XRP Price Prediction: Will the $2.20 Support Hold as Bitcoin Crashes?

XRP Chart Analysis: The $2.20 Support Remains the Battleground

- $XRP touched the $2.20 level at least four times, each time producing a strong bounce.

- Several fakeouts occurred — price briefly dipped under $2.20 but immediately recovered, showing buyers aggressively defending the support.

- The most recent candle once again shows bullish reaction from this zone, confirming its significance.

- The upper resistance remains at $2.50, the level XRP has failed to break multiple times.

XRP/USD 4-hour chart - TradingView

This forms a range between $2.20 and $2.50, with higher volatility expected as Bitcoin continues to influence market direction.

Bitcoin Crash Puts XRP at Risk: Why XRP Is Still a Lagger

Even during positive market moments, XRP tends to move late compared to other altcoins — a well-known characteristic.

But when Bitcoin crashes, XRP often follows with amplified delay.

Currently:

- Bitcoin broke below $95,000, triggering heavy liquidations .

- Depth charts are showing thin liquidity.

- Market panic remains high.

- Altcoins are bleeding across the board.

XRP’s resilience at $2.20 is notable — but historically, when Bitcoin makes a violent move, XRP eventually reacts.

That means the real question becomes:

👉 What happens if Bitcoin continues falling toward $90K?

Bearish Scenario: What Happens if XRP Breaks Below $2.20?

If Bitcoin drops to $90,000, the probability of XRP losing its support increases sharply.

If $2.20 breaks:

- First target: $2.05–$2.10 (minor demand zone)

- Stronger downside target: $2.00 psychological support

- Worst-case wick: $1.90, matching prior consolidation areas

The market has shown multiple fakeouts below $2.20, but the structure suggests weakening demand — especially if external pressure (Bitcoin) intensifies.

XRP/USD 4-hour chart - TradingView

Bullish Scenario: Can XRP Rebound Toward $2.50 Again?

A successful rebound (as we see on the chart) can lead to:

- Retesting $2.35–$2.40

- A potential breakout toward $2.50, the range high

- If Bitcoin stabilizes above $100K again, volatility in altcoins should cool down, giving XRP space to climb

However, as long as Bitcoin remains unstable, XRP’s upside stays limited.

XRP Price Prediction: Short-Term Outlook

| Bullish Bounce | $2.35 → $2.50 |

| Neutral Range | $2.20 → $2.35 |

| Bearish Breakdown | $2.05 → $2.00 (if BTC hits 90K) |

Given current chart signals, the $2.20 support remains the critical line for determining the next move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The community shapes the future of blockchain gaming with SACHI

- SACHI launches "The Origin" NFT event (200 exclusive OGs) to precede $SACHI token launch, offering early access and in-game perks. - CEO Jonas Martisius emphasizes NFTs as symbols of early support, fostering community engagement ahead of November 19 TGE. - Limited availability and "Origin" status incentives aim to drive exclusivity and loyalty in blockchain gaming ecosystem. - SACHI's vision integrates blockchain to create a self-sustaining gaming universe with tokenized rewards for player contributions.

SACHI's NFTs Mark the Beginning of a Player-Led Revolution in Blockchain Gaming

- SACHI launched "The Origin," a 200-NFT mint event granting early access to its blockchain gaming platform and future rewards. - The NFTs, called "SACHI OGs," symbolize early participation and offer exclusive perks like "Origin" status and visibility across official channels. - By integrating blockchain, SACHI aims to create a self-sustaining economy where players become stakeholders through tokenized rewards and digital identity markers. - Analysts predict the limited NFT supply could drive secondary mar

