How to Participate in Circle's Native Chain Arc Testnet Interaction?

The tutorial covers topics such as Testnet Coins, NFT Minting with Domain, Contract Deployment, and more, making it easy to understand and follow.

Original Title: "Circle's Stablecoin Public Chain Arc Testnet Interaction Guide"

Original Author: Asher, Odaily Planet Daily

Last week, Circle's stablecoin Layer 1 project Arc announced on X platform that its public testnet is now live. Below, Odaily Planet Daily takes you through a "zero-cost" participation in the Arc testnet interaction to receive a token airdrop.

Arc: A Layer 1 Dedicated to Stablecoins Launched by Circle

Arc is a next-generation EVM-compatible Layer 1 blockchain launched by the "first stock of stablecoins," Circle, aiming to build the economic operating system of the internet, deeply integrating programmable stablecoins with on-chain financial innovation. Arc is designed for financial applications, focusing on global payments, forex, lending, and capital markets, with the goal of providing a secure, low-cost, compliant, and scalable foundational settlement layer for the internet's programmable money.

Arc aims to address the three major pain points faced by existing public chains in enterprise and institutional-grade financial applications: inadequate high-frequency transaction performance, lack of privacy and compliance support, and excessive transaction fee volatility. By optimizing its architecture and introducing a stable fee model, Arc will achieve efficient financial-grade transaction experiences and drive stablecoins from being just a "digital dollar" towards becoming the core infrastructure for global payments, lending, forex, and capital markets.

Arc Testnet Interaction Guide

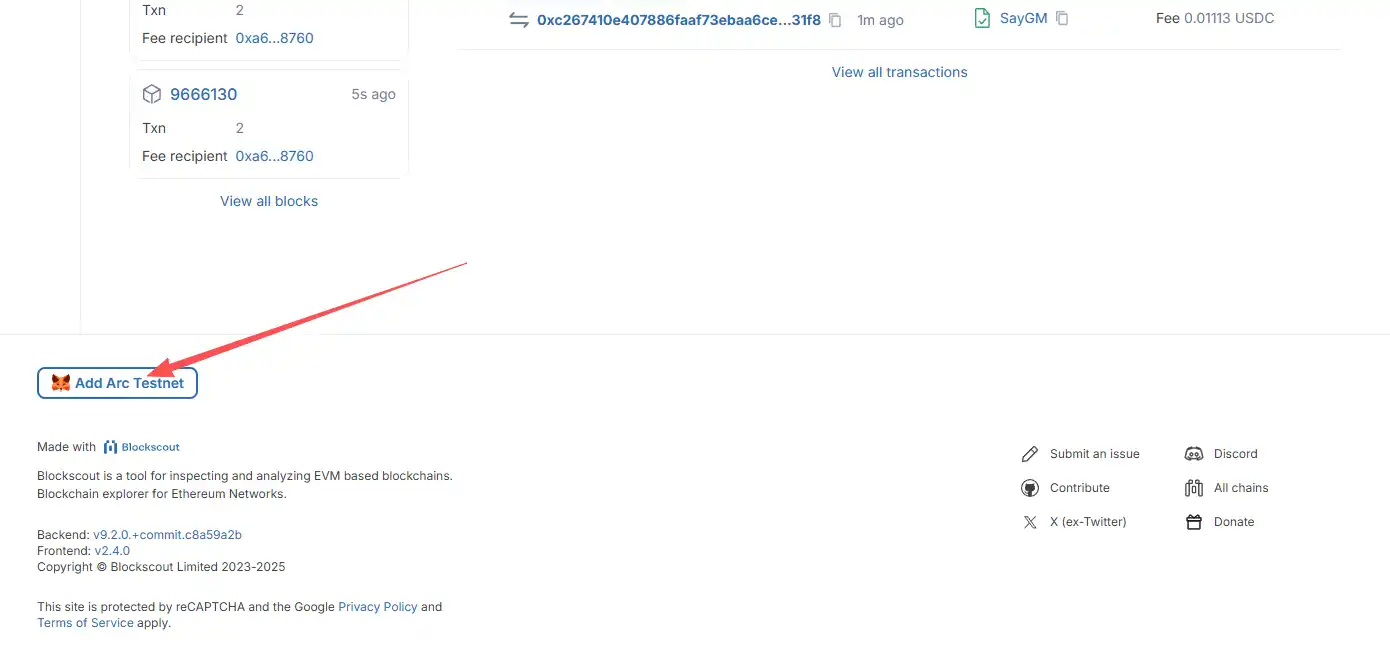

STEP 1. Add the Arc test network in your wallet, scroll to the bottom of the page, click on Add Arc Testnet in the bottom left corner, and confirm in your wallet popup.

