Visa Introduces a Global Stablecoin Platform to Broaden Worldwide Payment Opportunities

- Visa launches stablecoin payout pilot via Visa Direct, enabling real-time USDC transfers to crypto wallets for emerging market gig workers. - Program allows fiat-funded transactions with stablecoin receipts, addressing currency volatility and limited banking infrastructure in regions like Bolivia. - Partnerships with Nium and Wirex expand cross-border solutions, while regulatory compliance via KYC/AML requirements ensures broader accessibility. - Initiative reflects Visa's strategy to bridge traditional

Visa Inc. (V) has introduced a pilot initiative that allows companies to send stablecoin payments straight to consumers’ crypto wallets, representing a notable step forward in its digital asset strategy. Announced at the Singapore Fintech Festival 2025, the program utilizes

Through the pilot, businesses can initiate payments in fiat while recipients have the option to accept funds in stablecoins, enabling nearly immediate international settlements. Cuy Sheffield, Visa’s crypto lead, highlighted the project’s potential to broaden access to financial services, stating, "

In countries like Bolivia, where inflation has spurred stablecoin usage, this feature meets an urgent demand. “People prefer to receive stablecoins because their local money lacks stability,” explained Mark Nelsen, Visa’s head of commercial and money

Collaborations with fintech firms such as Nium and Wirex further highlight Visa’s commitment to this sector. Nium, which provides cross-border payment infrastructure, joined Visa’s stablecoin settlement pilot to update global money transfers, minimizing delays from weekends and reconciliation

The pilot’s initial rollout is focused on U.S. companies and global platforms, with plans to expand further in mid-2026, depending on regulatory progress

Experts see this as a calculated move to address the rising need for digital payment options. Ark Invest, led by Cathie Wood, recently revised its

Visa’s entry into the stablecoin market demonstrates its intention to lead global payments beyond just credit cards. By integrating stablecoin functions into its platform, Visa seeks to connect traditional finance with the crypto world, strengthening the dollar’s influence in a decentralized economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

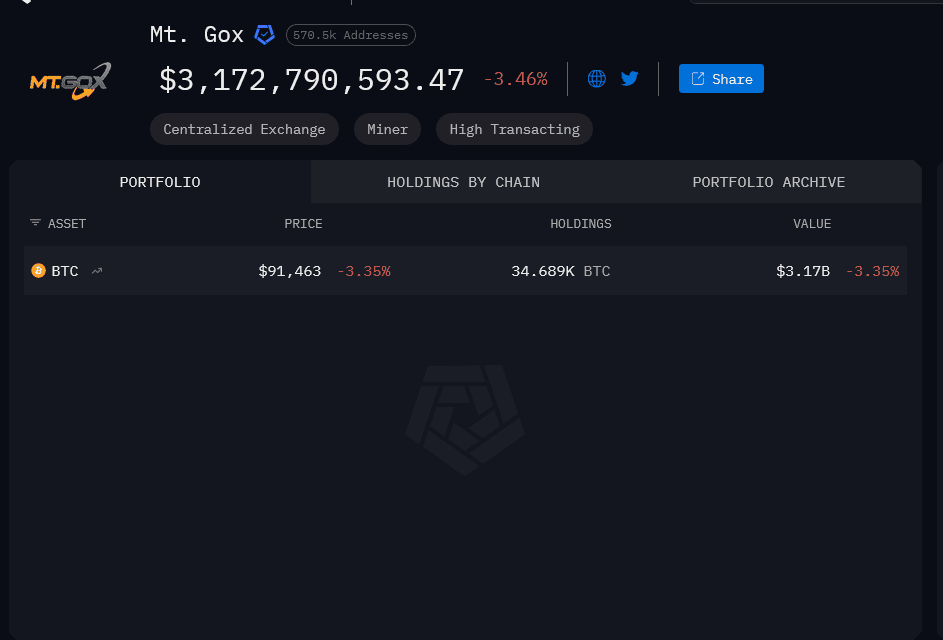

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).