A certain whale who was previously long on the ETH/BTC exchange rate reduced their position multiple times within 40 minutes

According to on-chain data analyst @ai_9684xtpa, the whale address that previously went long on the ETH/BTC exchange rate has reduced its position multiple times in the past 40 minutes. The address has cycled through five operations by "redeeming margin > selling to repay loans," accumulating a total of 615.45 WETH exchanged for 30.5 WBTC and repaid into Aave. As each withdrawal of margin further squeezes healthiness, only small-scale operations can be done without external capital intervention. Currently, the healthiness is still only at 1.01, indicating extremely high risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitunix Analyst: Whale Sell-Off Accelerates, Not Panic Yet but Liquidity Gap Poses Risk

Public Chain Activity Ranking for the Past 7 Days: Solana Remains Firmly at the Top

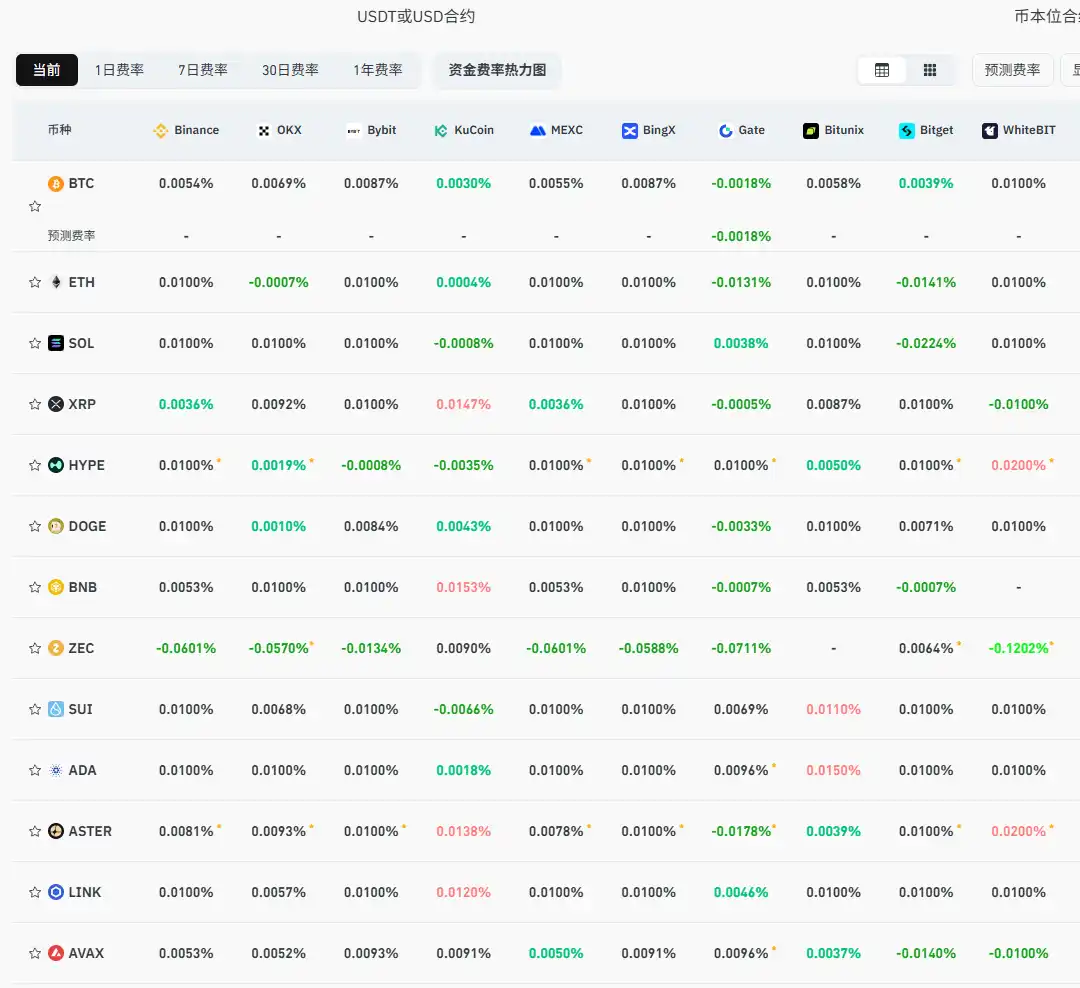

Current mainstream CEX and DEX funding rates indicate that bearish sentiment in the market has weakened.

CoinMarketCap: Launched the decentralized finance index token CMC20