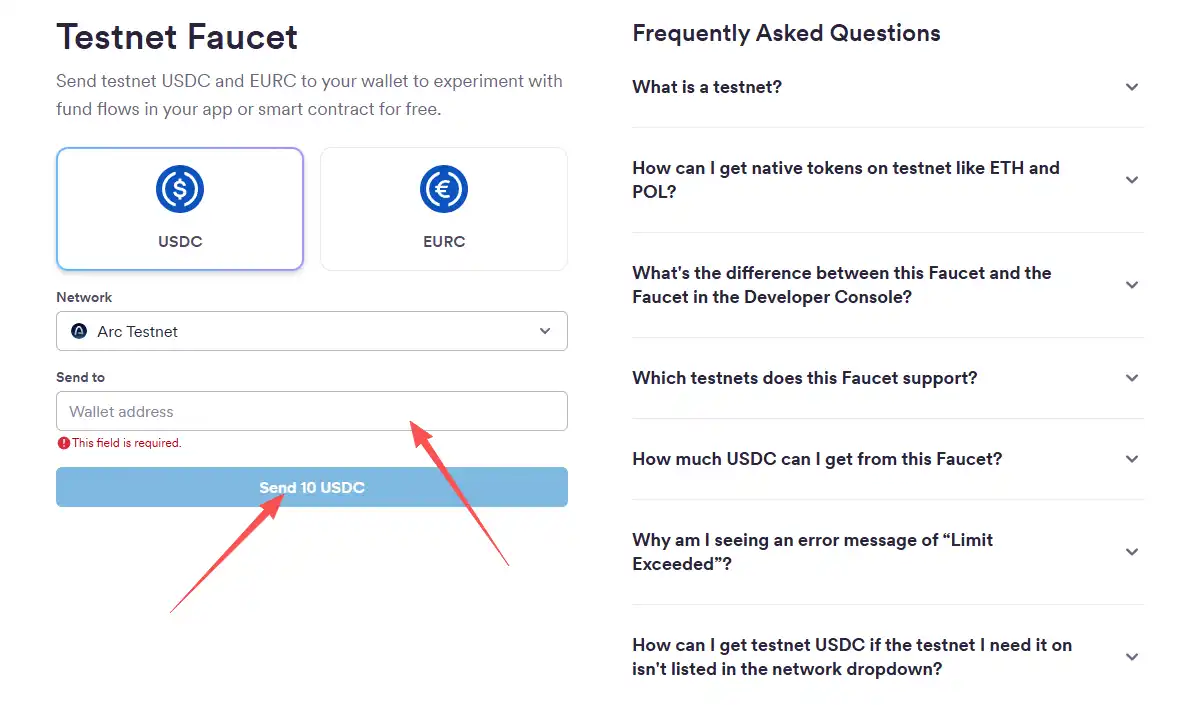

STEP 2. Claim testnet test coins, receive both USDC and EURC.

