Morning Brief | US stocks closed: Dow Jones fell 225 points, Nasdaq rose 0.46%; Bitcoin lending platform Lava announced completion of $200 million financing; Token network protocol suffered hacker attack, Ethereum once plummeted 9%

Summary of major market events on November 4.

Compiled by: ChainCatcher

Important News:

- Token network protocol hacked, Ethereum once plummeted 9%

- Data: Crypto sector plunges across the board, BTC falls below $108,000, ETH once drops nearly 8%

- Yilihua: Current crypto market is excessively panicked, short-term presents investment cost-effectiveness

- US stocks close: Dow drops 225 points, Nasdaq rises 0.46%

- Analyst: Gold pullback has temporarily subsided, optimistic target at $4,700

- Bitcoin lending platform Lava announces completion of $200 million financing, with Anthony Pompliano and others participating

- Standard Chartered: Will launch Bitcoin and Ethereum custody services in Hong Kong next year

What important events happened in the past 24 hours?

Wintermute denies plans to sue Binance, CEO calls rumor baseless

ChainCatcher reports that Wintermute CEO has denied rumors that it is suing Binance, stating on X that the rumor is baseless: "We have never planned to sue Binance, and there is absolutely no reason to do so in the future."

Token network protocol hacked, Ethereum once plummeted 9%

ChainCatcher reports, according to Golden Ten Data, that on Monday Ethereum once dropped 9%, falling below the key support level of $3,600, down about 25% from the August 22 high of $4,885. Before the crash, the Ethereum-based DeFi protocol Balancer lost possibly over $100 million in a hacker attack. This vulnerability is the latest in a series of bearish events in recent weeks, unsettling digital asset investors. Stocks related to digital assets also came under pressure, with Coinbase down nearly 4% and Strategy down more than 1%.

Data: Crypto sector plunges across the board, BTC falls below $108,000, ETH once drops nearly 8%

ChainCatcher reports, according to SoSoValue data, that all sectors of the crypto market fell sharply, with declines generally ranging from 2% to 10%. Bitcoin (BTC) dropped 2.31% in 24 hours, once falling to around $105,000 (UTC+8), but has since rebounded to $107,000.

Ethereum (ETH) once dropped nearly 8%, with the decline narrowing to 4.94% and rebounding above $3,600. In addition, the SocialFi sector led the decline with a 10.1% drop, with Toncoin (TON) down 10.67%. In other sectors, the PayFi sector fell 5.55% in 24 hours, but Dash (DASH) bucked the trend for two consecutive days, rising another 25.71%; the CeFi sector fell 6.54%, with Aster (ASTER) down 20.72%; the Meme sector fell 6.92%, with MemeCore (M) and BUILDon (B) rising 1.01% and 3.93% respectively; the Layer1 sector fell 7.06%, with Zcash (ZEC) bucking the trend and rising 7.09%; the DeFi sector fell 7.66%, with World Liberty Financial (WLFI) down 12.51%; the Layer2 sector fell 8.48%, with Merlin Chain (MERL) relatively resilient, up 1.13%. Crypto sector indices reflecting historical sector performance show that the ssiSocialFi, ssiLayer2, and ssiDePIN indices fell 10.21%, 9.05%, and 9% respectively.

Yilihua: Current crypto market is excessively panicked, short-term presents investment cost-effectiveness

ChainCatcher reports that Liquid Capital (formerly LD Capital) founder Yilihua posted on X: "While the Nasdaq keeps rising, the sentiment in the crypto market is excessively panicked. In the short term, the crypto market presents investment cost-effectiveness. One should be greedy when others are fearful, but also be prepared for risk control and stop-loss, as there may be unknown risks. I still advise non-genius professional traders not to play with contracts; the volatility of spot crypto is already large enough."

