Bitcoin falls below $100,000: Capital outflows and cooling sentiment—Is the bull market coming to an end?

Author: Nancy, PANews

Original Title: Bitcoin Falls Below $100,000, Intensified Capital Outflows Increase Downside Risk—Is the Bull Market Over?

Entering November, the crypto market has experienced intense volatility. In the early hours of November 5, Bitcoin fell below the key psychological threshold of $100,000, hitting a nearly five-month low. Altcoins plunged collectively, and market panic quickly escalated.

Bitcoin Faces Capital Outflows, Long-term Holders Significantly Reduce Positions

The weakness in Bitcoin's performance is not simply due to macro uncertainties; the key factor is the shift in capital flows.

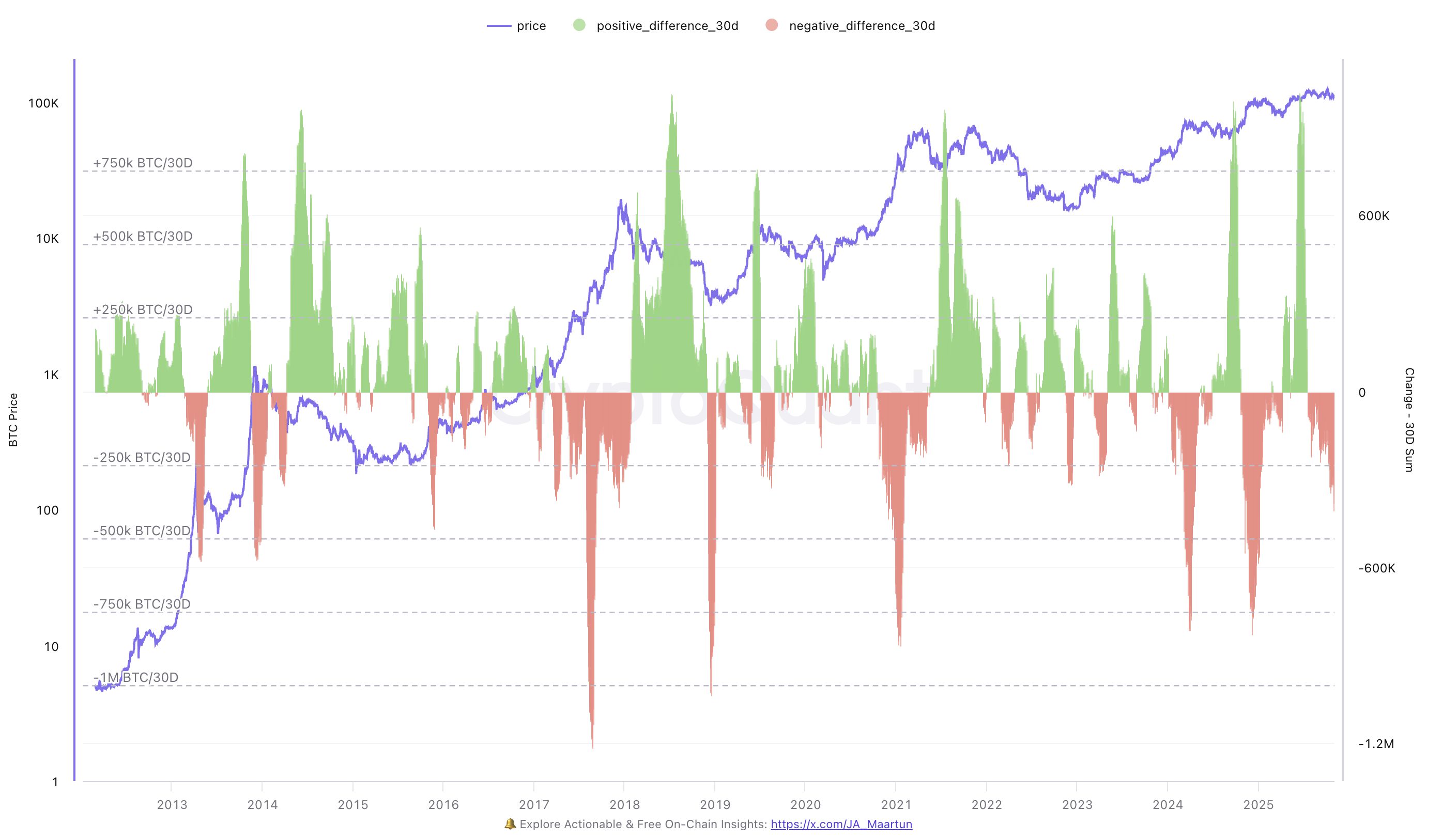

According to CryptoQuant data, over the past 30 days, long-term Bitcoin holders have cumulatively sold more than 327,000 BTC. Since early October, there has been a continuous net outflow of funds, with long-term holders’ selling pressure consistently maintained at around 300,000 BTC, reflecting weak market confidence and liquidity pressure. Although Bitcoin attempted several rebounds in mid-to-late October, each upward movement was accompanied by significant capital outflows, indicating that the rebounds lacked new capital inflows and that buying momentum was insufficient.

