Bitget US stock contracts reach a cumulative trading volume of $2.5 billion, with popular trading targets including MSTR, TSLA, and GOOG.

ChainCatcher News, Bitget's US stock contract section has reached a cumulative trading volume of over $2.5 billion. According to platform data, the Top 3 most popular trading assets are MicroStrategy (MSTR), Tesla (TSLA), and Google (GOOG), with cumulative trading volumes of $830 million, $550 million, and $340 million, respectively.

Previously, Bitget had launched 25 USDT-margined perpetual contracts for US stocks, covering popular sectors such as technology and internet, semiconductor chips, financial trusts, aviation industry, and consumer dining. The platform supports flexible leverage from 1 to 25 times, and the fee rate does not exceed 0.06%, providing users with a more convenient experience than traditional brokers and banks. On this basis, Bitget has recently added contracts for Netflix (NFLX), Futu (FUTU), JD.com (JD), Reddit (RDDT), and the Nasdaq 100 Index Fund (QQQ), further expanding its product matrix and continuously improving the panoramic exchange (UEX) ecosystem layout.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rumble Q3 Financial Report: Revenue at $24.8 million, holding 210.82 bitcoins

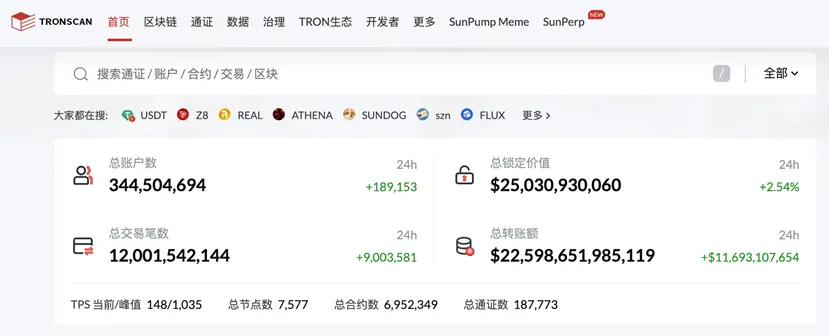

Total TRON transactions surpass 12 billion

ZEC surpasses $680, up over 15% in 24 hours