US stocks close: Dow drops 225 points, Nasdaq rises 0.46%

ChainCatcher reports, according to Golden Ten Data, that US stocks closed with the Dow Jones Industrial Average preliminarily down 225 points, the S&P 500 up 0.17%, and the Nasdaq Composite up 0.46%. Some star tech stocks performed strongly: Micron Technology up 4.8%, Amazon up 4%, Tesla up 2.59%, and Nvidia up 2.17%. The Nasdaq Golden Dragon China Index closed up 0.26%.

Analyst: Gold pullback has temporarily subsided, optimistic target at $4,700

ChainCatcher reports, UBS analysts said the current pullback in the gold market is only temporary, and gold prices are still expected to reach $4,200 per ounce; if geopolitical or market risks intensify, the optimistic scenario could see gold prices surge to $4,700 per ounce.

"The long-awaited pullback in the market has temporarily subsided," UBS said in a research report released Monday. "Apart from technical factors, we have not found any fundamental support for this sell-off."

The Swiss banking giant pointed out, "Weaker price momentum has triggered a second round of declines in futures positions," but also emphasized that underlying demand for gold remains strong.

UBS analysts also cited the World Gold Council's "Q3 Gold Demand Trends Report," which confirmed that "gold buying demand from central banks and individual investors remains strong and continues to heat up."

ZKsync founder releases ZK token update proposal: all network revenue will be used to buy back and burn ZK tokens

ChainCatcher reports that ZKsync founder Alex (@thealexgluchowski) released "ZK Token Proposal Part I," proposing a major update to the ZK token economic model. The core mechanism is that all network-generated revenue will be used to buy back and burn ZK tokens.

Alex stated that in the future, ZK tokens will no longer be limited to governance use, but will have actual value capture functions. Sources of network value include: all such revenue will flow into mechanisms controlled by governance, used for ZK buybacks and burns, staking rewards, and ecosystem development funds. Alex emphasized that this move aims to directly link the value of ZK tokens to network usage, driving ZKsync to form a self-reinforcing sustainable economic system.

Stablecoin payment infrastructure platform Zynk completes $5 million seed round, led by Hivemind Capital

ChainCatcher reports that stablecoin payment infrastructure platform Zynk has completed a $5 million seed round, led by Hivemind Capital, with participation from Coinbase Ventures and others.

Zynk stated that it will use the new funds to expand its payment channels, enhance liquidity and compliance infrastructure, and establish partnerships with major payment service providers.

Standard Chartered: Will launch Bitcoin and Ethereum custody services in Hong Kong next year

ChainCatcher reports, according to Hong Kong media Ming Pao, that Standard Chartered Hong Kong and Greater China & North Asia CEO Mary Huen said Standard Chartered will launch innovative digital asset solutions in Hong Kong next year, including digital asset custody services supporting the two largest cryptocurrencies by market cap, Bitcoin and Ethereum, as well as strategic cooperation plans with other institutions.

Standard Chartered Hong Kong pointed out that the bank plans to be the first to launch digital asset custody services supporting Bitcoin and Ethereum in Hong Kong in January next year, expanding on services already offered in Luxembourg and the UAE (via Dubai International Financial Centre).

CZ: Added to ASTER position yesterday, every investment buy is short-term underwater

ChainCatcher reports, CZ shared on social media: "Every time I buy coins, I get stuck, 100% record.In 2014, I bought BTC at an average price of $600, and within a month it fell to $200, lasting 18 months.In 2017, I bought BNB, which also fell 20-30% and lasted several weeks.This time... can't say yet. Added a bit more yesterday (UTC+8). So everyone should pay attention to risks. I won't disclose anymore in the future to avoid affecting everyone's trading."

Data: BitMNR and SharpLink ETH holdings have unrealized losses exceeding $1.9 billion

ChainCatcher reports, according to on-chain analyst Yujin's monitoring, as ETH price fell below $3,500, both BitMNR and SharpLink's ETH treasuries suffered significant unrealized losses.

BitMNR holds 3,395,422 ETH, worth $11.88 billion, with an average cost of $4,037, currently at an unrealized loss of $1.82 billion.

SharpLink holds 860,299 ETH, worth $3.01 billion, with an average cost of $3,609, currently at an unrealized loss of $93.77 million.

