Research Report|In-Depth Analysis and Market Cap of GAIB AI (GAIB)

Bitget2025/11/19 10:16

By: Bitget

I. Project Overview

I. Project Overview

Core Concept

GAIB AI is positioned as RWAiFi Infra (Real-World Asset and Decentralized Finance Infrastructure), aiming to bring the AI infrastructure economy on-chain. It integrates computing resources (Compute), AI infrastructure (AI Infra), and robotics technology (Robotics) from real-world assets to offer users opportunities to participate in the AI economy and generate real AI yield. Users can earn these yields by joining AID and sAID within the ecosystem, and the project has launched AI Dollar (USD1).

AID (AI Synthetic Dollar): The core value of the protocol. It is a stablecoin fully backed by U.S. Treasuries and other stable assets. This not only gives AID the characteristics of a stablecoin but also allows it to generate underlying yields (such as Treasury interest) through RWA, making it an interest-bearing stable asset.

sAID (Staking AID): Users can stake AID into sAID to earn dual yields: RWA yield (Treasury interest) and AI Infra yield (GPU utilization and robotics revenue). This is a key token in realizing the RWAiFi model.

As of November 2025, GAIB's RWAiFi model (RWA + AI + DeFi) has deployed tokenized assets worth USD 50.4 million across more than 10 regions, with a project pipeline of USD 2.5 billion.

