in building a decentralized indexer infrastructure.

Tap Protocol recently completed a $4.2 million funding round led by Sora Ventures, attracting venture capital firms like Cypher Capital and angel investors, including executives from Animoca Brands. This capital will support the expansion of Tap’s developer team and further refine the protocol functionalities, which over 14 projects have already adopted.

Analysts see the increased adoption of $TRAC may drive additional infrastructure for Bitcoin’s Ordinals space, potentially echoing DeFi Summer on Ethereum. A more robust network would incentivize developers, furthering innovation on the Bitcoin network, such as the recent TTP Liquid Fund announced on Feb. 13.

Jason Fang from Sora commented on the growth of Tap on X, stating,

“All these data are signs that we’re already on our way to build a fully decentralized indexer economy! The more holders, the more infrastructure supporting $TRAC, the more robust the TAP protocol gets, and the more developers we’ll attract to Bitcoin!”

Tap Protocol’s dominance in Ordinals transactions highlights the liquid landscape of development on the Bitcoin network. With the continued focus on Bitcoin, including companies such as MicroStrategy pivoting to a Bitcoin development company, the spotlight is clearly on Bitcoin protocols.

Disclaimer: Sora Ventures is an investor in CryptoSlate.

Mentioned in this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decrypting Lumoz: How to Build the Technology and Business Strategies for a ZK-Rollup Ecosystem

This article will analyze Lumoz's ecosystem development strategy and business competition strategy to explore how new players should enter the ZK-Rollup ecosystem track in the right way.

Vitalik on Ethereum's Possible Futures (VI): The Splurge

In the design of the Ethereum protocol, about half of the content involves various types of EVM improvements, while the remaining part consists of a variety of niche topics. This is what "prosperity" means.

The New Cycle and Old Rules of Crypto VC

As mergers and acquisitions and IPOs become mainstream exit strategies, and as LP types diversify and fund cycles lengthen, will crypto VCs—especially those in Asia—see a rebound at the bottom of the new cycle?

Vitalik's latest research: How must LSDFi protocols and liquidity change to enhance decentralization and reduce consensus overload?

This article will mainly focus on two major issues currently facing LSDFi protocols and liquidity pools: the centralization risk posed by node operators and the unnecessary consensus burden.