US government "shutdown" enters 35th day, tying the longest record in history

ChainCatcher reports that as Eastern US time entered November 4, the US federal government "shutdown" entered its 35th day, tying the longest "shutdown" record in US history. Over the past 30-plus days, Democrats and Republicans have been deadlocked, with 13 Senate votes failing to pass a temporary funding bill proposed by Republicans. It is reported that the Senate will hold the 14th round of voting today (November 4 local time). The US Congressional Budget Office recently stated that depending on the duration of the federal government "shutdown," the annual growth rate of US real GDP in Q4 this year is expected to fall by one to two percentage points. This means a 4-week "shutdown" would cost the US economy $700 million; a 6-week shutdown, $1.1 billion; and an 8-week shutdown, as much as $1.4 billion.

Meme Trending List

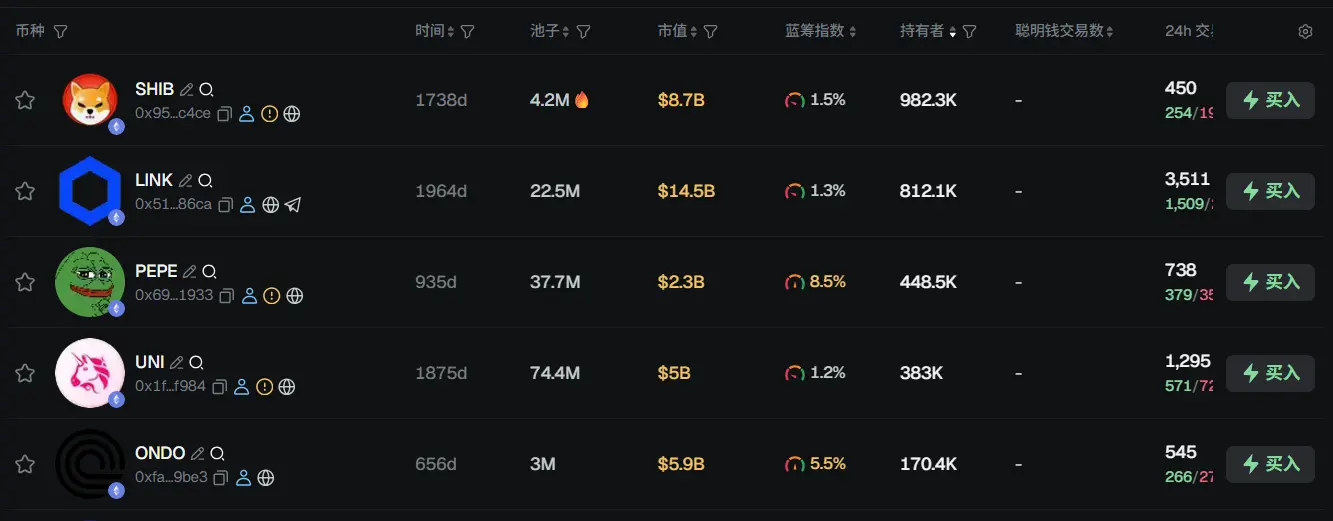

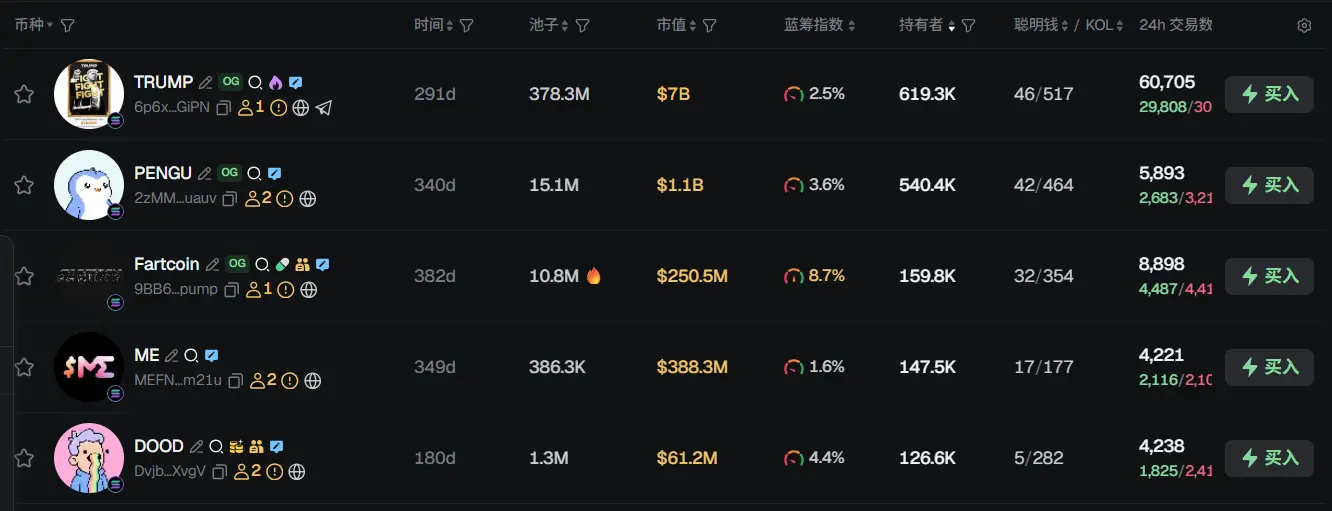

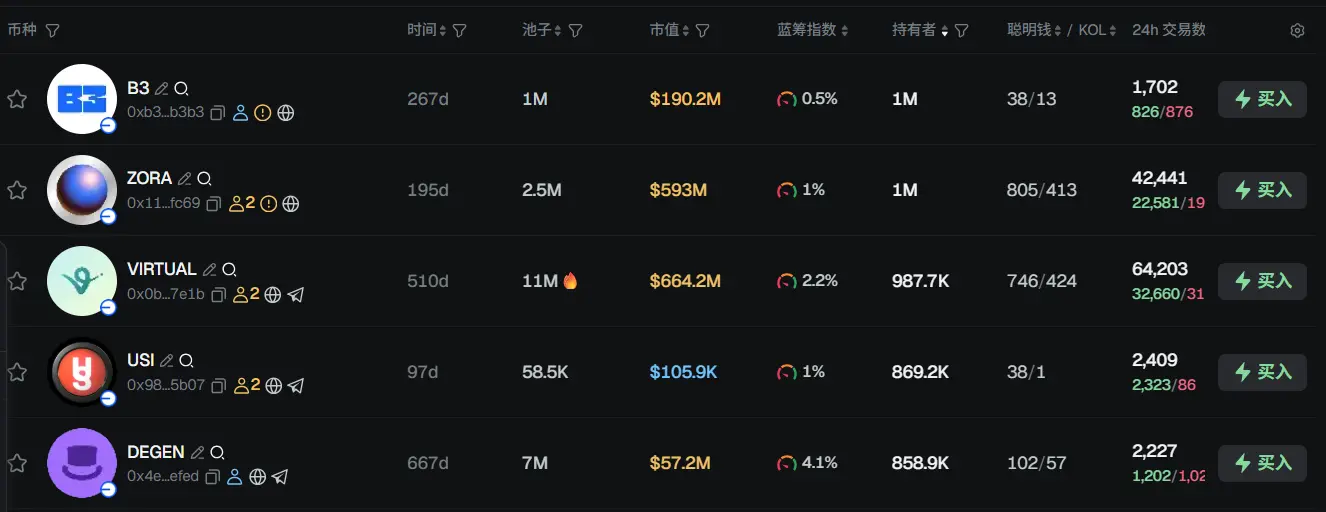

According to data from meme token tracking and analysis platform GMGN, as of 09:00 on November 3 (UTC+8),

The top five trending ETH tokens in the past 24h are: SHIB, LINK, PEPE, UNI, ONDO

The top five trending Solana tokens in the past 24h are: TRUMP, PENGU, Fartcoin, ME, DOOD

The top five trending Base tokens in the past 24h are: B3, ZORA, VIRTUAL, USI, DEGEN

What are some noteworthy articles to read from the past 24 hours?

