Speculation over potential Ethereum ETF approval in May sends ether price surging

There is a 70% likelihood for the approval of a spot Ethereum ETF, Bloomberg Intelligence analyst Eric Balchunas said.The SEC’s first verdict for the spot Ethereum ETF application has a deadline of May 23.Joe Caselin of BIT says he’s seeing a “buy the rumor, ignore the news, buy the next rumor” event.

Over the past 24 hours, the price of ether rose 8% to $2,613 — recording nearly 18% growth in the last seven days. Crypto industry experts say this signifies investor optimism for a potential ether ETF following the SEC’s approval of eleven spot bitcoin ETFs earlier today.

“Starting with BTC ETF, we are seeing a 'buy the rumor, ignore the news, buy the next rumor' set up,” said Joe Caselin, head of institutional marketing at BIT crypto exchange. “BlackRock filed its ETH ETF application in Nov 2023, and while that is a lot less certain than the numerous BTC ETF applications that were just approved, the potential is huge, as it would mark the first such product for ETH, which already has a large appeal with institutional investors.”

BlackRock, expected to launch its bitcoin ETF on Thursday , has a track record of 575 approvals from the regulator and only one ETF rejection. The first final decision deadline for the SEC on the spot ETH ETF application, from Ark and 21Shares, is on May 23 .

Uncertainties remain surrounding the spot Ethereum ETF approval, given the current SEC chair Gary Gensler’s adamant stance that every cryptocurrency other than bitcoin is a financial security. Be that as it may, Gensler’s predecessor, Jay Clayton, once mentioned that a small number of tokens might cease to be considered securities if they became broadly decentralized. Former SEC director of corporate finance William Hinman also said during a speech in 2018 that, considering its decentralized nature, ether coins are not financial securities.

Is a Solana ETF a possibility?

If the SEC decides to approve spot Ethereum ETFs, other large-cap cryptocurrencies — such as Solana — may be next, Rachael Lucas, crypto technical analyst at Australia-based crypto exchange BTC Markets, told The Block. “Although Solana is a comparatively young ecosystem compared to Bitcoin and Ethereum, its noteworthy performance in 2023, marked by positive news and increased developer activity, has captured investor attention. Notably, Solana achieved an impressive price gain of 920%, significantly outpacing Bitcoin's 155% growth in the same period,” Lucas said.

Caselin of BIT shared the same opinion that an Ethereum ETF launch will bring more financial vehicles, giving access to a wider variety of crypto assets. “We might be looking at a whole range of ETFs that provide access to top market cap tokens and projects, although it may make more sense for a top 50 ETF rather than 50 individual ETFs — not unlike an SP 500 for large-cap or 'blue-chip' tokens.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock: Bitcoin Investment Enters a New Phase of "How to Optimize"