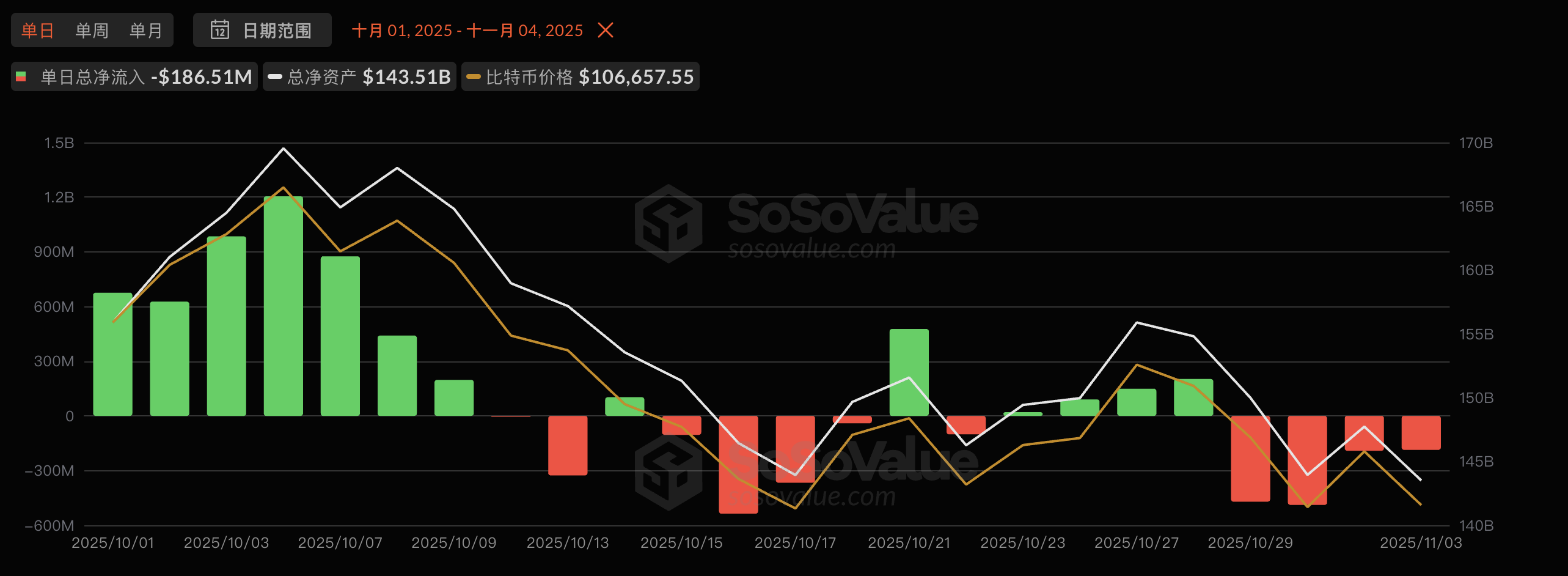

Meanwhile, subtle changes have also occurred in ETF market capital flows. According to SosoValue data, in October, US spot Bitcoin ETFs saw a cumulative net inflow of $3.42 billion, which provided strong support for Bitcoin’s spot price in early October. However, by the end of the month, the situation reversed, with a net outflow of $1.33 billion in just the past four days. Among them, BlackRock’s IBIT saw a single-day redemption of $291 million, marking the largest single-day outflow since early August. Changes in ETF capital are often seen as a “thermometer” of institutional sentiment. The current capital shift indicates that institutional investors have clearly turned cautious in the short term, and market optimism is cooling.

