- Fast transactions and network upgrades position Solana for long-term institutional and developer growth.

- Decentralized oracles power asset tokenization, making Chainlink vital for blockchain-finance integration.

- Telegram-backed Toncoin simplifies crypto payments, fueling mass adoption through social and financial features.

The crypto market never stops moving, and investors are always searching for the next big breakout. As 2025 unfolds, a few altcoins stand out for their strong fundamentals and growing ecosystems. These projects show steady progress, real-world adoption, and solid community support. Let’s take a closer look at three digital assets—Solana, Chainlink, and Toncoin—that appear ready to surge before 2026.

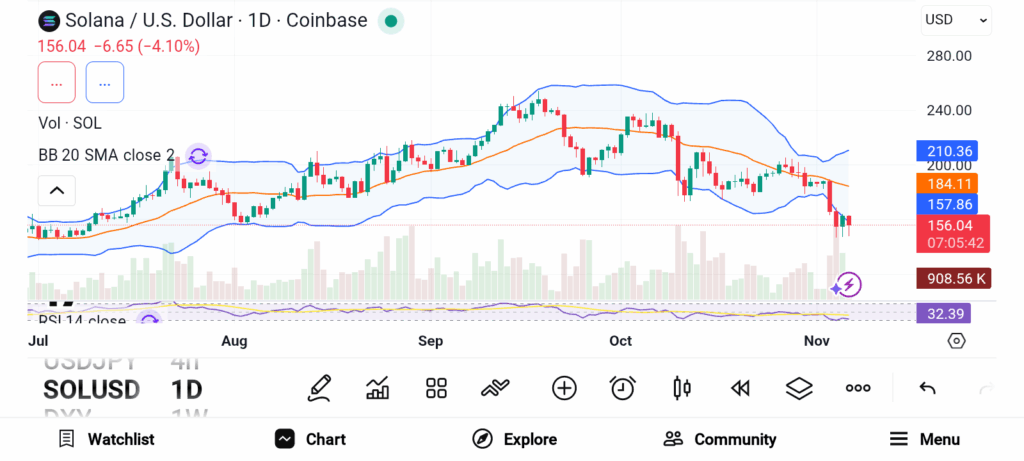

Solana (SOL)

Source: Trading View

Source: Trading View

Solana’s SOL continues to shine as one of the most promising digital assets for 2025 and beyond. Known for ultra-fast transactions and low network fees, Solana attracts developers building payment and gaming applications. The platform’s speed and efficiency make it a preferred choice for decentralized projects that need scalability. In September 2025, the team addressed several network issues that previously caused outages.

This improvement restored trust among investors and developers. Institutional adoption has also increased, with growing interest from payment networks and blockchain-based gaming companies. Many analysts believe Solana still has room to grow, even after a strong performance this year. The ecosystem’s continued expansion suggests that SOL could remain a top pick for anyone seeking long-term value in crypto.

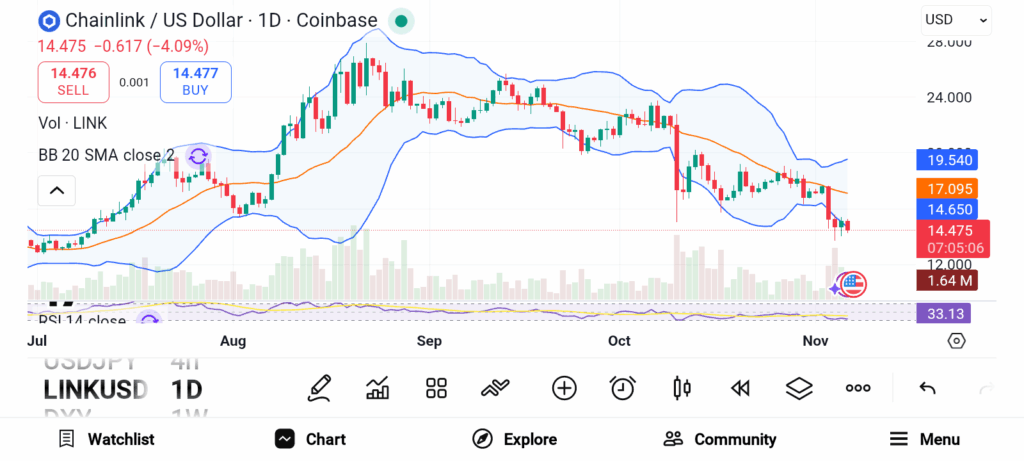

Chainlink (LINK)

Source: Trading View

Source: Trading View

Chainlink has become essential in the growing trend of real-world asset tokenization. The project’s decentralized oracle network connects smart contracts to off-chain data, enabling assets like bonds, stocks, and commodities to trade securely across blockchains.As tokenized markets expand into the trillions, Chainlink stands at the center of this transformation.

Investors looking for undervalued altcoins often consider Chainlink a strong choice. The project’s ability to link traditional finance with blockchain technology makes it one of the best-positioned cryptos for the future. With partnerships increasing and demand for reliable oracles rising, Chainlink’s momentum looks ready to accelerate before 2026.

Toncoin (TON)

Source: Trading View

Source: Trading View

Toncoin has gained serious attention due to support from Telegram, one of the world’s largest social platforms. With access to more than 900 million users, Toncoin benefits from a built-in audience for decentralized finance and gaming services. In 2025, Toncoin introduced updates that allow users to make crypto payments directly inside Telegram chats.

Toncoin’s approach blends social interaction with financial utility, a combination few projects have achieved successfully. As more Telegram users explore decentralized apps, Toncoin could experience massive growth. Some analysts even predict it could become one of the most profitable low-cap gems in 2025.

Solana, Chainlink, and Toncoin each demonstrate unique strengths driving investor interest. Solana delivers speed and scalability, Chainlink connects real-world data to blockchain, and Toncoin brings crypto to millions through Telegram. Together, they represent a mix of innovation and usability that could fuel major gains before 2026.