Bitcoin ( BTC ) could have dropped $9,000 last week because of a single whale, a new theory suggests.

In a post on X (formerly Twitter) on Jan. 18, James Van Straten, research and data analyst at crypto insights firm CryptoSlate, drew attention to a “massive” entity selling BTC.

1 Bitcoin whale, $100 million profit?

Bitcoin’s 15% dive from $49,000 highs which began on Jan. 11 is widely attributed to a “sell the news” event as part of the United States approval of spot exchange-traded funds (ETFs).

For Van Straten, however, there is a new contender on the radar.

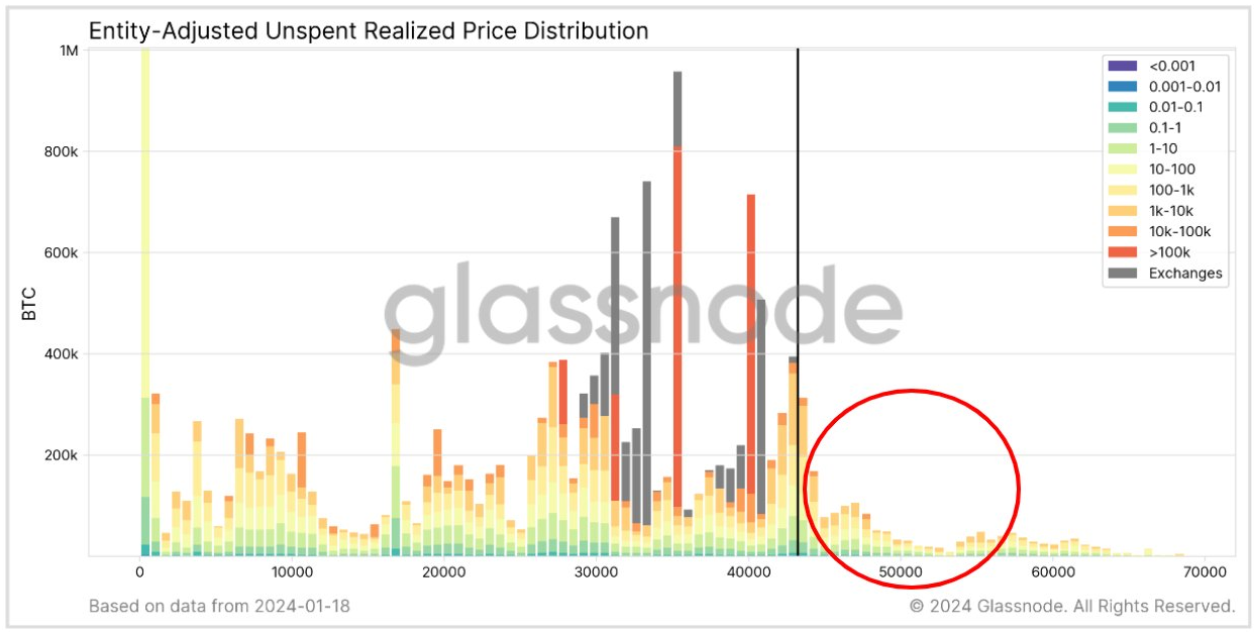

Analyzing the realized price of the BTC supply — the price at which coins last moved — a conspicuous decrease at the highs stands out.

His research implicated an unknown entity in the proceedings. This investor purchased a giant hoard of 100,000 BTC during Bitcoin’s run to all-time highs in 2021, worth $4.8 billion at the time.

Last week, having held the position through the subsequent BTC price drawdown, the whale finally broke even — and the chance to sell at $49,000 was too good to pass up.

“This is why (in my opinion) on Jan. 12, Bitcoin had its largest 1-day drawdown since the FTX collapse and tanked after the ETF started trading,” Van Straten wrote alongside data from on-chain analytics firm Glassnode.

Even with just $1,000 between the entry and exit, the size of the whale’s BTC stack would have netted them a cool $100 million profit — still a worthy prize despite enduring Bitcoin’s longest-ever bear 5f1d76f3-971c-4c23-92f7-07fbd1689f48.

“I assumed they would have held due to holding a 75% unrealized loss,” Van Straten continued.

“Then that sent the market into a frenzy, combined with liquidations, ‘sell the news,’ and record loss-taking.”