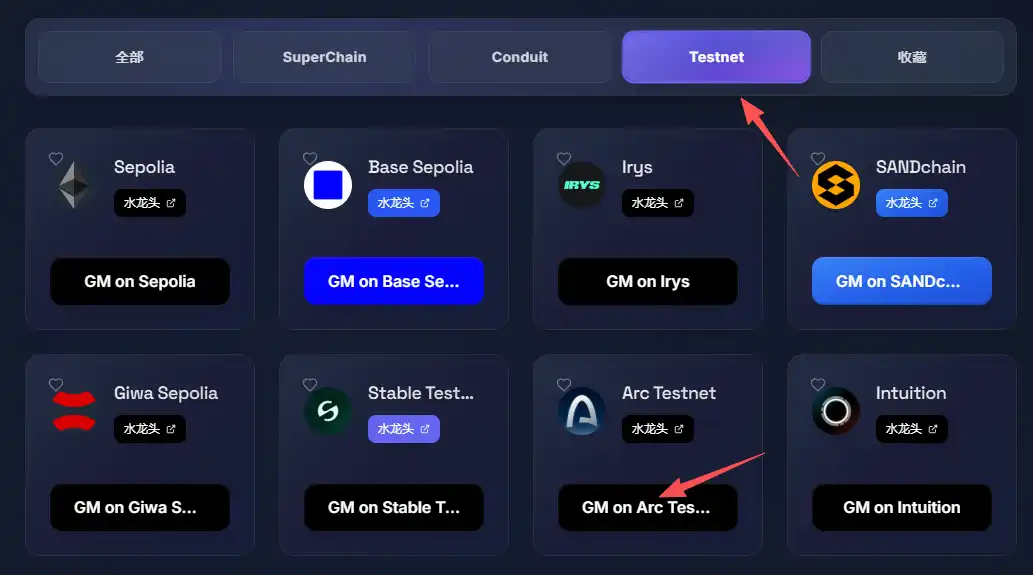

STEP 3. Send GM on the Arc testnet, connect your wallet, then find GM on Arc Testnet and click to confirm in your wallet popup.

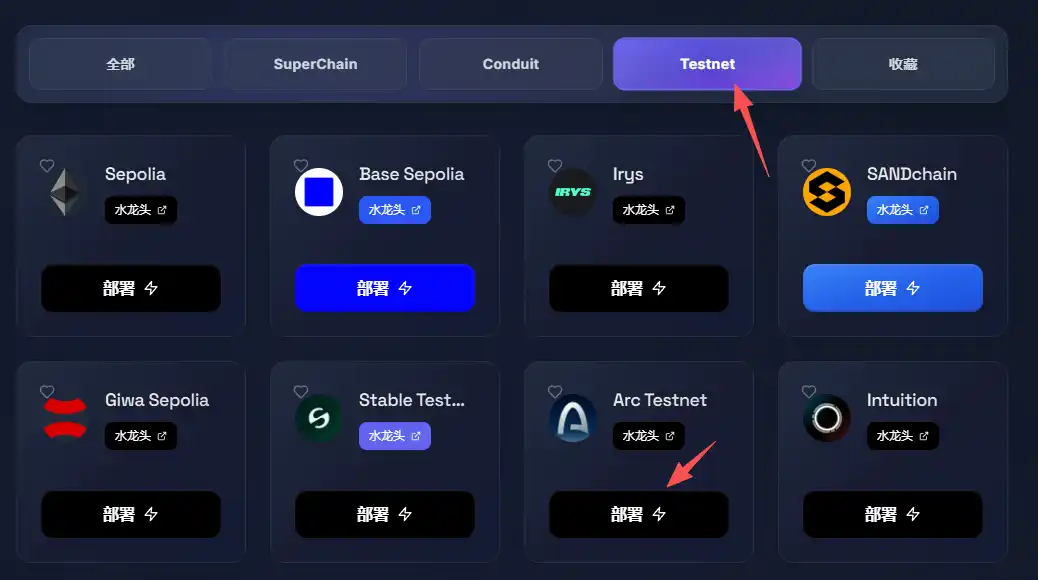

STEP 4. Deploy Contract on Arc Testnet, find Arc Testnet, click Deploy and confirm in the wallet popup.

