Bitcoin miner hashprice nearing $40, miners back in 'survival mode': Report

Bitcoin’s mining sector is under mounting pressure as the hash price, the industry’s key profitability metric, slips toward levels that could force smaller operators offline and strain the wider supply chain.

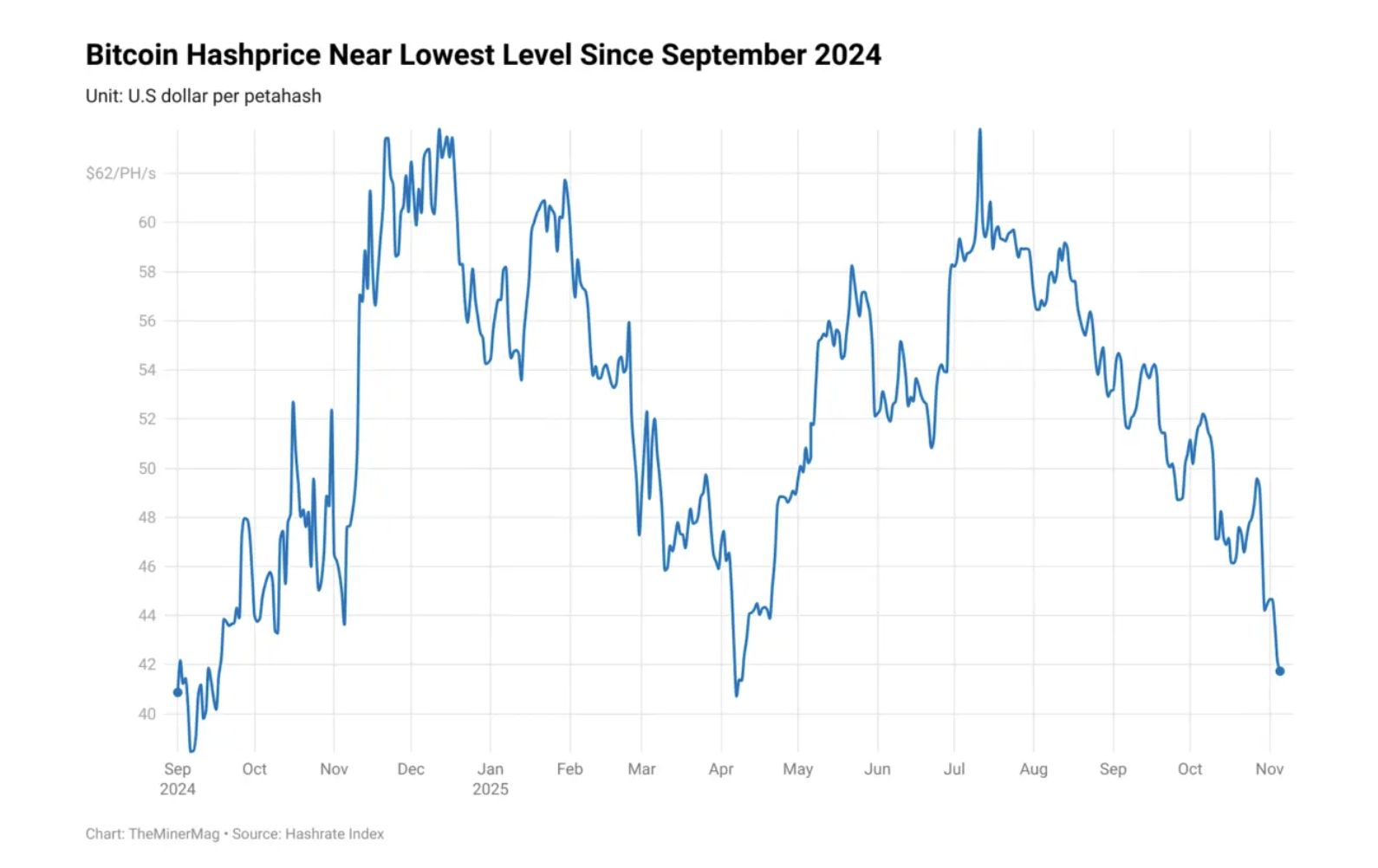

Hash price, which measures expected daily revenue per unit of computational power, is currently around $42 per petahash per second (PH/s). The metric has been in steady decline since July, when it surged above $62 per PH/s.

