PDD's Rising Profits Fail to Compensate for E-Commerce Expansion Challenges

- PDD Holdings reported mixed Q3 2025 results: $15.21B revenue missed forecasts by $90M despite $2.96 non-GAAP EPS beating estimates by $0.63. - E-commerce growth slowed amid intensified competition in China and U.S. regulatory shifts impacting Temu's operations. - Profitability showed resilience with 14% YoY net income growth to $4.41B, driven by cost discipline and 41% R&D spending increase. - $59.5B cash reserves highlight financial strength, but Q4 revenue projections face risks from pricing wars and g

PDD Holdings Inc. (PDD), which owns China's Pinduoduo and the U.S.-oriented Temu, posted a mixed set of results for the third quarter of 2025. Despite outperforming profit forecasts, its shares slipped 3.6% in premarket trading. The company reported non-GAAP earnings per American depositary share (EPADS) of $2.96, exceeding analyst predictions by $0.63, while total revenue reached $15.21 billion

The revenue miss, which

Nonetheless, the company demonstrated solid profitability.

Cash holdings

Looking forward, PDD's growth outlook remains uncertain due to macroeconomic challenges. While revenue growth

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Markets Today: Bitcoin Slips Below $90000, Yen Eyes Recovery, Gold Hits 1-Week Lows as Markets Brace for US Data

While broader markets fluctuate, specialized crypto-gaming projects are steadily gaining momentum

- Kamirai bridges DeFi and gaming via Kamirex Exchange, a high-speed DEX for Asia's crypto demand, and a PlayStation/Xbox RPG using its token for transactions and governance. - $HUGS meme coin leverages Milk Mocha IP with 60% APY staking, deflationary token burns, and charity-linked revenue, combining viral branding with blockchain utility. - Mutuum Finance's Ethereum-based lending protocol raised $18.7M in presale, offering institutional-grade DeFi solutions with 250% token price growth and 18,000+ holder

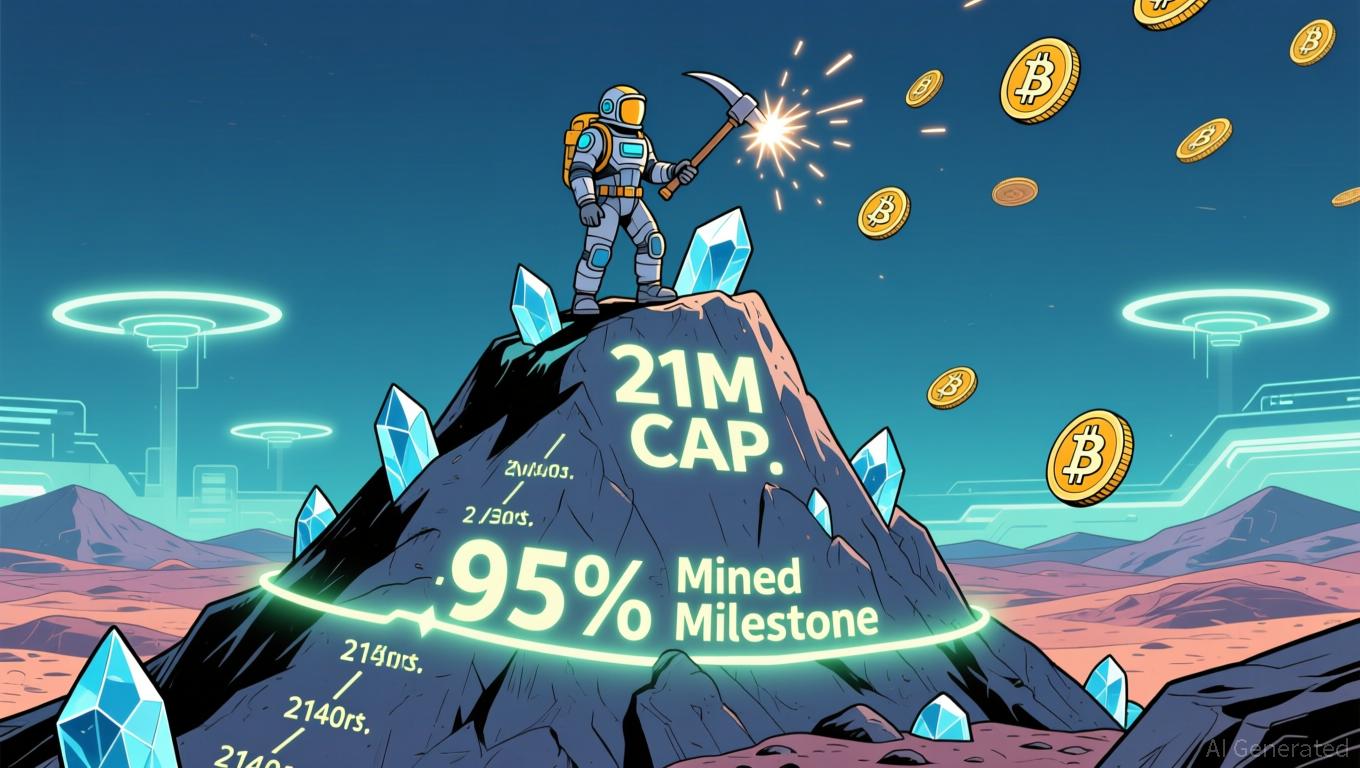

Bitcoin News Today: 95% of Bitcoin's Supply Reached—A Powerful Symbol of Scarcity Triumphing Over Fiat Currency Devaluation

- Bitcoin's supply now exceeds 95% of its 21 million cap, with 2.05 million remaining to be mined by 2140 via halving mechanisms. - The 2024 halving reduced block rewards to 3.125 BTC, intensifying miner reliance on fees as output halves every four years. - Experts highlight Bitcoin's scarcity as a hedge against fiat debasement, though price impacts remain limited as adoption and regulation gain priority. - New projects like Bitcoin Munari aim to replicate Bitcoin's capped supply model while adding program

AI Industry's Contrasting Approaches: C3.ai Faces Downturn While SoundHound Rises on Strong Cash Flow

- C3.ai faces declining revenue (-20% YoY) and widening net losses ($117M Q1 FY2026), driven by margin compression from IPD sales and operational reorganization risks. - SoundHound AI leverages $269M cash reserves to expand conversational AI, achieving 68% YoY revenue growth and strategic acquisitions like Interactions. - Citigroup's strong Q4 earnings ($2.24/share) and dividend hike attract institutional investors, contrasting with AI sector's fragmented performance and valuation challenges. - Divergent A