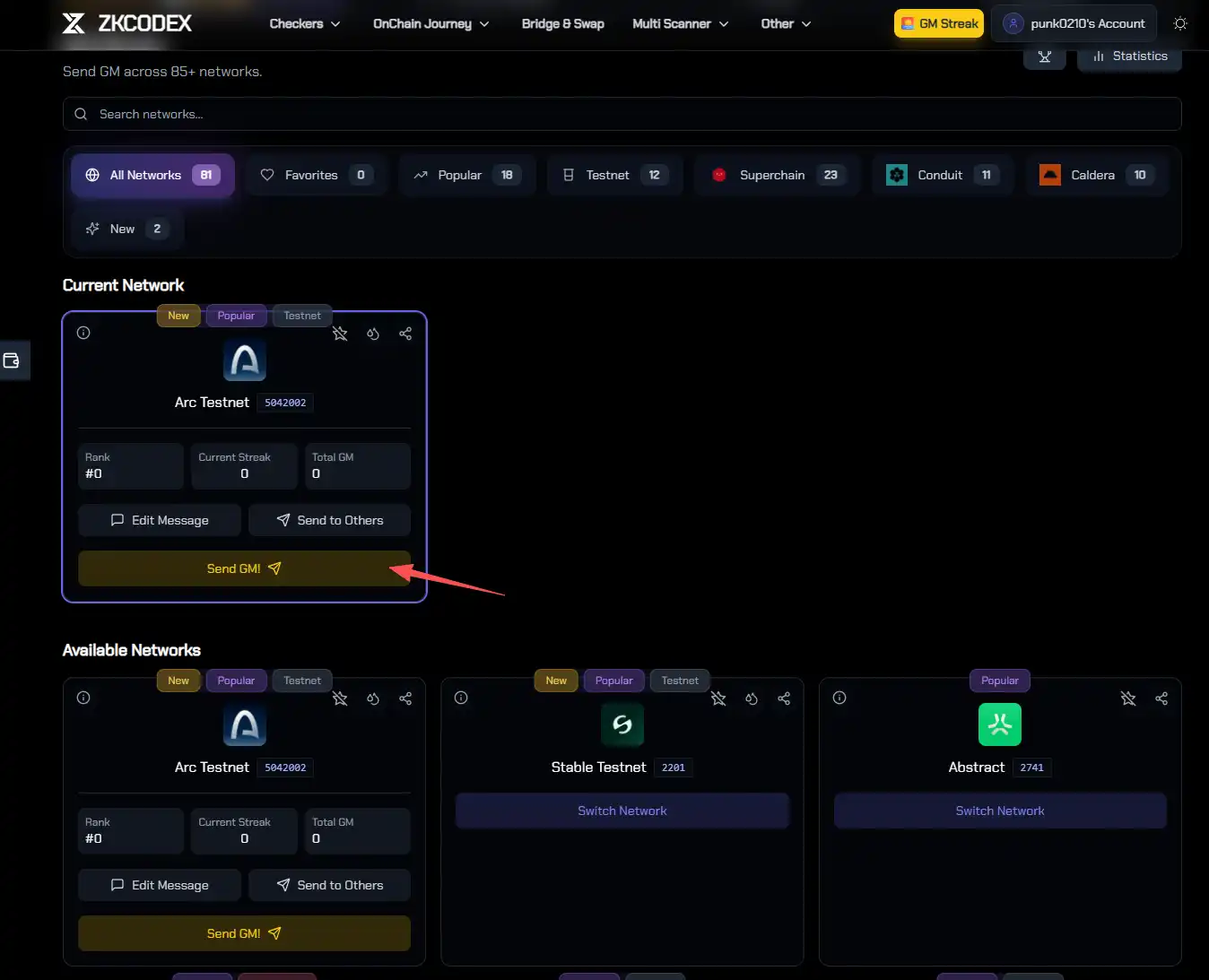

STEP 5. Send GM on Arc Testnet in ZKCODEX Platform, connect wallet, find Arc Testnet, click Send GM, and confirm in the wallet popup.