Balancer code issue causes losses over $100 million, nearly devastating blow to DeFi industry

Note: Today, DeFi protocol Balancer suffered a hacker attack, with the amount stolen now exceeding $116 million. Multiple projects have taken self-rescue measures: Lido has withdrawn its unaffected Balancer positions; Berachain directly announced a network pause to conduct an emergency hard fork to fix BEX vulnerabilities related to Balancer V2.

In addition, Flashbots Strategy Director and Lido Strategic Advisor Hasu posted, "Balancer v2 went live in 2021 and has since become one of the most watched and frequently forked smart contracts. This is very concerning. Every time a contract that has been live for so long is attacked, it sets DeFi adoption back by 6 to 12 months."

The following is the original content:

On November 3, veteran DeFi protocol Balancer was reported to have lost over $70 million in assets to theft. The news was subsequently confirmed by multiple parties, and the amount stolen continued to rise. At the time of writing, Balancer's stolen assets have increased to over $116 million. This article provides a brief analysis of the incident.

Conversation with GOAT Network core contributor Kevin: From BitVM2 mainnet to institutional-grade BTC yield, revealing the next explosive cycle for Bitcoin Layer2

As the first native ZK Rollup in the Bitcoin ecosystem to achieve real-time proof, GOAT Network recently released its complete roadmap after TGE, with a clear core goal: to make Bitcoin truly liquid.

ChainCatcher invited GOAT Network core contributor Kevin for an in-depth conversation. Kevin is also the co-founder of Metis, a key infrastructure in the Ethereum ecosystem, with extensive practical experience in ZK and scaling. In this interview, he systematically explains how GOAT, through a three-pronged approach of product, ecosystem, and institutional deployment, is building a sustainable ecosystem for Bitcoin Layer2, and shares his views on key breakout nodes and future trends in the sector.

Giants step back, ETF cools: What is the real reason for this Bitcoin drop?

For most of 2025, Bitcoin's support level seemed unshakable because corporate digital asset treasuries (DAT) and exchange-traded funds (ETF) unexpectedly joined forces to form a support base.

Corporations bought Bitcoin by issuing stocks and convertible bonds, while ETF inflows quietly absorbed new supply. Together, they built a solid demand base, helping Bitcoin withstand the pressure of tightening financial conditions.

Now, this foundation is beginning to loosen.

Here's a scary story: Even Koreans are trading less crypto

South Korea has long been one of the world's most fervent crypto nations, even coining the term "Kimchi Premium," where Korean traders once paid up to 10% more for Bitcoin than the global average.

But by 2025, the trend has changed. The trading volume of Upbit, Korea's largest crypto exchange, has dropped 80% compared to the same period last year, and the activity of Bitcoin-KRW trading pairs is far less than in previous years; meanwhile, the Korean stock market is booming, with the KOSPI index surging over 70% this year and continuously hitting record highs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin May Face "The Last Drop": The Real Scenario of Liquidity Squeeze Is Unfolding

Bitcoin may be in the "final drop" stage of this correction. At the intersection where fiscal spending resumes and the next interest rate cut cycle begins, a new liquidity cycle will also be restarted.

Galaxy Research Report: What Is Driving the Rise of the Doomsday Vehicle Zcash?

Regardless of whether ZEC’s price strength can be sustained, this round of market rotation has successfully forced the market to reassess the value of privacy.

Asian stock markets plunge with circuit breakers triggered; Korea hits circuit breaker during trading, Nikkei falls below the 50,000 mark

Wall Street warns: This is just the beginning, and the panic triggered by the bursting of the AI bubble has only just started.

Only 0.2% of traders can exit at the bull market peak: The art of "smart exits" in the crypto cycle