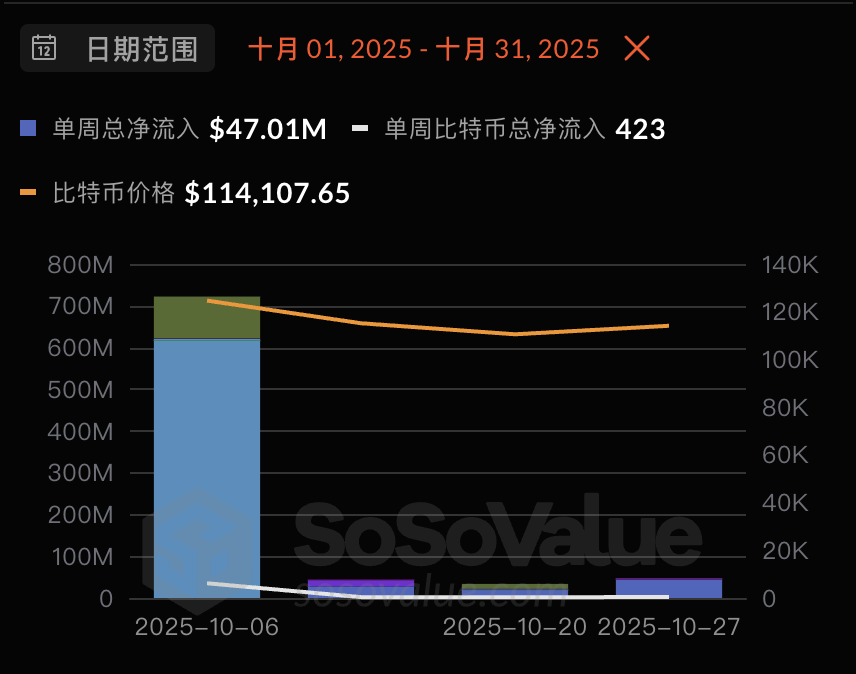

Similar signs are also appearing at the level of publicly listed companies. SosoValue data shows that in October, global listed companies (excluding mining companies) had a net purchase of about 7,251 BTC. However, behind this seemingly robust number lies a structural change: about 85.1% of the buying was concentrated in the first week of the month, with a significant decline in additional purchases thereafter. Major buyers such as Strategy and Metaplanet have generally slowed their buying pace.

From this perspective, the scale and sustainability of new capital entering Bitcoin are no longer sufficient to offset the persistent selling pressure from long-term holders, and the market’s supply-demand structure is facing a temporary imbalance.

Mining Companies and Institutions Under Collective Pressure, Market Enters Cost Game

Bitcoin’s recent price movements have once again heightened market nerves. As Bitcoin fell below the $100,000 mark, multiple pressures are gradually surfacing. Although the overall market has not yet seen panic selling, multiple signals indicate that Bitcoin is at a critical stage of cost-line competition and structural testing.

