Tokenization benefits ‘light at first,’ but will expand if democratized: NYDIG

The tokenization of stocks won’t immediately be of immense benefit to the crypto market, but the benefits could increase if such assets are allowed to better integrate on blockchains, says NYDIG.

“The benefits to networks these assets reside on, such as Ethereum, are light at first, but increase as their access and interoperability and composability increase,” NYDIG global head of research Greg Cipolaro said in a note on Friday.

The initial benefits will be the transaction fees charged for using tokenized assets, and the blockchain hosting them will “enjoy increasing network effects” for storing them, Cipolaro added.

Tokenizing real-world assets, or RWAs, such as US stocks, has become a hot topic in the crypto industry, with major exchanges, including Coinbase and Kraken, wanting to launch tokenized stock platforms in the US after their success overseas.

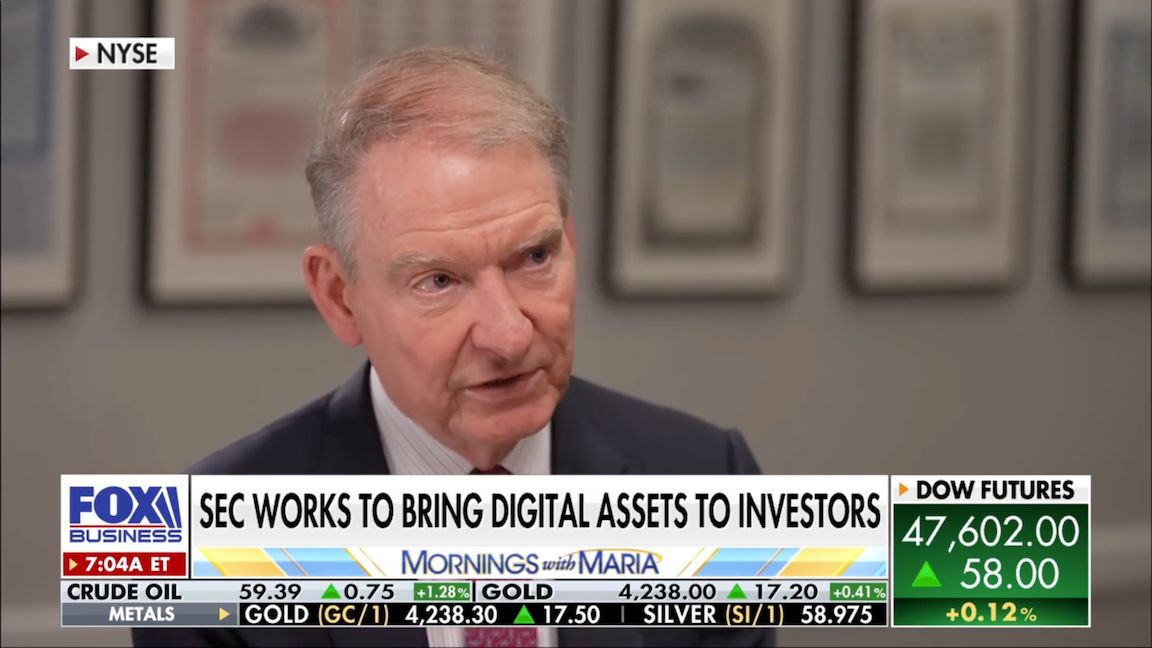

Securities and Exchange Commission chair Paul Atkins said earlier this month that the US financial system could embrace tokenization in a “couple of years,” which Cipolaro said shows that “tokenization is likely going to be a big trend.”

“In the future, one could see these RWAs being part of DeFi (composability), either as collateral for borrowing, an asset to be lent out, or for trading,” he added. “This will take time as technology develops, infrastructure is built out, and rules and regulations evolve.”

Tokenized assets can “differ greatly”

Cipolaro noted that making composable and interoperable tokenized assets isn’t straightforward, as “their form and function differ greatly” and are hosted on public and non-public networks.

The Canton Network, a non-public blockchain created by the company Digital Asset Holdings, is currently the largest blockchain for tokenized assets with $380 billion, or “91% of the total ‘represented value’ of all RWAs,” Cipolaro explained.

Ethereum, meanwhile, is “by far and away” the most popular public blockchain for tokenized assets, with $12.1 billion of RWAs deployed on it, he added.

Related: US financial markets ‘poised to move onchain’ amid DTCC tokenization greenlight

“But even on an open, permissionless network such as Ethereum, the design of the specific tokenized asset can vary greatly,” Cipolaro said. “These RWAs are often securities, broker-dealers, KYC/investor accreditation, whitelisted wallets, transfer agents, and other structures from traditional finance are required.”

He added that even though tokenized assets still need traditional financial structures, companies are using blockchain technology for the benefit of “near instant settlement, 24/7 operations, programmatic ownership, transparency, auditability, and collateral efficiency.”

“In the future, if things become more open and regulations become more favorable, as Chairman Atkins suggests, access to these assets should become more democratized, and thus these RWAs would enjoy expanded reach,” Cipolaro said.

“Investors should pay attention,” he added, “even if the economic impacts to traditional cryptocurrencies are minimal today.”

Magazine: Can Robinhood or Kraken’s tokenized stocks ever be truly decentralized?