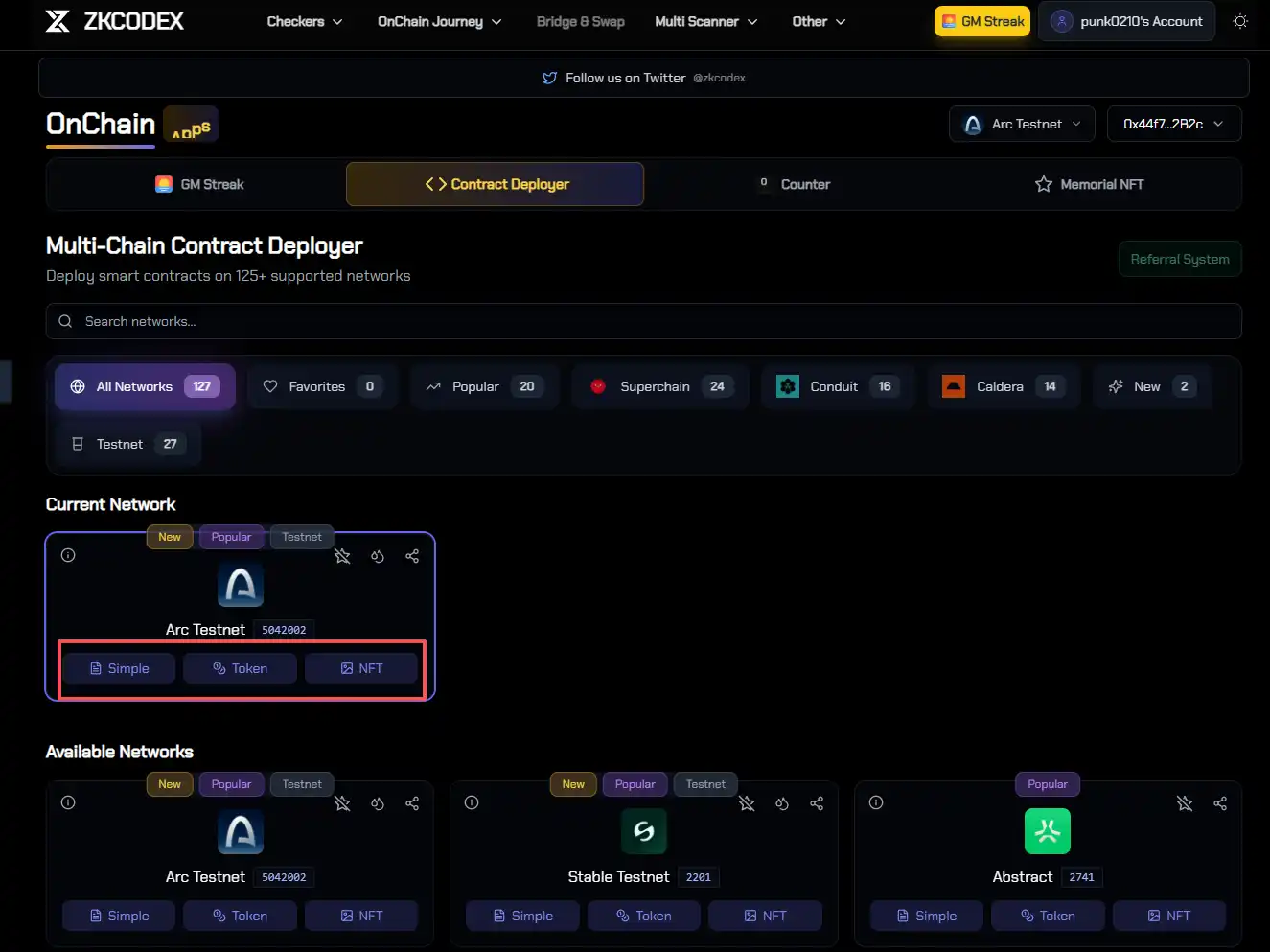

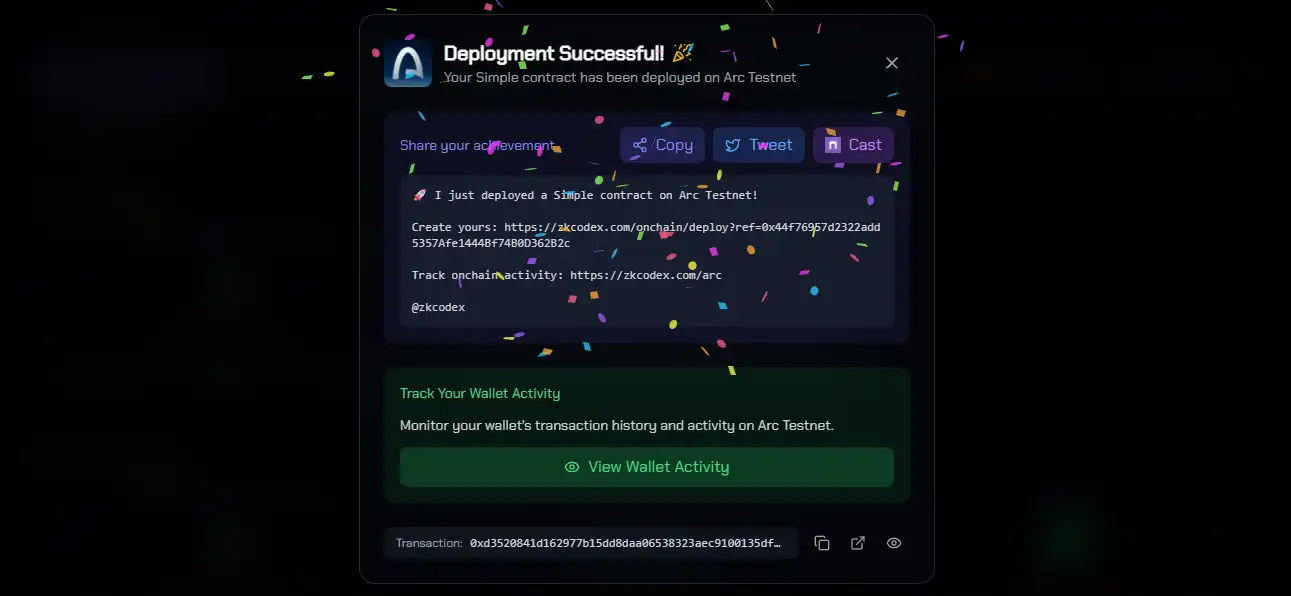

STEP 6. In ZKCODEX Platform, choose Arc Testnet, connect wallet, find Arc Testnet, click Simple Deploy, Token Deploy, NFT