Date: Thu, Nov 20, 2025 | 05:30 AM GMT

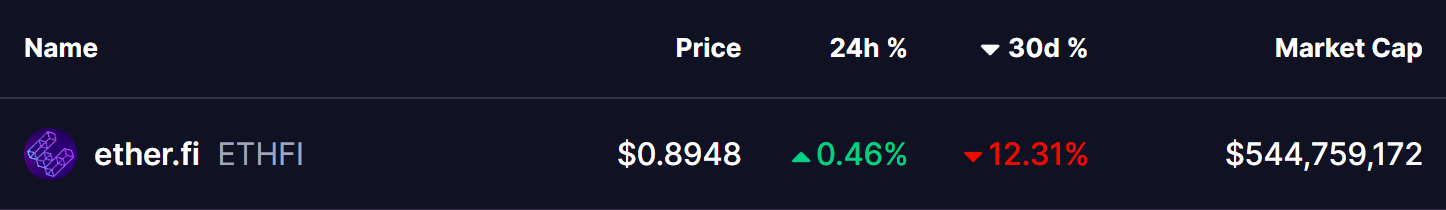

The broader altcoin market continues to remain under pressure as Ethereum (ETH) extends its 30-day decline beyond 21%, dragging sentiment across multiple assets — including ether.fi (ETHFI). Over the same period, ETHFI has slipped nearly 12%, but the chart now hints at a developing structure that could shift the momentum in favour of buyers.

A potential harmonic formation is taking shape, suggesting that a rebound may be closer than it appears.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Signals More Upside

On the daily timeframe, ETHFI is forming a Bearish Butterfly harmonic pattern — a structure known for its tendency to push price upward until the final D-point completes. While the ultimate reversal typically happens at the PRZ (Potential Reversal Zone), the leg moving toward that zone often encourages a steady climb.

The pattern began at Point X near $1.1335, followed by a corrective drop into A, then a bounce into B around the 0.762 Fibonacci retracement. Price later slipped into Point C at $0.8229, marking the key support that is currently holding the structure together.

ether.fi (ETHFI) Daily Chart/Coinsprobe (Source: Tradingview)

ether.fi (ETHFI) Daily Chart/Coinsprobe (Source: Tradingview)

From this C-level, ETHFI has begun to show initial stabilization. The token is now hovering near $0.8949, indicating the early stages of a potential turnaround, though stronger confirmation still remains necessary for a confident bullish push.

What’s Next for ETHFI?

The immediate priority for bulls is a continued defense of the C-support region around $0.8229. As long as price holds above this area, the harmonic pattern remains valid and the possibility of a CD-leg toward higher levels stays intact.

If buyers maintain momentum, the next key test sits at the 40-day moving average, currently at $0.9929. A clean reclaim of this dynamic resistance would reinforce bullish sentiment and increase the probability of a sustained upward leg.

Should ETHFI build enough strength, the journey leads toward the Potential Reversal Zone between $1.2298 (1.272 Fibonacci extension) and $1.3523 (1.618 extension). This area is where the Butterfly pattern completes and typically forms a heavy resistance zone or trend-shifting reversal level.

Failure to defend the $0.8229 support, however, would weaken the harmonic formation and postpone the bullish scenario. A break below this level could expose ETHFI to deeper downside exploration before any meaningful rebound attempt develops.