The push toward the $40 level leads Bitcoin mining operations, which are already facing razor-thin profit margins, to consider shutting down their rigs, according to TheMinerMag.

The decline in hash price is also affecting the mining supply chain. Hardware providers are filling fewer orders to struggling miners and are also taking a hit on any BTC-denominated sales due to the drop in price after the October market crash, the report said.

Mining hardware manufacturers, such as Bitdeer, have turned to self-mining to offset the shortfall in demand for mining machines.

The razor-thin profit margins, high capital expenditure on upgrading hardware and rising energy costs have caused many Bitcoin miners to pivot to AI and high-performance computing data centers to generate revenue as Bitcoin mining becomes more competitive.

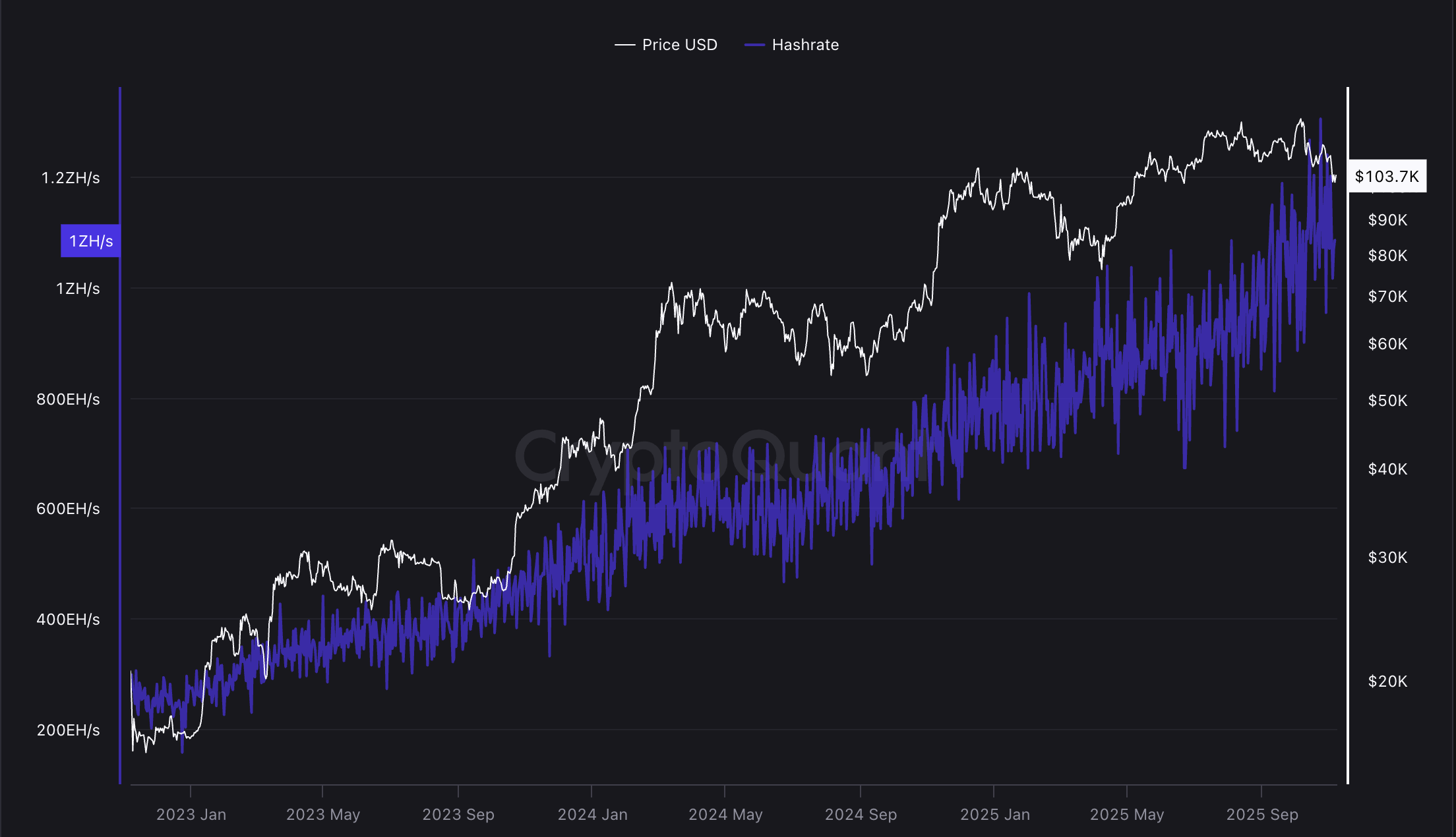

Miners pivot to AI amid constantly increasing hashrate

Bitcoin miners are guaranteed to have their rewards slashed by 50% every four years during the Bitcoin halving, as the computational power and electricity needed to mine blocks continue to climb.

The initial block reward for successfully mining a block in 2009 was 50 BTC, and node runners were mining BTC using CPUs on personal computers.

Following the April 2024 halving, the BTC block reward decreased to 3.125 BTC, and today, specialized mining hardware known as application-specific integrated circuits (ASICs) is required to mine BTC.

These challenging economics have forced many miners to diversify into adjacent AI data center and compute businesses, which have generated billions of dollars in revenue for companies that made the switch.

In October, Cipher Mining inked a $5.5 billion deal with tech giant Amazon to provide compute power to Amazon Web Services over a 15-year period.

IREN, a Bitcoin mining company, signed a similar deal with Microsoft in November to provide GPU computing services, valued at $9.7 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Crypto Market Divides as Pessimism Clashes with Institutional Confidence in Ethereum

