Date: Sun, Nov 16, 2025 | 05:10 AM GMT

The broader altcoin market is showing some weekend relief after the sharp sell-off earlier this week that dragged Ethereum (ETH) down to $3069 before recovering back toward the $3200 region.

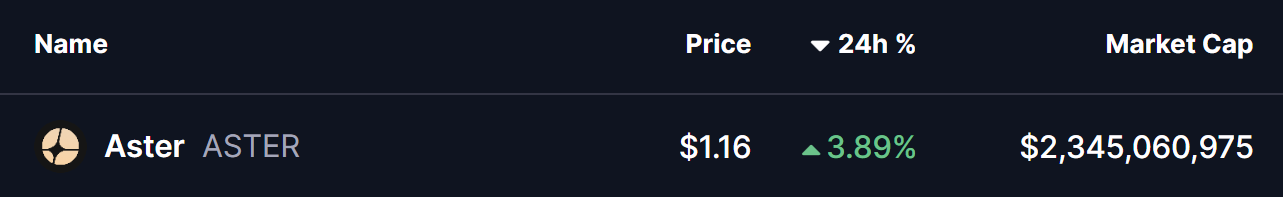

Following this recovery, Aster (ASTER) has also turned green with modest gains, but what truly stands out is its technical structure. The latest chart suggests that a key bullish pattern is developing—one that could potentially trigger a breakout in the coming sessions.

Source: Coinmarketcap

Source: Coinmarketcap

Diamond Pattern in Play

On the daily chart, ASTER appears to be consolidating within a diamond pattern, a formation known for signaling bullish reversals when it appears after a downtrend. Since late October, the price has been making a shift between higher highs and lower lows inside this structure, eventually falling to a bottom around $0.8170 before staging a strong rebound.

This recovery has now lifted ASTER to the $1.16 zone, placing it just beneath the descending trendline of the pattern. The tightening structure is indicating growing buyer strength and compressing volatility—both early signs that a breakout attempt could be approaching.

Aster (ASTER) Daily Chart/Coinsprobe (Source: Tradingview)

Aster (ASTER) Daily Chart/Coinsprobe (Source: Tradingview)

What’s Next for ASTER?

Price action is currently hovering just below the descending trendline, with the narrowing range suggesting that a decisive move may take place from the current candle. Still, a minor dip toward the $1.07 support cannot be ruled out before another breakout attempt begins.

If buyers manage to push ASTER above the descending trendline, the next major confirmation would be a reclaim of the 50 MA at $1.3173. Securing this level would solidify bullish momentum and open the pathway toward the breakout target of $1.6179, representing an impressive 38% upside potential from current price levels.

However, confirmation remains key. Without a clear breakout and sustained close above the trendline, ASTER may continue to contract within the diamond pattern before showing its next directional move.