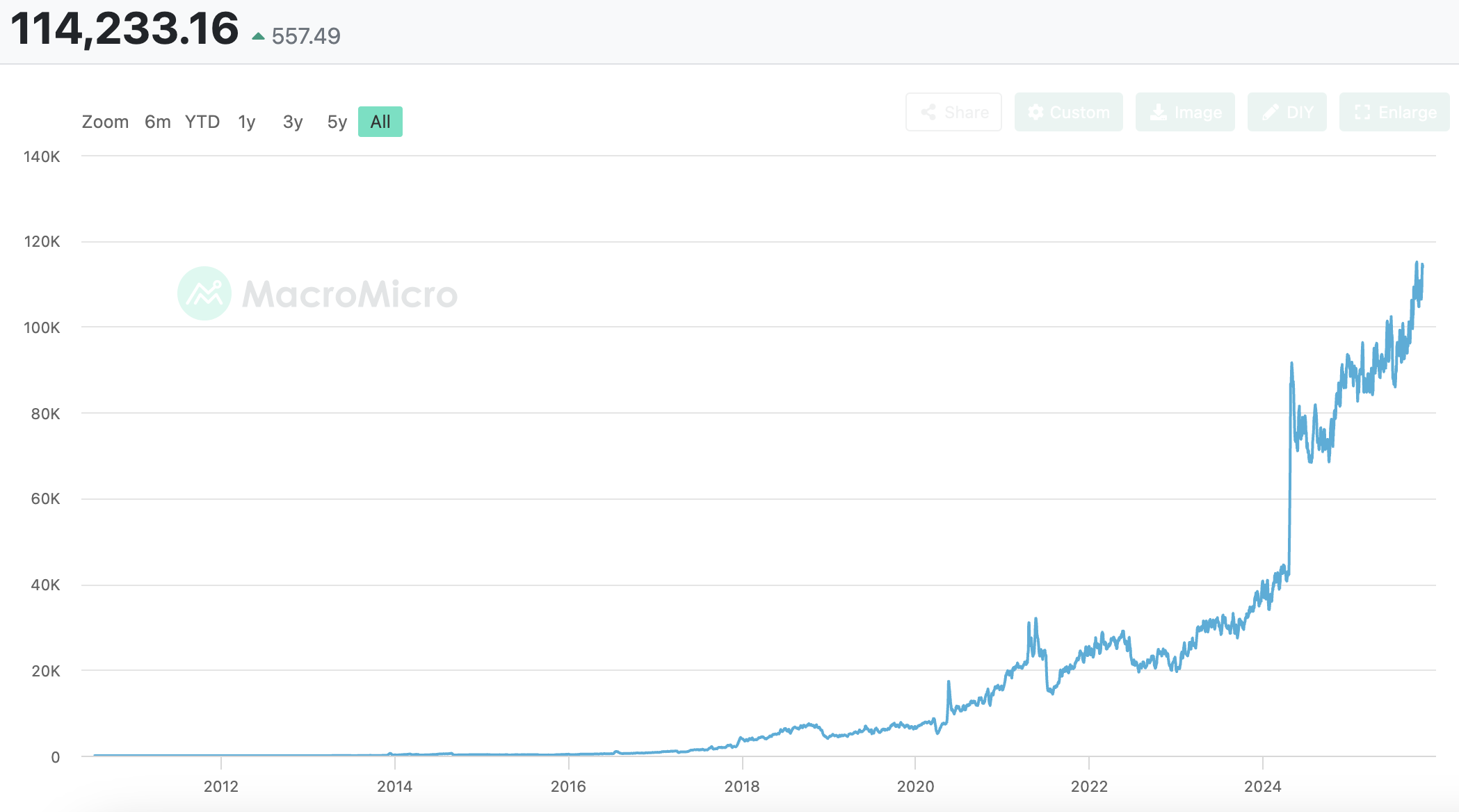

According to MarcoMicro data, as of November 4, the average production cost of Bitcoin has risen to about $114,000. This means that most mining companies’ mining costs are now higher than or close to the market price. At current price levels, many mining companies not only see sharply reduced mining profits but also face additional cost pressures from sales, administration, and energy, making cost reduction the top priority for maintaining operations. If market demand shrinks further, some mining companies are seeking business diversification to hedge against cyclical risks, including shifting to AI infrastructure construction and computing power leasing businesses.

Institutional holders are also under significant pressure. SosoValue data shows that among the 38 global listed companies holding Bitcoin, at least 24 have seen their holding prices fall below their cost lines, including Metaplanet, Bullish, Galaxy Digital, Next Technology, and others. Even top industry institutions are struggling to maintain book profits in the current range, and some smaller DAT companies have started reducing holdings due to liquidity pressure. For example, US-listed BTC treasury company Sequans confirmed it had sold 970 BTC to reduce debt.

From a technical perspective, several industry insiders believe the market still faces further downside risk in the short term. Katie Stockton, founder of Fairlead Strategies, pointed out that Bitcoin has fallen below the key 200-day moving average (around $109,800). The 200-day moving average is one of the most widely watched indicators for defining long-term trends and also serves as a support level for Bitcoin. This may signal that the cryptocurrency will decline further, with the next target possibly at $94,200. Markus Thielen, CEO of 10x Research, recently stated that Bitcoin is approaching the support line since the sharp drop on October 10. If it falls below $107,000, it may test $100,000. Matrixport analysis pointed out that Bitcoin is currently close to the 21-week moving average, which has historically often served as a reversal signal. Although the current trend may have further downside potential, it does not mean the market is over. This reminds investors that instead of being disturbed by short-term market fluctuations, it is better to refer to time-tested indicators as a stable basis for decision-making.

Structural Adjustment in Bitcoin Supply and Demand, Patient Investors See Early Opportunities to Build Positions

In terms of market sentiment, it is not entirely pessimistic. glassnode data analysis indicates that Bitcoin maintained a range-bound trend this week, with some improvement in market momentum, but capital inflows have slowed. ETF outflows and declining profitability show that the market is in a phase of sustained consolidation under relative equilibrium. Since July, Bitcoin has repeatedly been blocked by the cost line of high-level buyers, indicating heavy selling pressure above and a possible short-term retest of the key support area around $104,000. Historically, periods when short-term holders are under pressure or even capitulate often provide attractive entry opportunities for patient investors.

Wintermute pointed out that global liquidity is expanding, but funds have not flowed into the crypto market. ETF inflows have stalled since summer, BTC ETF assets under management hover around $150 billion, and DAT activity has dried up. The four-year cycle concept no longer applies to mature markets. The current market structure is healthy, leverage has been cleared, positions are tidy, and liquidity is the key factor driving performance. ETF inflows and DAT activity will be closely monitored, as these will be important signals for liquidity returning to the crypto market.