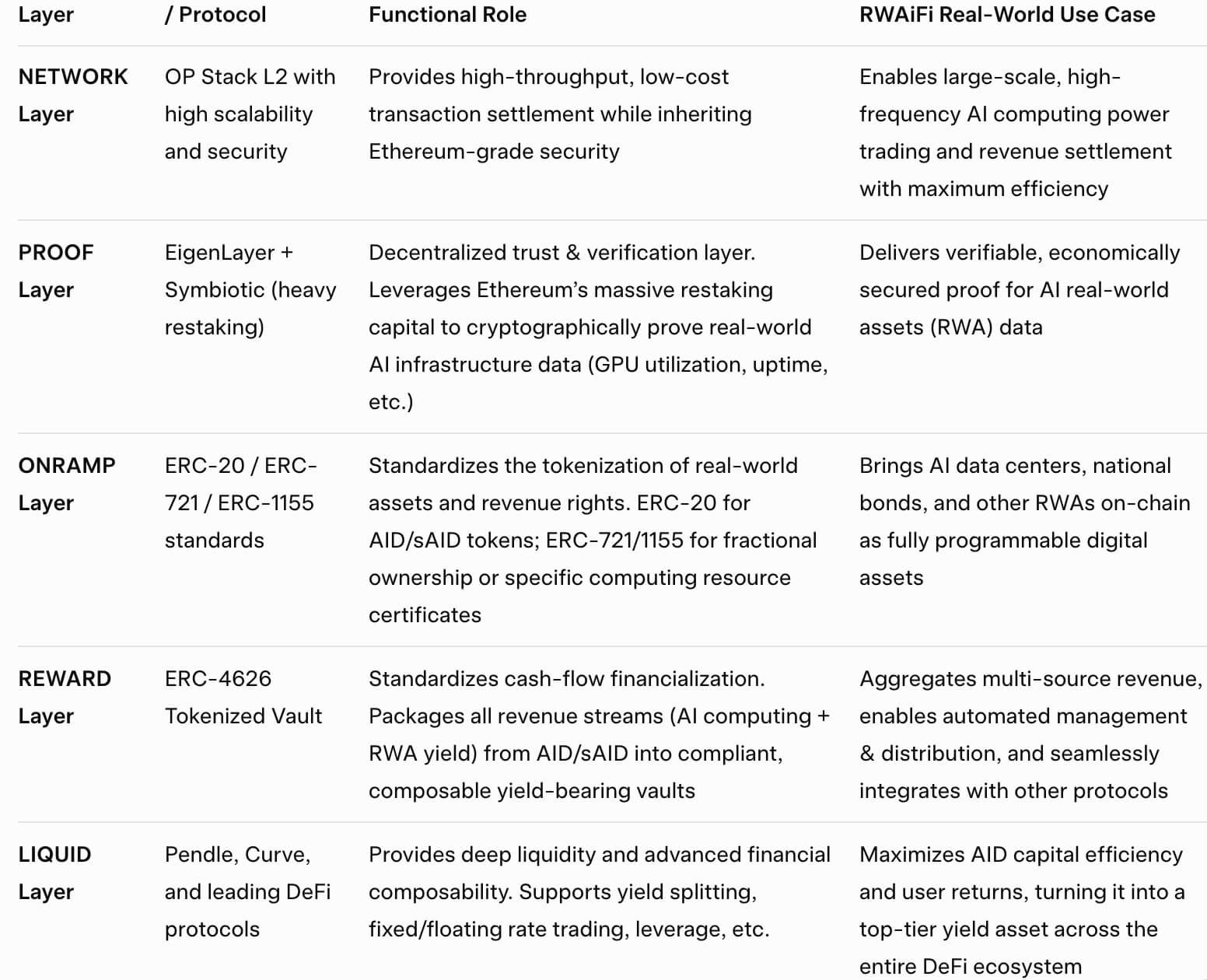

Technical Architecture

GAIB’s core goal is to distribute real yields generated by AI infrastructure (GPU utilization and robotics revenue) to stakers via AID, a stablecoin backed by RWA (U.S. Treasuries and stable assets). The architecture uses a five-layer modular design, with each layer carrying specific functions to ensure security, efficiency, and composability.

II. Project Highlights

Actual Yield Generation: Unlike speculative AI tokens, GAIB provides yields from tangible cash flows, such as a USD 30 million GPU refinancing deal with SIAM AI (Thailand’s sovereign AI cloud deploying 8,000+ NVIDIA H100/H200/GB200 units). Investors earn via the net asset value (NAV) appreciation of sAID, with a current APY of approximately 15% from a diversified GPU and robotics portfolio.

Embodied AI Tokenization: Expanded into robotics in September 2025, partnering with OpenMind, PrismaX, Sahara, and Camp Network to tokenize humanoid robots, drones, and autonomous systems. This creates programmable assets for DeFi applications, targeting a USD 4.44 billion embodied AI market expected to reach USD 23.06 billion by 2030 at a 39% CAGR.

Decentralized Verification Network: Employs stake-weighted consensus with professional certifiers (legal, technical, financial) providing cryptographic proofs for asset existence, location, and performance. Integrated with EigenLayer/Symbiotic for Ethereum-level security without KYC barriers.

Cross-Chain Liquidity: Deployed via LayerZero OFT on Ethereum, Arbitrum, Base, BNB Chain, and Solana to enable cross-chain liquidity. AID/sAID integrates with Morpho lending, Pendle yield trading, and Curve liquidity provision.

Institutional Partnerships: Partners with NVIDIA-preferred collaborators (e.g., SIAM AI controlling 90% of Thailand’s AI hosting), Aethir, io.net, and GMI Cloud. Signed an MoU with Grande Group (NASDAQ: GRAN) on November 18, 2025, to globally finance AI data centers and robotics hardware.

III. Market Valuation Outlook

Based on USD 15 million financing and comparable project valuation multiples of 20–30x, analysts expect an initial market cap of USD 100–200 million (circulating supply), with an FDV of approximately USD 500–750 million.

Comparative Projects:

Aethir/io.net (DePIN): GPU-focused but limited to utility; peak market cap around USD 500 million (2025).

Ondo Finance (RWA): Tokenized Treasuries; market cap over USD 1 billion. GAIB’s expansion into productive AI assets may enjoy a 2–3x premium, with medium-long-term confidence depending on AI adoption.

