- SOL price rises 2.3% as Solana teases a major announcement, sparking community speculation.

- Institutional ETF inflows and staking incentives boost SOL’s short-term momentum.

- Solana’s Alpenglow upgrade, currently in the testing phase, aims to improve network speed, efficiency, and adoption potential.

The SOL price has bounced back as Solana fuels excitement with a cryptic teaser hinting at a major upcoming announcement.

The teaser comes at a time when the cryptocurrency market is navigating volatility, and Solana’s price has not been spared as major coins drop.

Solana’s cryptic message

Solana’s official X account has dropped a brief but compelling teaser , simply stating, “Something big is coming.”

The understated message has triggered waves of speculation across social media, with analysts and enthusiasts debating the potential significance of the announcement.

Historical patterns suggest that major updates from leading blockchain networks often impact token performance, and this Solana tease appears designed to generate maximum attention.

Investors are particularly intrigued by the timing, seeing that Solana ranks among the top layer-1 blockchain networks, known for high-speed transactions and low fees, and it has been steadily expanding with DeFi and NFT projects.

Any new development from Solana could strengthen its network capabilities and enhance adoption, making this announcement even more significant.

SOL price rebounds

Following the cryptic message, SOL price has climbed 2.3% to $139.77 at press time, outperforming the broader cryptocurrency market, which has fallen by 0.2% today.

Besides the cryptic teaser, this uptick can also be attributed to a combination of institutional demand and staking-related incentives.

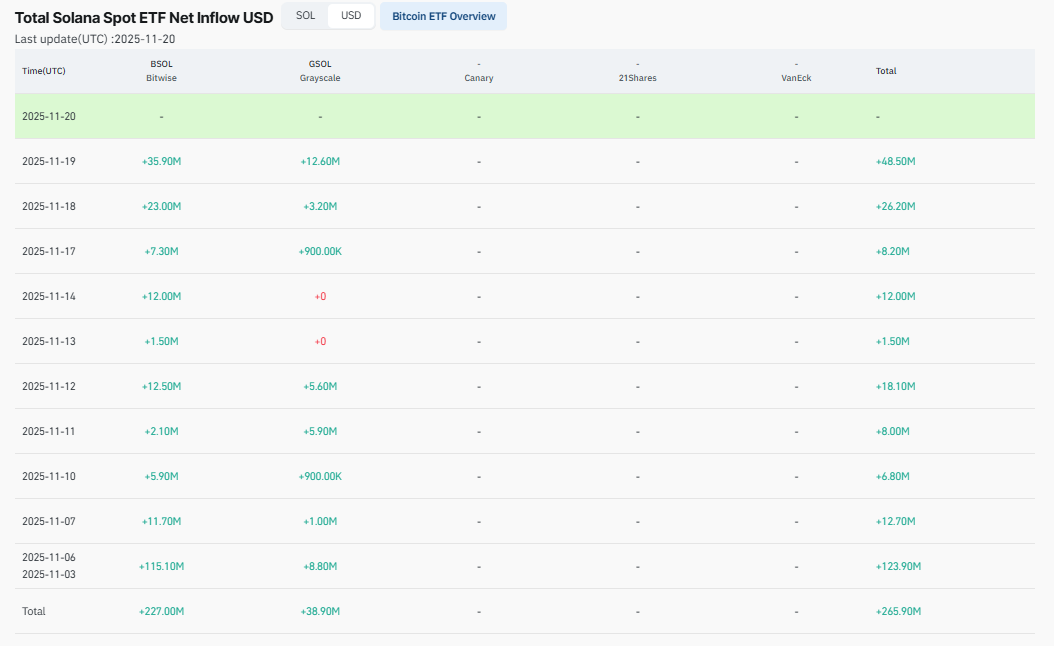

Solana-based ETFs have experienced a total of $265 million in inflows over the past ten days, highlighting institutional confidence as traders rotated capital from Bitcoin (BTC) and Ethereum (ETH) products into Solana (SOL).

Total Solana Spot ETF Net Inflow | Source: Coinglass

Total Solana Spot ETF Net Inflow | Source: Coinglass

The Grayscale Solana Trust ETF (GSOL) has also staked its holdings through institutional validators, offering investors an appealing yield of around 7%, further bolstering confidence in Solana’s ecosystem.

Technical indicators reinforce this bullish momentum with the Relative Strength Index (RSI) rebounding to 35.92 from an oversold region that seems to have encouraged tactical buying.

The altcoin’s price has also rebounded above the 7-day simple moving average at $138.42, suggesting short-term support, though resistance remains at the 30-day SMA of $168.2.

Solana price analysis | Source: TradingView

Solana price analysis | Source: TradingView

While the rebound is positive, sustained momentum will be necessary for SOL to break higher and maintain its gains.

Solana ecosystem upgrades and long-term optimism

Beyond short-term market movements, Solana is pursuing technological improvements that may shape long-term investor sentiment.

The Alpenglow network upgrade, currently in its test phase, aims to reduce transaction finality to 150 milliseconds, enhancing efficiency and scalability.

These improvements address historical congestion issues and strengthen Solana’s position among high-speed, low-cost blockchains.

Combined with staking opportunities through ETFs like GSOL, these upgrades could attract both developers and yield-focused investors, potentially increasing network adoption and overall ecosystem growth.

As the speculation builds, the combination of institutional support, technical rebounds, and staking-driven incentives is contributing to a cautiously optimistic outlook.