- US stocks closed mixed on Nov 7, 2025, as Bitcoin fell below $100,000 amid $711.8M in crypto liquidations. - ARK Invest boosted Ethereum exposure by buying $9M of BitMine shares, signaling institutional confidence in ETH treasuries. - UK aligns stablecoin rules with US by Nov 10, while crypto firms form consortium to standardize cross-border payments. - Coinbase and Block underperformed revenue forecasts, with Block down 9% despite $6.11B revenue. - Market remains divided between Bitcoin bearishness and

Bitcoin Updates: Cango Utilizes Energy-Efficient Infrastructure to Connect Bitcoin Mining with the Future of AI Computing

- Cango Inc. transitions from auto platform to Bitcoin mining and AI HPC, leveraging global infrastructure and energy expertise. - Achieves 50 EH/s mining capacity in 8 months, with Q2 2025 revenue of $139.8M and $656M in Bitcoin holdings. - Acquires 50 MW Georgia facility to optimize energy costs and expand dual-purpose infrastructure for AI workloads. - Plans direct NYSE listing to enhance transparency amid regulatory scrutiny and industry shifts toward hybrid AI-mining models. - Aims to refresh 6 EH/s e

XRP News Today: MoonBull Secures Liquidity While Solana Holds $160—Can XRP Spark the 2025 Bull Market?

- MoonBull ($MOBU) gains traction with Ethereum-based presale, projecting 9,256% ROI if it hits $0.00616 listing price. - Solana (SOL) consolidates near $160 support level amid $323M institutional inflows, while XRP sees 15% price drop but rising wallet growth. - Ripple's Palisade acquisition boosts institutional focus, yet XRP's price divergence raises questions about adoption vs. valuation. - Analysts highlight MoonBull's 2-year liquidity lock and structured 23-stage presale as differentiators in crowded

Solana News Update: Institutional Trust in Solana Strengthens as Retail Markets Fluctuate

- Solana leads blockchain payment standardization efforts as Ripple acquires Palisade and invests $4B in crypto infrastructure expansion. - Forward Industries authorizes $1B Solana-backed share buyback, signaling institutional confidence in blockchain treasury systems. - Market volatility highlighted by $22.7M whale loss contrasts with SOL Strategies' 6.68% APY, showing diverging risk profiles between retail and institutional players. - Solana Company shifts regulatory focus to U.S. compliance to optimize