SEC Delays Decision on Invesco-Galaxy Spot Ethereum ETF Proposal

May 23 continues to be a significant date for the approval of spot Ethereum ETFs, representing VanEck’s final deadline for approval.

The United States Securities and Exchange Commission (SEC) has again delayed its decision on whether to approve or not a joint spot Ethereum exchange-traded fund (ETF) proposed by Invesco and Galaxy Digital.

This marks the second postponement after a similar delay in December and aligns with the SEC’s recent trend of pushing back deadlines for Ethereum ETF proposals.

SEC to Institute Proceedings

According to a Tuesday filing, the SEC indicated that it was “instituting proceedings,” delaying the decision-making process on the proposed ETF.

“Institution of proceedings is appropriate at this time in view of the legal and policy issues raised by the proposed rule change,” the filing stated.

The agency has also extended deadlines for other spot Ethereum ETF proposals, including one from Grayscale Investments. Similar to its inquiry with Grayscale, the SEC raised questions regarding Ethereum’s proof-of-stake mechanism and the potential for concentration of control or influence by a few entities. These factors could pose unique concerns related to fraud and manipulation.

The SEC can extend the Invesco-Galaxy spot Ethereum ETF review period for up to 240 days before reaching a final decision. Invesco filed the proposal with the commission in October 2023, and it was published in the Federal Register in November, setting the deadline for the SEC’s decision to July 2024.

Meanwhile, stakeholders have a limited time to submit their comments on the Invesco-Galaxy Ethereum ETF proposal. Comments are due within 21 days, followed by a 35-day rebuttal period, according to the SEC.

Market Analysts Remain Uncertain

The delay in approving spot Ethereum ETFs has left market analysts uncertain when such investment vehicles might gain approval.

While some analysts at Standard Chartered suggest that approval could come as soon as May 23, others, like Bloomberg Intelligence analyst James Seyffart, anticipated the recent delay, stating, “100% expected, and more delays will continue to happen in coming months.”

SEC just delayed @InvescoUS @galaxyhq ‘s #Ethereum ETF. 100% expected and more delays will continue to happen in coming months.

The only date that matters for spot #ethereum ETFs at this time is May 23rd. Which is @vaneck_us ‘s final deadline date pic.twitter.com/gkVZL2QuPK

— James Seyffart (@JSeyff) February 6, 2024

Seyffart emphasized that the critical date for spot Ethereum ETFs remains May 23, which is VanEck’s final deadline for approval.

The SEC’s recent decision to approve several spot Bitcoin ETFs prompted speculation about a similar approach toward Ethereum-based investment vehicles. However, Gensler clarified in a statement that the SEC’s move last month was specific to that cryptocurrency and should not be interpreted as a broader endorsement of cryptocurrency ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer’s philosophy of branding.

App delays and launch sniping: Base co-founder’s token issuance sparks community dissatisfaction

While most major altcoins are showing weakness, Jesse has chosen to issue a token at this time, and the market may not respond positively.

"Crypto bull" Tom Lee: The crypto market correction may be nearing its end, and bitcoin is becoming a leading indicator for the US stock market.

"Crypto bull" Tom Lee stated that on October 10, an abnormality in the cryptocurrency market triggered automatic liquidations, resulting in 2 million accounts being liquidated. After market makers suffered heavy losses, they reduced their balance sheets, leading to a vicious cycle of liquidity drying up.

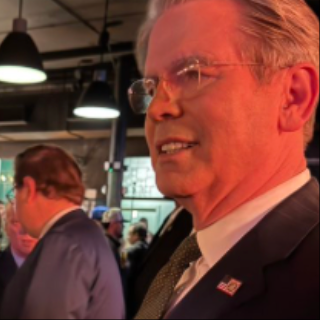

Besant unexpectedly appears at a "Bitcoin-themed bar," crypto community "pleasantly surprised": This is the signal

U.S. Treasury Secretary Janet Yellen made a surprise appearance at a bitcoin-themed bar in Washington, an act regarded by the cryptocurrency community as a clear signal of support from the federal government.