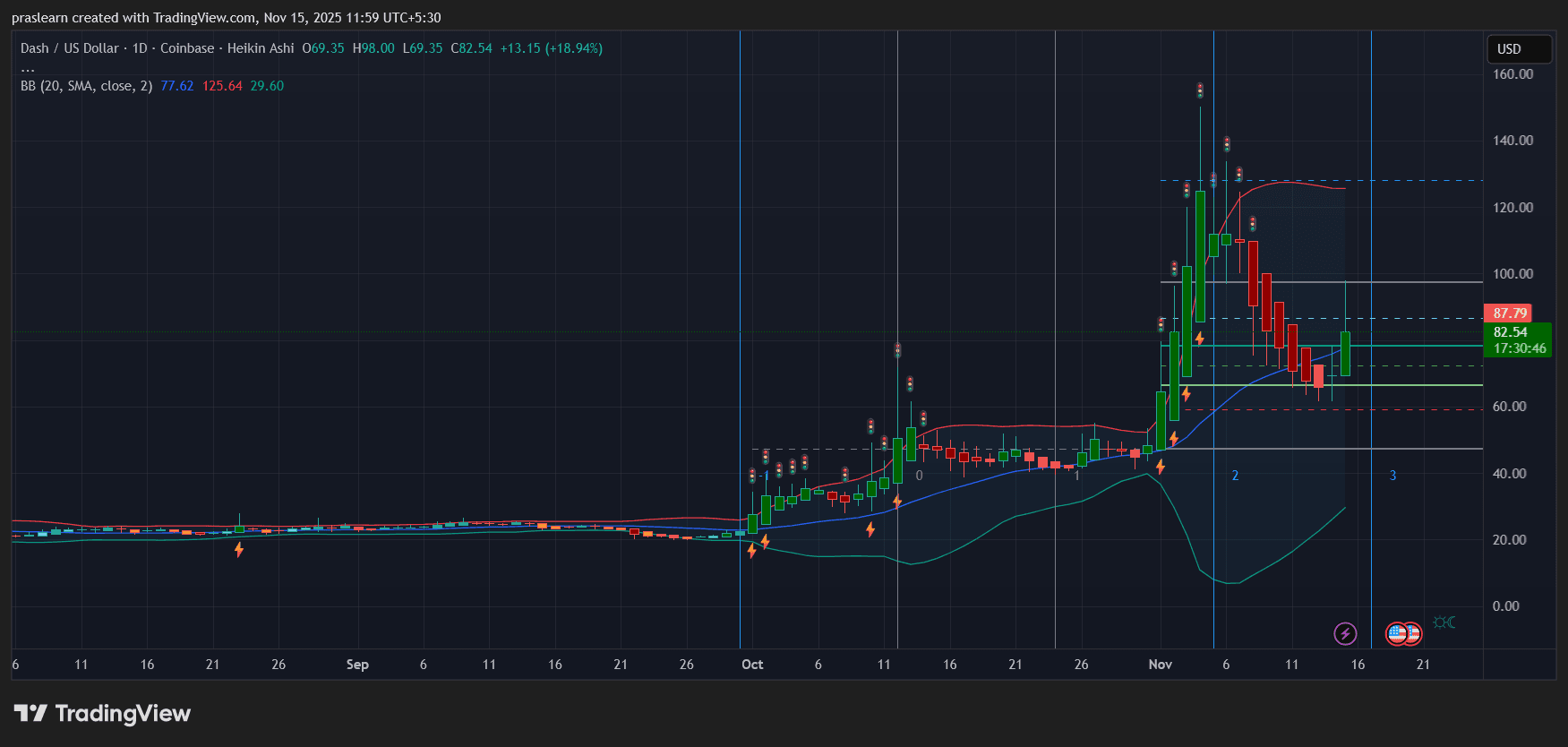

Zcash vs Dash: Which Privacy Coin Looks Stronger As Markets React to Tariff Relief?

Nigeria's Embedded Finance Experiences Rapid Growth Amidst Reforms and International Oil Market Uncertainties

- Nigeria's embedded finance market is projected to reach $4.34 billion by 2025 with a 12.2% CAGR, driven by digital adoption in e-commerce, healthcare , and education. - Economic reforms under President Tinubu led S&P to upgrade Nigeria's credit outlook to "positive," while Moody's raised its rating to "B3" in May 2025. - Fiscal challenges persist as Nigeria raised $2.35 billion via Eurobonds to address 2025 budget deficits amid global oil price volatility and implementation hurdles. - Fintech growth acce