Deploy, and confirm in wallet popup.

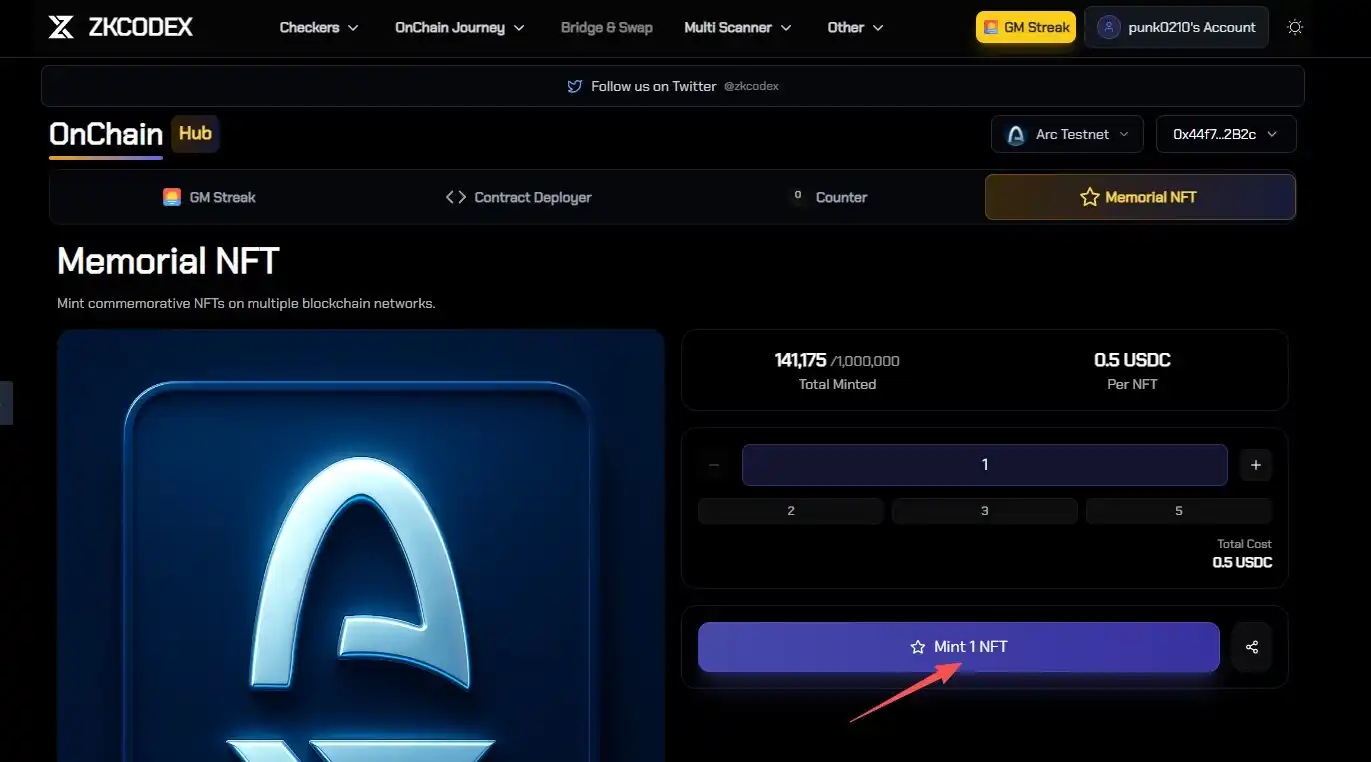

STEP 7. In ZKCODEX Platform, choose Arc Testnet to mint another NFT, click Mint 1 NFT, and confirm in the wallet popup.