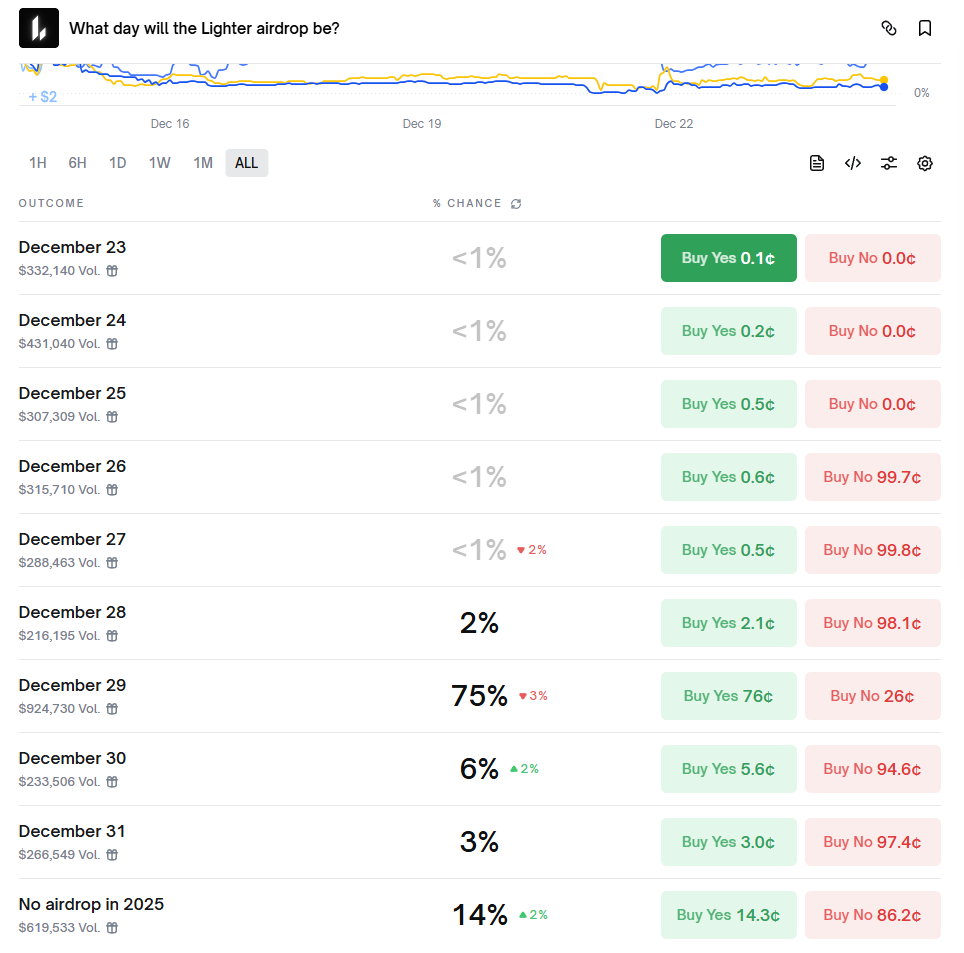

Lighter TGE Coming Soon: Comprehensive Overview of Timing Window, On-chain Signals, and Market Pricing

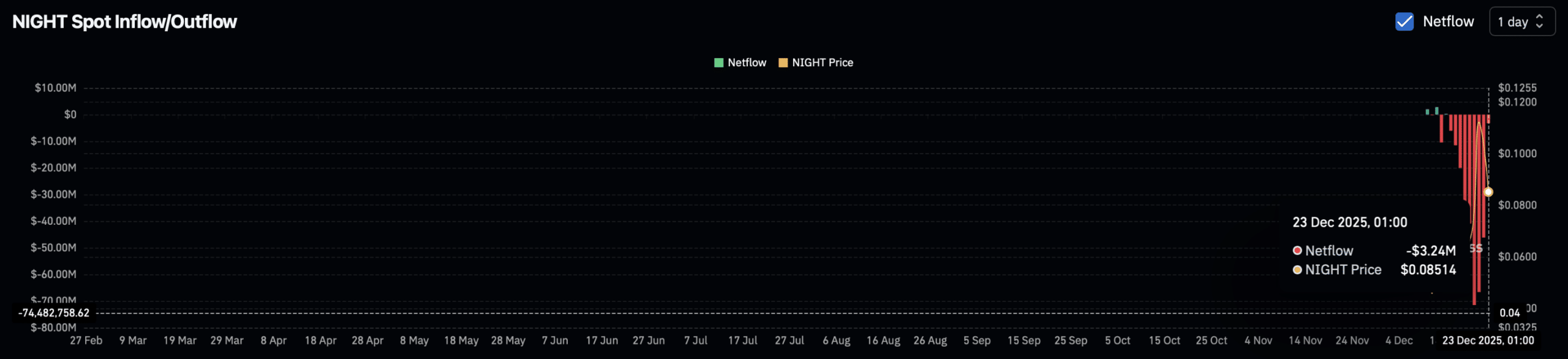

Midnight – Is NIGHT’s pullback just a pause amid 12% OI drop?