DoorDash Shares Drop 10% as Focus on Growth Reinvestment Outweighs Earnings Outperformance

- DoorDash's stock fell over 10% post-earnings despite $3.45B revenue beat, driven by 25% GOV growth and 21% order increase. - Management signaled $300M+ 2026 AI/tool investments and revised Deliveroo's EBITDA contribution down by $32-40M due to accounting changes. - Analysts cut price targets (Wells Fargo to $239) as $754M adjusted EBITDA (up 41%) was overshadowed by reinvestment concerns despite $723M free cash flow. - 42% YTD gains amplified sell-off sensitivity, with 31 analysts retaining "Moderate Buy

Shares of DoorDash (DASH) tumbled by more than 10% in after-hours trading on November 5, 2025, after the food delivery leader posted third-quarter results that fell short of expectations, even though revenue growth remained robust. The sharp decline reflected investor unease about management’s intention to boost spending in 2026 and a revised forecast for Deliveroo’s earnings impact, as reported by a

The company’s third-quarter revenue reached $3.45 billion, topping the consensus estimate of $3.36 billion, according to a

The earnings shortfall was further impacted by management’s guidance for higher investment in 2026.

Investor confidence weakened further after the company raised its Q4 2025 GOV forecast to $28.9–$29.5 billion but trimmed its adjusted EBITDA outlook to $710–$810 million, as highlighted in a

Analysts responded quickly. Wells Fargo reduced its price target for

The share price drop followed a 42% gain since the start of the year, heightening sensitivity to profit-taking and concerns about reinvestment. The company’s upcoming earnings call at 5:00 p.m. ET on November 5 is expected to shape short-term trading, as investors look for more information on capital deployment, the integration of Deliveroo, and holiday season demand.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anker-supported hybrid RV company Evotrex emerges from stealth mode

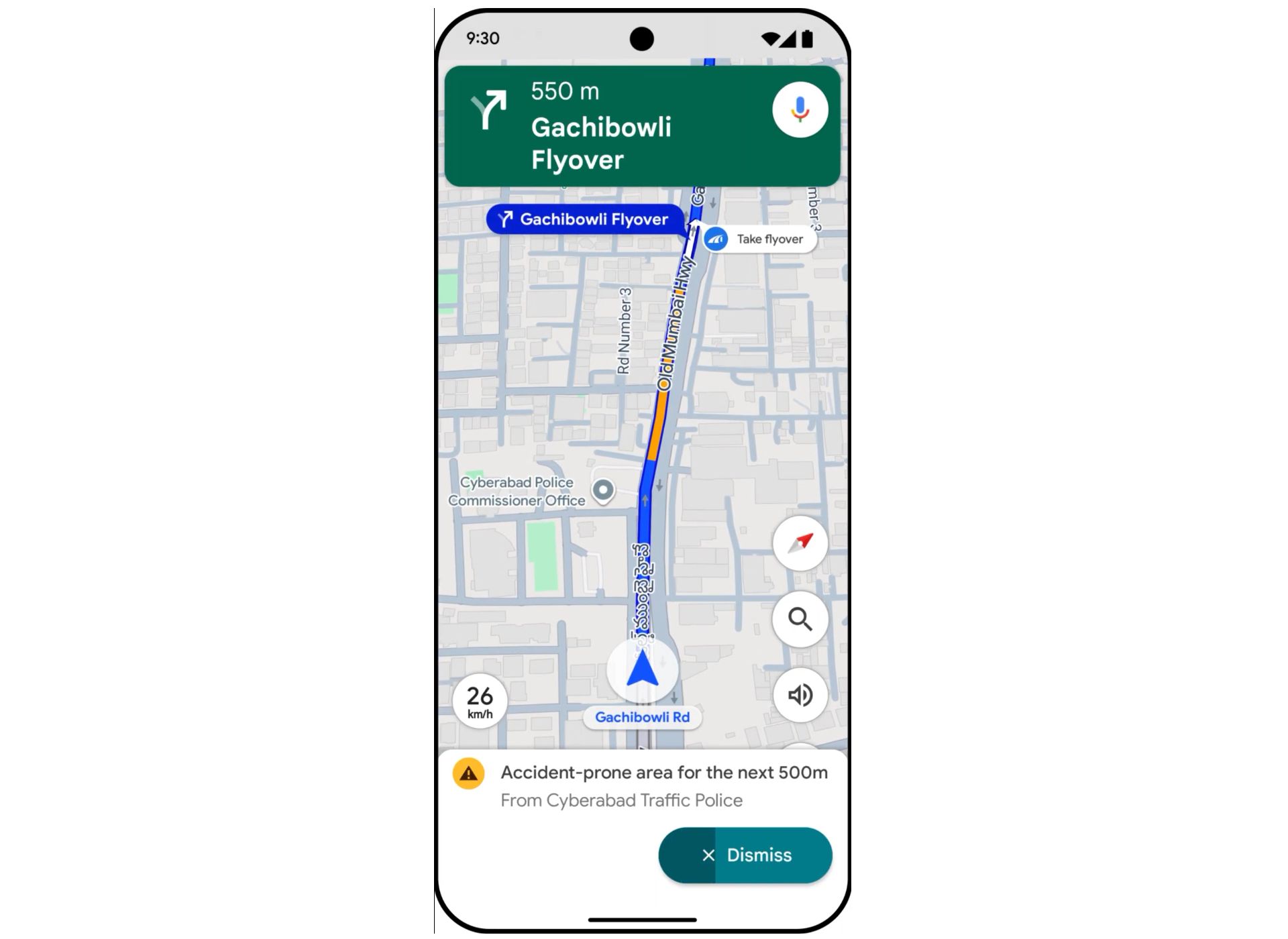

Google Maps enhances navigation in India by integrating Gemini and introducing safety notifications

Spotify now allows you to view your listening statistics on a weekly basis