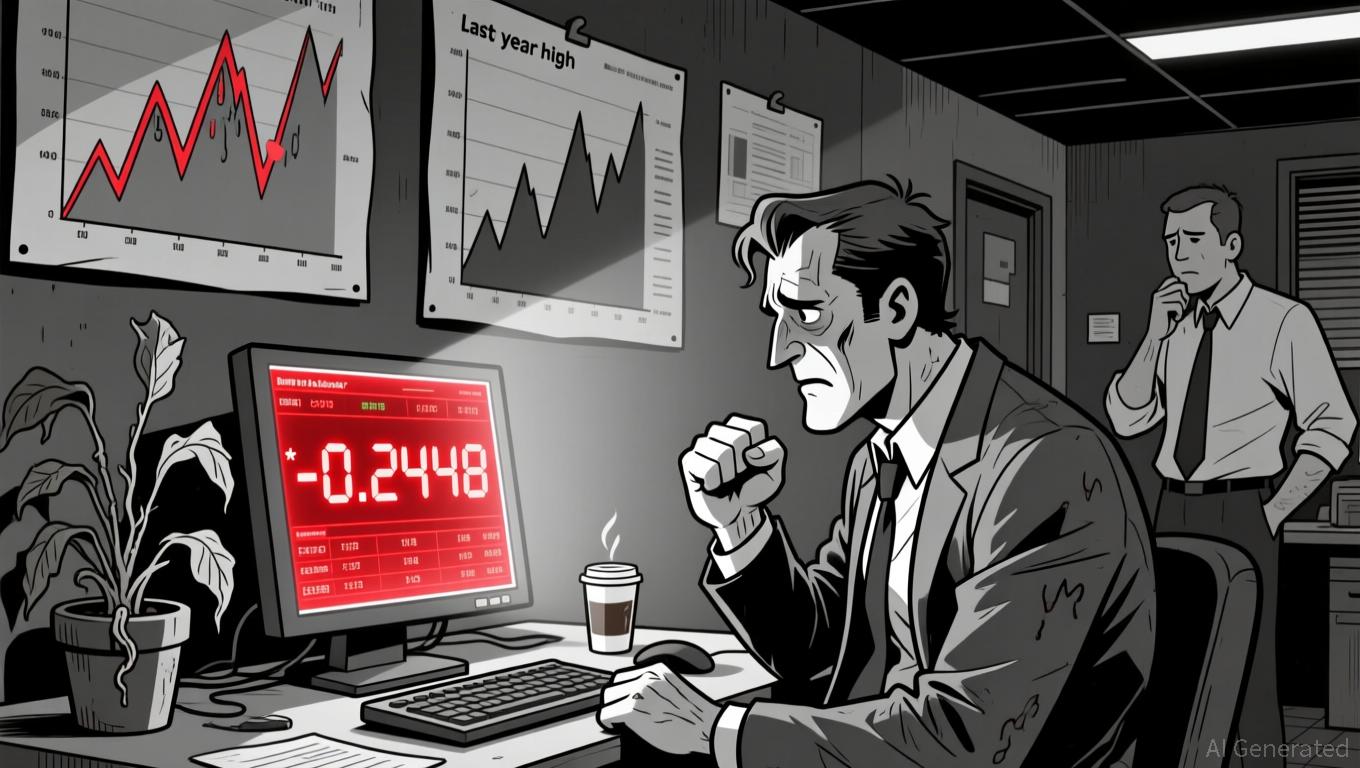

Stellar (XLM) Drops 4.18% Over 24 Hours as Market Fluctuates

- Stellar (XLM) fell 4.18% in 24 hours to $0.2448, with 19.57% monthly and 26.27% annual declines. - The drop reflects broader crypto market volatility, not direct XLM-specific news or catalysts. - While Bitcoin and Ethereum rose, XLM's decline persists independently, lacking short-term momentum. - Analysts cite macroeconomic uncertainty and regulatory shifts as potential future risks for XLM's trajectory.

On November 19, 2025,

The news summary provided covers a range of business and market updates, but none are connected to Stellar (XLM) or its ecosystem. Announcements from organizations like XPLR Infrastructure, Maryland-based firms, Quanex Building Products, and Xometry pertain to unrelated matters such as tender offers, school enrollment statistics, securities lawsuits, and business growth awards. While significant in their own sectors, these developments have no bearing on XLM’s price or direction.

Likewise, updates about Husky Inu (HINU) mention a slight price uptick during its pre-launch period, but this has no direct impact on XLM’s market. The article also points to a general rebound in the crypto sector, with

With no direct news affecting XLM and only broad market commentary available, the ongoing decline seems to stem from general market forces rather than any specific event related to the Stellar network. Experts suggest that ongoing macroeconomic challenges and shifting regulatory landscapes may influence XLM’s future performance, but there are currently no immediate triggers affecting its price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Brazil's Plan to Tax Cryptocurrency Ignites Debate Over Regulation and Investor Protections

- Brazil plans to tax cross-border crypto transfers via IOF expansion, targeting $30B annual revenue loss from unregulated stablecoin flows by 2025. - Stablecoins like USDT , dominating 2/3 of Brazil's crypto volume, face stricter forex rules amid concerns over money laundering and informal currency exchange. - Lawmakers clash over crypto policies: one bill seeks tax exemptions for long-term investors, while another proposes court powers to confiscate crypto linked to cybercrime. - The government's dual st

Bitcoin Updates: UAE’s Holdings in Bitcoin Triple as the Gulf Region Adopts Digital Gold

- Abu Dhabi's ADIC and Mubadala acquired 16M shares in BlackRock's IBIT ETF, tripling ADIC's stake to $518M, positioning UAE as a top Bitcoin holder via ETFs. - The investment occurred before a 20% Bitcoin price drop, with ADIC emphasizing Bitcoin's role as a "digital gold" for portfolio diversification. - UAE's strategy aligns with Gulf trends, including Dubai's Digital Dirham and Saudi Arabia's blockchain partnerships, as sovereign funds increasingly allocate to crypto assets. - Despite institutional int

Evaluating the Drivers and Reliability Behind PENGU’s Recent Rapid Price Increases

- PENGU's 12.8% 24-hour surge to $0.016 is driven by Bitcoin's rebound and NFT ecosystem liquidity spikes. - Proposed PENGU ETF combining tokens with NFTs could attract institutional capital amid 2025 regulatory clarity trends. - On-chain data reveals diverging signals: price gains vs. 33% retracement, bearish MACD, and increased exchange outflows. - Niche tokens like PENGU face liquidity risks despite macro optimism , with $202M 24-hour volume far below major ETF benchmarks. - Sustained PENGU growth requi

Zcash News Today: Zcash’s Advanced Privacy Features Present a Challenge to Bitcoin’s More Straightforward Competitor

- Zcash (ZEC) gains momentum after $59M Winklevoss Capital investment and Leap Therapeutics' rebrand to Cypherpunk Technologies to manage ZEC assets. - Privacy-focused Zcash leverages zero-knowledge proofs to obscure transaction details, attracting developers seeking enhanced confidentiality despite Bitcoin Lightning Network competition. - Q4 2025 Coinholder-Directed Grants Program opens voting (Nov 14-25) to fund ecosystem projects, strengthening Zcash's governance model and institutional credibility. - S