IV. Economic Model

Tokenomics

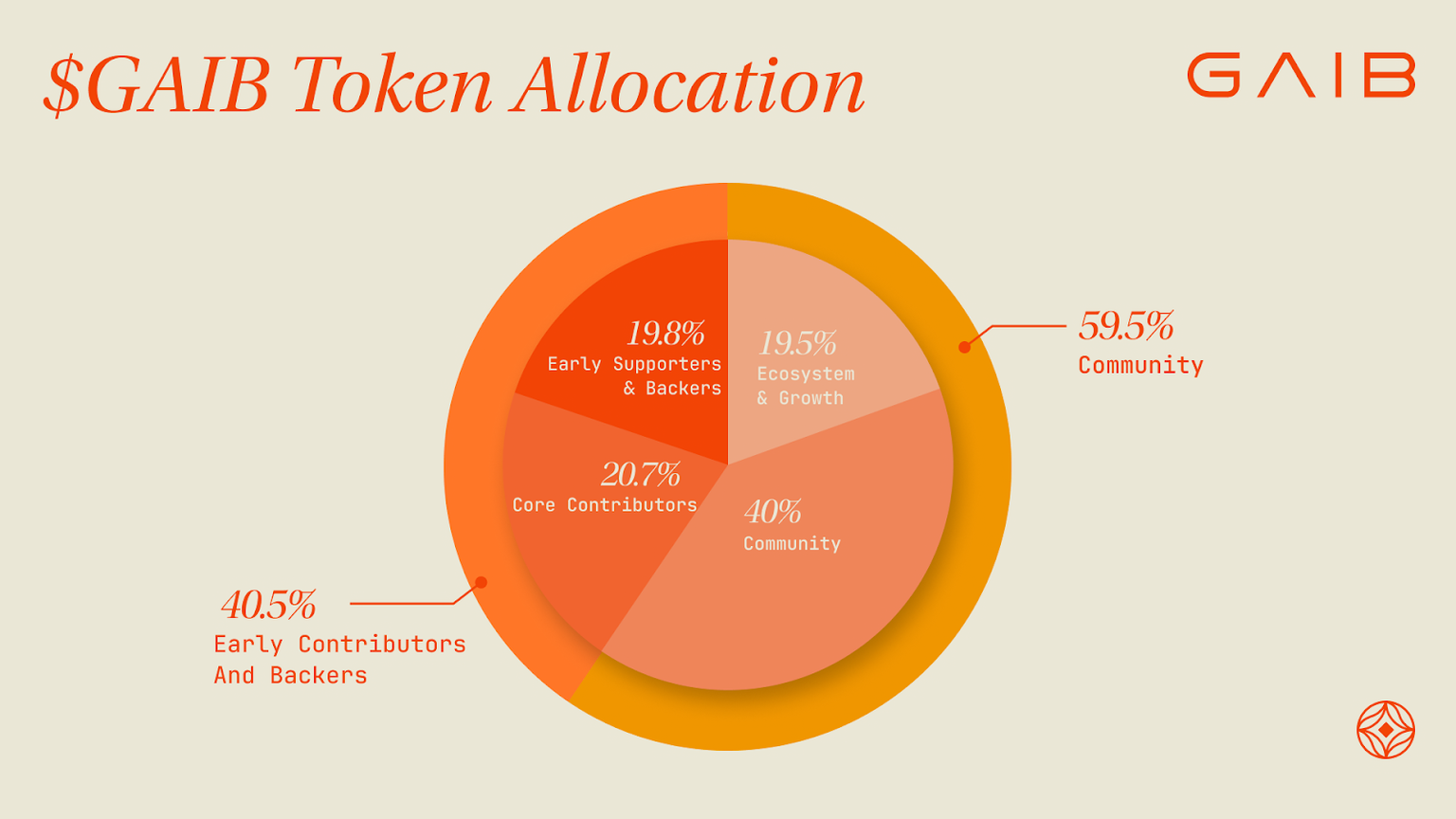

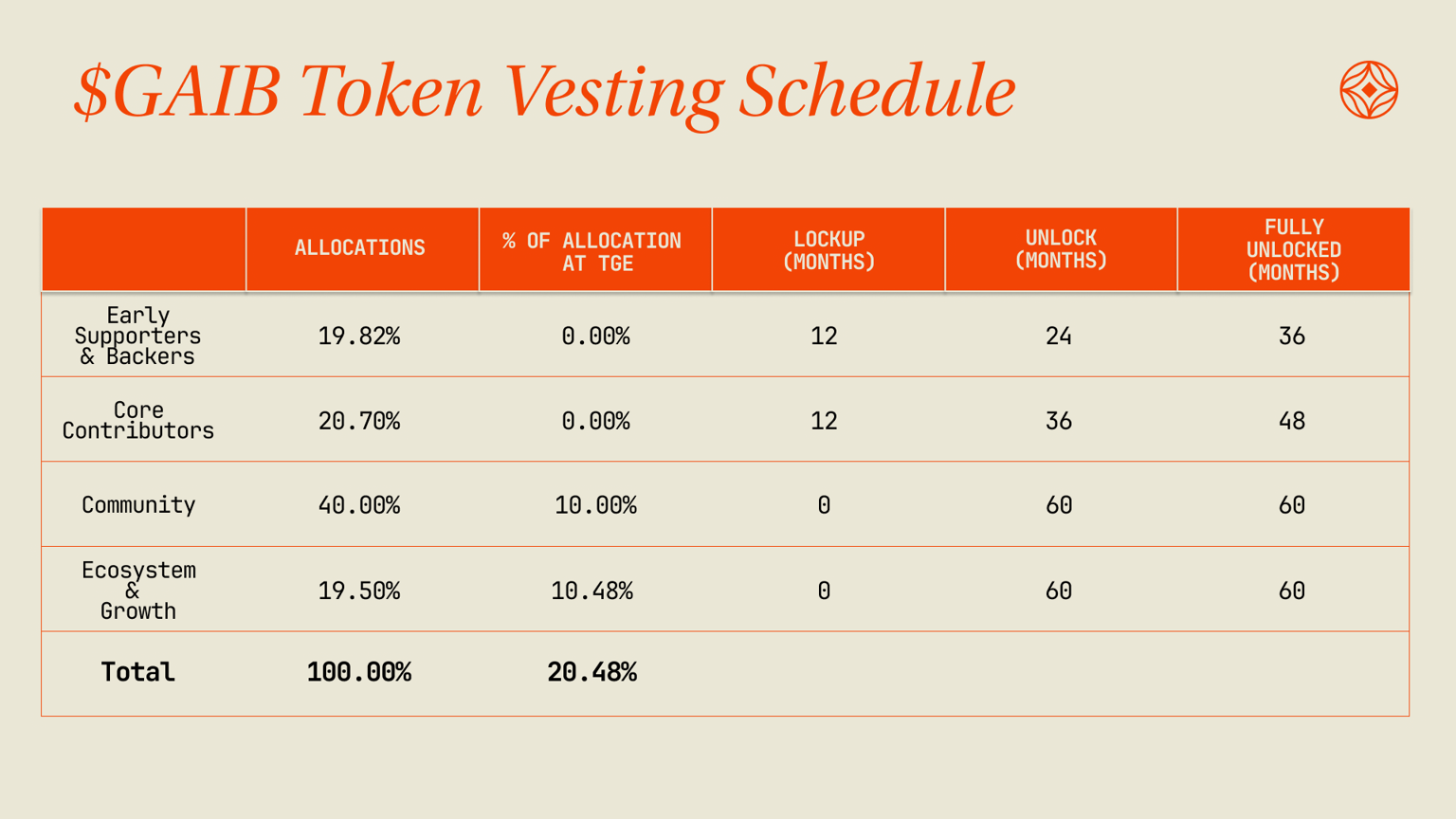

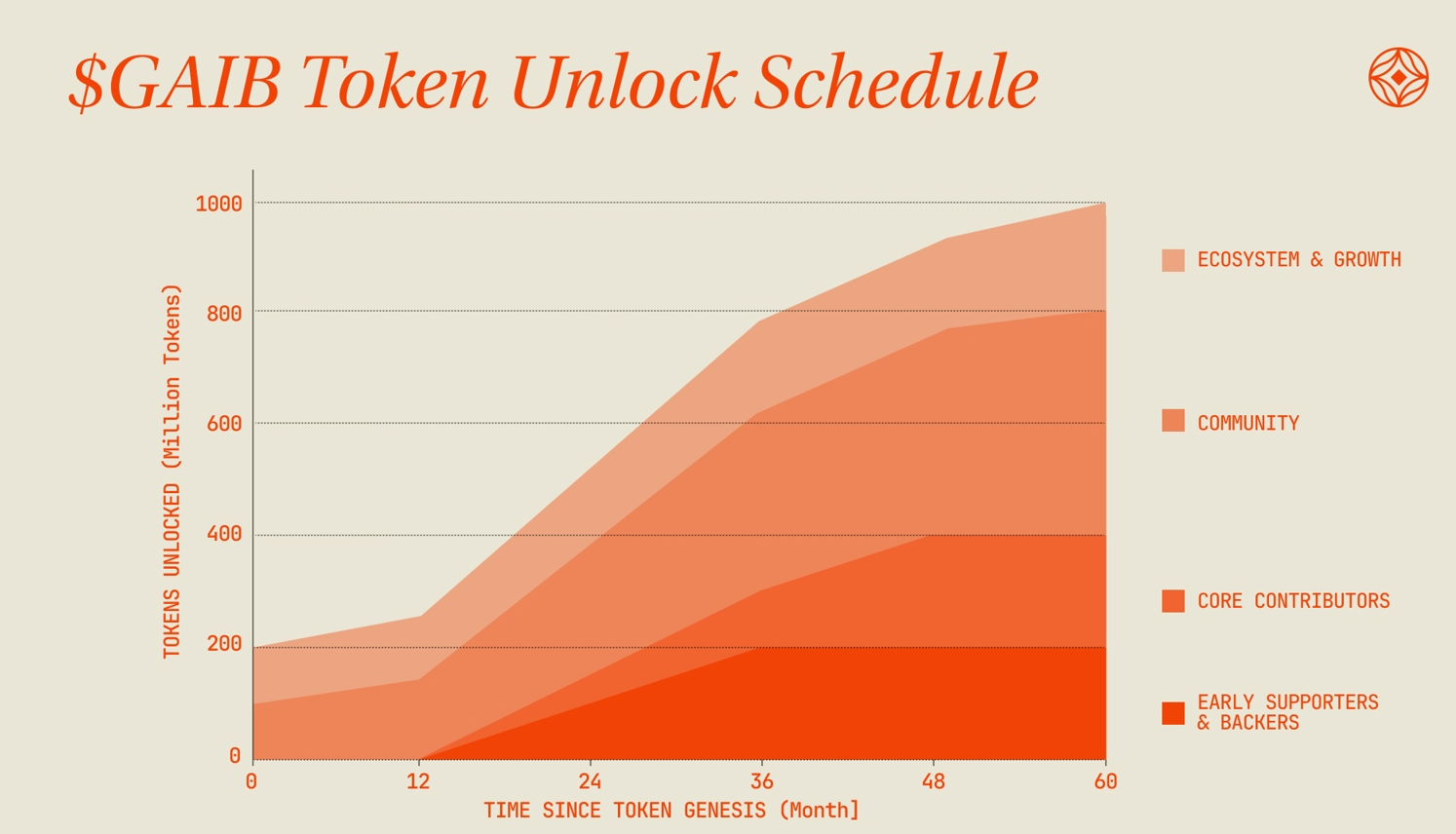

Total Supply: 1 billion GAIB (fixed, non-inflationary) .Initial Circulating Supply: ~204.8 million (20.48%) at TGE on November 19, 2025

Early Supporters & Backers: 19.82%, 0% released at TGE, 12-month lock, then linear release over 24 months (fully unlocked by month 36).