Bitwise CIO Matt Hougan stated that although Bitcoin has fallen below $100,000, hitting a new low since June and sparking concerns about a crypto winter, he believes the current market is closer to a bottom rather than the start of a new long-term bear market. Retail investors are currently in a stage of extreme despair, with frequent leverage liquidations and market sentiment at new lows; however, institutional investors and financial advisors remain bullish, continuing to allocate to Bitcoin and other crypto assets through ETFs. Institutions are becoming the main driving force in the market. Retail crypto investors’ selling is nearing exhaustion, and he believes Bitcoin’s price bottom is imminent and will arrive sooner than expected. He expects Bitcoin to still have a chance to reach new highs this year, possibly rising to the $125,000–$130,000 range, and if the trend is ideal, even reaching $150,000. As institutional buying continues to grow, the next phase of the crypto market will be driven by more rational capital.

BitMEX founder Arthur Hayes published a new article stating that the US Treasury and Federal Reserve are brewing a “Stealth QE,” which may become a key catalyst for a new round of gains in Bitcoin and the crypto market. Currently, US government spending is expanding, preferring to issue debt rather than raise taxes. Foreign central banks, due to the risk of dollar assets, prefer to buy gold, and US private savings rates are insufficient to support Treasury issuance, while the four major commercial banks have only absorbed a small portion of new debt. “Relative value hedge funds” have become marginal buyers of US Treasuries, relying on repo leverage financing to buy debt. The US Treasury is expected to issue about $2 trillion in new debt annually to cover deficits. When liquidity is tight, the Federal Reserve injects funds into the market through the standing repo facility, which is equivalent to “disguised QE.” As the use of this facility increases, global dollar liquidity rises, with effects equivalent to QE. Hayes predicts this will reignite the bull market in Bitcoin and crypto. Currently, government shutdowns and Treasury auctions have led to short-term liquidity tightening, and he advises investors to preserve capital and wait for the right moment, stating that after “Stealth QE” starts, the market will rebound strongly.

From the perspective of on-chain capital and holding structure, the current Bitcoin market is undergoing a structural test of supply-demand imbalance. According to on-chain data analyst @Murphy, Bitcoin is currently experiencing a “structural test” of supply-demand imbalance, with long-term holders recently selling large amounts, and market demand insufficient to fully absorb this selling pressure. The reason these holders are selling is that they still have relatively high profits, but as prices fluctuate and pull back, their profit margins are being compressed. Historically, when the daily distribution volume of long-term holders falls below 15,000, the market usually stabilizes again. When their realized profit-loss ratio drops below the “warning line,” selling motivation will significantly weaken, and market pressure will ease. According to past cycles, this adjustment period may last another 1–2 months, during which trend trading entry opportunities may arise.

CryptoQuant CEO Ki Young Ju pointed out that the unrealized profits of whales are currently not high, indicating that the market has not yet entered a frenzy stage, possibly because the scale of the Bitcoin market has expanded and high profit margins are harder to achieve. Meanwhile, Bitcoin’s hash rate continues to hit new highs, and mining companies are still expanding, showing a clear long-term bullish signal. Current demand mainly comes from ETFs and Strategy, but both have slowed their buying recently; if growth resumes, market momentum may restart. Short-term whales (mainly ETFs) are near breakeven, while long-term whales have about 53% profit. The traditional four-year cycle pattern is weakening, and future liquidity sources and scale are harder to predict. In addition, the average holding cost of Bitcoin is about $55,900, with holders averaging 93% profit. On-chain capital inflows remain strong, but the main reason for price stagnation is weak demand, not selling pressure.

Crypto investment institution QCP Capital pointed out that the recent sell-off lacks obvious macro drivers, even though other risk assets have performed well under favorable policy conditions. Over the past month, the market has absorbed about 405,000 BTC from OG holders, and the price has not fallen below $100,000. Although listed companies have slowed their accumulation and some small digital asset reserve companies have sold, spot prices remain supported. Currently, long-term holders are taking profits, while institutional capital inflows and application adoption are consolidating the market foundation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Microsoft Strikes $9.7B Deal With IREN as AI Demand Surges

XRP ETF: Nate Geraci predicts a launch within two weeks

Sequans Sells 970 Bitcoins, Unsettling the Markets

Crypto: Kaiko ranks XRP above Solana and Dogecoin in 2025