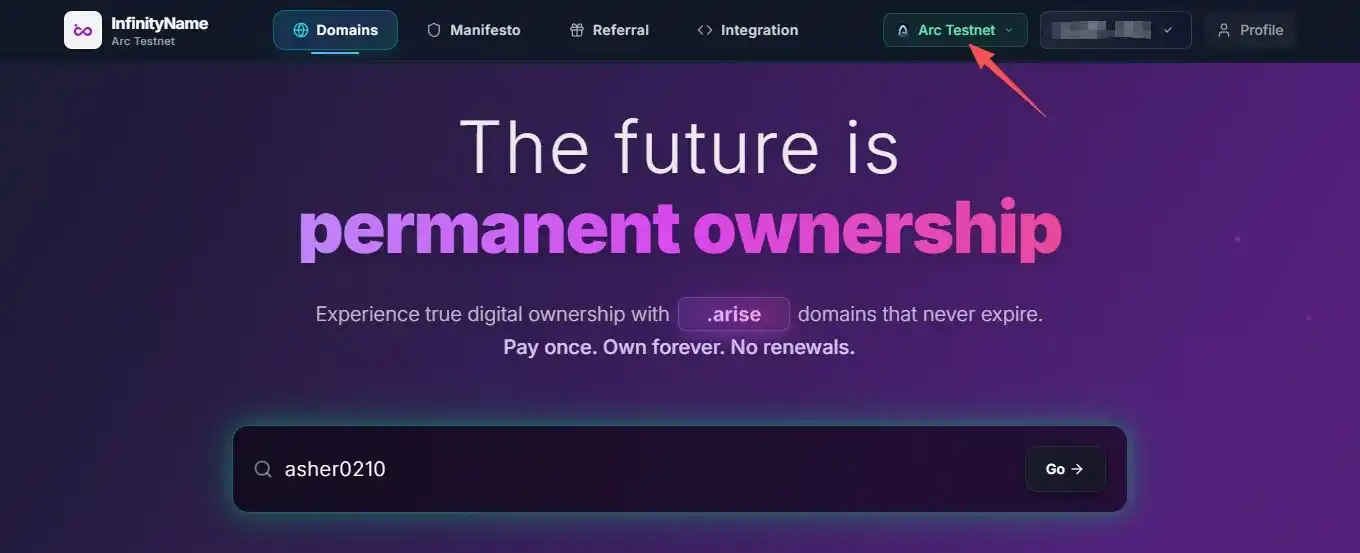

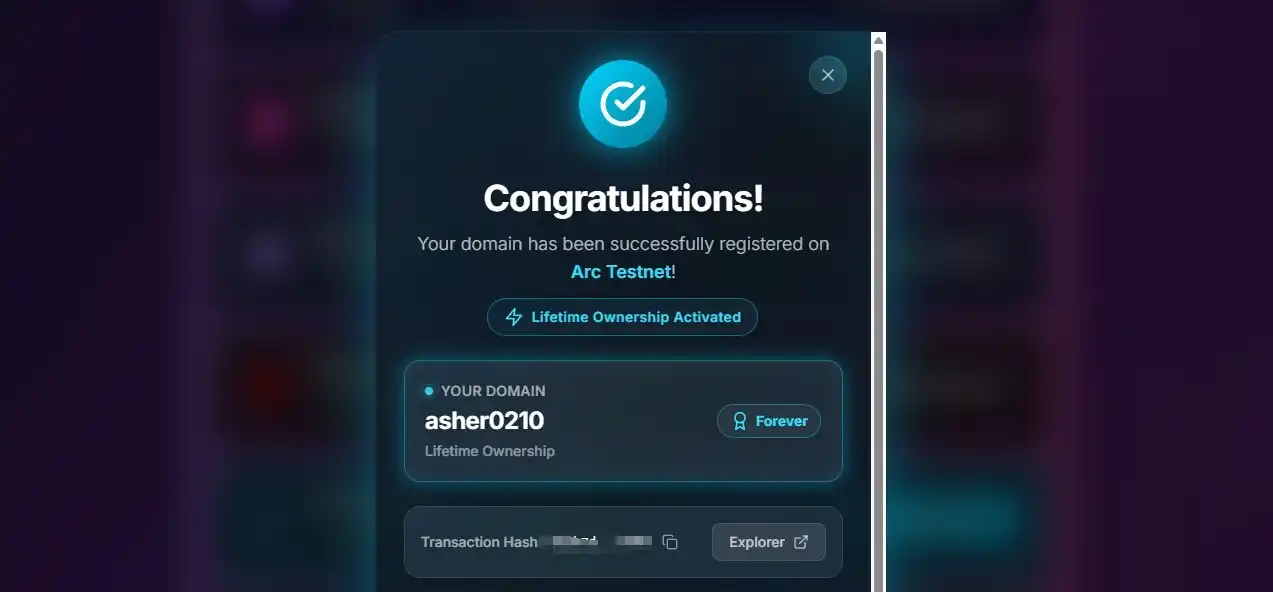

STEP 8. Register a .arc domain on InfinityName Platform, connect wallet, enter desired domain name, find Arc Testnet Registration, and confirm in the wallet popup.

Above is the complete tutorial on interacting with the Arc testnet. If there are any upcoming testnet incentive activities, Odaily Weekly will also be updated as soon as possible.

In addition, on October 30, Arc released the first batch of 11 projects built on the public testnet, which are also worth paying attention to, namely: on-chain stablecoin-related protocol ZKP2P, universal encrypted trading platform Sequence, intelligent agent solution interconnection platform Superface, stablecoin wallet infrastructure Blockradar, stablecoin banking service Copperx, crypto API development company Crossmint, cross-border fund sending and management program Hurupay, wallet infrastructure Para, personalized finance platform CFi, zero-knowledge proof-based wallet Hinkal, cross-chain infrastructure Axelar Network.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Bitcoin Faces Volatility Compression: November's Critical $100k Battle

- Bitcoin faces a volatility squeeze near $100,000 as November 2025 approaches, with potential for dramatic price swings. - Galaxy Digital cuts 2025 BTC price target to $120,000, citing institutional outflows, whale distributions, and market corrections. - Technical indicators show compressed Bollinger Bands and extreme volatility levels, historically preceding major price moves. - Geopolitical risks and regulatory scrutiny contrast with JPMorgan's $165,000 2025 forecast, pending ETF inflows and Fed policy

Starknet Allocates 100 Million STRK to Address DeFi’s Challenges in Scalability and Security