Core Contributors: 20.70%, 0% released at TGE, 12-month lock, then linear release over 36 months (fully unlocked by month 48).

Community: 40.00%, 10% released at TGE, no lock, linear release over 60 months (fully unlocked by month 60).

Ecosystem & Growth: 19.50%, 10.48% released at TGE, no lock, linear release over 60 months (fully unlocked by month 60).

GAIB powers governance, network security, and capital coordination within the ecosystem, aligning interests of validators, users, and partners through a unified utility mechanism.

Governance & Participation: Users can lock GAIB into ve-tokens to gain governance and voting rights, enabling decisions on new RWA classes (GPU, robotics, energy), chain deployments, and protocol fee adjustments.

Network Security & Verification: GAIB staking supports GAIB Active Validator Service (AVS), securing cross-chain transactions and asset proofs (location, custody, proof-of-work). Misbehavior triggers slashing to maintain economic security and integrity.

Ecosystem Access: Stakers have priority access to tokenized GPU segments, robotic asset pools, and AID/sAID allocations. Active participants and veGAIB voters may receive community and ecosystem incentives.

Economic Incentives & Rewards: Part of protocol fees fund validator rewards, treasury reserves, and ecosystem incentives. GAIB encourages user contribution and engagement, ensuring fair returns. Additional GAIB rewards are proportionally distributed based on actual usage, contribution, and transaction activity; inactive users or holders do not receive incentives.

V. Team Introduction

Core Team Members:

Kony Kwong — CEO & Co-Founder: Former top-tier VC, focused on AI and blockchain early-stage investments. Oversees GAIB strategy, capital operations, and ecosystem rollout.

Alex Yeh — Co-Founder: Serial entrepreneur in AI infrastructure, experienced in enterprise cloud platforms. Responsible for AI infrastructure layout, compute network design, and on-chain integration of real-world computing resources.

Jun Liu — CTO: Blockchain architecture expert, experienced in multi-chain protocols, cross-chain communication, and re-staking frameworks. Leads protocol development, validator network construction, and distributed asset proof systems (PoL/PoC/PoWk).

Mathilda Sun — Strategy Lead: VC background, specialized in DeFi, RWA tokenization, and financial structuring. Handles economic models, on-chain capital coordination, market strategy, and key ecosystem partnerships.

VI. Financing

GAIB raised USD 15 million from over 30 blue-chip investors:

Pre-Seed Round: USD 5 million on December 3, 2024, led by Faction, Hack VC, Hashed; participants included Animoca Brands, The Spartan Group, IVC, MH Ventures, Near Foundation, CMCC Global, IDG Capital, Presto Labs, L2 Iterative Ventures (L2IV), 280 Capital, Aethir, and angels such as Daniel Lubarov, Alyssa Tsai, Brian Retford, Michael Heinrich, Lucas Kozinski, Charlie Hu, Chris Yin, Evans HuangFu.

Undisclosed Round: USD 10 million on July 29, 2025, led by Amber Group, to support tokenized GPU and robotics expansion over USD 50 million and initial development of AID Alpha and key partnerships.

VII. Risk Disclosure

Market Risk:

Competition: DePIN and AI infrastructure sectors are competitive, with established players like Aethir and io.net.

AI Market Cyclicality: AI hype cycles may affect demand for infrastructure investment, impacting protocol yields.

Cyclicality: Long-term market sustainability depends on each project’s ability to maintain operations.

Selling Pressure Risk:

High initial circulating supply (>20%) may lead to price discovery and initial selling pressure around TGE. Mid-to-long-term holders should monitor price changes around token unlocks.

VIII. Official Links

Website: https://gaib.ai/

X (Twitter): https://x.com/gaib_ai

Disclaimer: This report is AI-generated, with human verification of information only. It does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

Lock now!

You may also like

Crypto prices

MoreBecome a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now