Bitcoin ( BTC ) clung to $42,000 at the Jan. 29 Wall Street open as fresh exchange-traded fund (ETF) outflows began.

Bitcoin launches into FOMC week with promising ETF flows and BTC price action sustaining weekend upside.

Bitcoin ( BTC ) clung to $42,000 at the Jan. 29 Wall Street open as fresh exchange-traded fund (ETF) outflows began.

Data showed BTC price action continuing to retreat from local highs of $42,800 seen over the weekend.

The largest cryptocurrency, fresh from a promising weekly close, faced familiar hurdles into the new week, with outflows from the Grayscale Bitcoin Trust (GBTC) resuming.

These totaled $360 million on the day, per data current at the time of writing — a further decrease from the previous daily tally and roughly 50% of peak daily outflows.

Today's #Bitcoin Sent to out by $GBTC /Grayscale comes out to be ~8.6K $BTC or ~$360M worth.

— Daan Crypto Trades (@DaanCrypto) January 29, 2024

Another decrease from last Friday and about half of what was being sent before.

I think it's safe to assume that flows (on both sides) will slowly cool off from here. https://t.co/wEbbkX6eRU pic.twitter.com/2gtai2dYlK

On the day, Bloomberg Intelligence analyst James Seyffart additionally noted that more than $5 billion had left GBTC since its conversion to an ETF. On Jan. 26, the latest full day’s trading, spot Bitcoin ETFs in total saw net inflows of $759 million despite the GBTC headwind.

Update for the #Bitcoin ETF Cointucky Derby after Friday (11 days). $5 billion out of $GBTC . Newborn 9 still offsetting those outflows with gross flows of $5.8 billion. Giving us net inflows of $759 million. Volume continued to slow. pic.twitter.com/QTJqqI4aoA

— James Seyffart (@JSeyff) January 29, 2024

Per data from asset manager BlackRock, meanwhile, its iShares Bitcoin Trust (iBIT) ETF held more than 52,000 BTC worth over $2 billion on the day.

The numbers were widely circulated on social media, with popular investor Rajat Soni highlighting the scale of the implied buy volume versus Bitcoin’s daily emission.

“Right now only 900 BTC are being issued every day. Blackrock clients alone are buying 2-5x the total daily production of BTC,” he calculated.

Ahead of a frenetic macro week, BTC price action left market participants cautiously optimistic but open to volatility.

Risk assets broadly braced for the United States Federal Reserve’s next decision on interest rates due Jan. 31, this marking the highlight of the week.

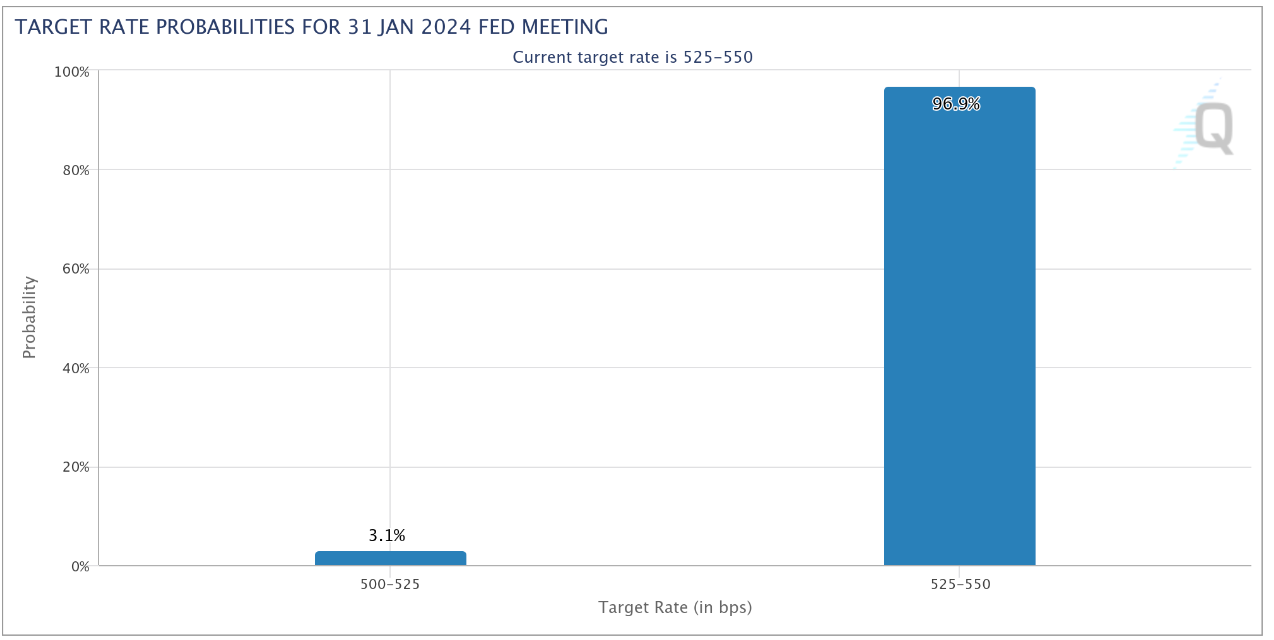

“Currently, the market gives a ~97% chance that the Fed remain on hold at this meeting, and 46% that they cut at March's meeting,” financial commentator Tedtalksmacro wrote in part of a post on X (formerly Twitter) at the weekend about data from CME Group’s FedWatch Tool .

He added that he expected this week’s meeting of the Federal Open Market Committee, or FOMC, to lay the foundations for rate cuts from March onward.

“Overall, I expect this meeting to setup March's decision. And that could move markets very quickly, depending on what comes out of Powell's mouth,” he concluded, referring to the press conference from Fed Chair Jerome Powell which will follow the rates announcement.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

Kiyosaki Predicts Massive Money Printing

ETF Canary Launch Has Little Impact On XRP

Chainlink Dominates RWA With Technical Strength

Bitcoin Price Prediction: Short-Term Bounce On Cards, But With a Twist