- Starknet allocates 100M STRK tokens to boost DeFi innovation, targeting scalability and security challenges through zero-knowledge infrastructure. - CeFi-DeFi convergence accelerates as platforms like SunPerp blend CEX usability with on-chain custody, surpassing $100M TVL despite recent sector vulnerabilities. - A $93M exploit at Stream Finance exposed DeFi risks, prompting urgent withdrawals and highlighting the need for robust risk frameworks in interconnected protocols. - AI integration in DeFi reshap

SBI and Chainlink Connect Traditional Finance and DeFi Through Secure Tokenized Compliance

- SBI Digital Markets adopts Chainlink CCIP to secure cross-chain transfers of tokenized assets like securities and real-world assets. - Integration uses CCIP's private transactions and ACE compliance engine to protect sensitive data while aligning with global regulations. - The partnership bridges TradFi and DeFi by enabling instant settlements and reducing cross-border transfer costs, supporting Asia-Pacific tokenized securities growth. - Industry experts highlight CCIP's role in addressing blockchain fr

Robinhood’s Bold Move: Expanding Prediction Markets via Collaborations Instead of Building Platforms

- Robinhood's prediction markets generated $100M+ annualized revenue in Q3 2025, surpassing expectations through partnerships with Kalshi and Polymarket. - The segment's explosive growth stems from 2024 regulatory changes and sports betting legalization, with 2.5B contracts traded in October 2025. - CEO Tenev prioritizes user scale over vertical integration, leveraging 26M users to capture market share without developing proprietary platforms. - Q3 revenue hit $1.19B with $386M net profit, driving $130B ma