Ethereum Staking Weekly Report November 4, 2025

1️⃣ Ebunker ETH staking yield: 3.32% 2️⃣ stETH (Lido) 7-day average annualized yield...

1️⃣ Ebunker ETH staking yield: 3.32%

2️⃣ stETH (Lido) average 7-day annualized yield: 2.89%

3️⃣ Total ETH staked: 35,710,327 ETH

4️⃣ Total ETH staking rate: 29.75%

5️⃣ ETH inflation last week: +18,166.49

6️⃣ Staking queue waiting time: < 25 days 12 hours

7️⃣ Exit queue waiting time: < 40 days 12 hours

8️⃣ Ebunker market share: 1.18%

9️⃣ Average Rated effectiveness score: 98.08%

🔟 Ebunker Rated effectiveness score: 98.5% (0.42% higher than average)

🎾 Ethereum Network Upgrades

🔘 The Fusaka upgrade was launched on the Hoodi testnet on October 29, marking the final testnet deployment before mainnet.

🔘 Developers are introducing a new p2p rule SOON, which significantly reduces message latency and bandwidth usage by prioritizing the delivery of blocks and validation messages to the fastest nodes.

🔘 The Ethereum Foundation has confirmed that the Fusaka mainnet upgrade will take place on December 3. This hard fork will integrate around 12 EIPs, focusing on scalability, security, and performance improvements.

🎾 ETH Staking

🔘 Token Terminal released Ether.fi's Q3 report: TVL reached $11.5 billions (up 78% quarter-on-quarter), cash expenditure was $48.52 millions (+422%), and quarterly revenue was $16.9 millions (+78%).

🔘 VanEck has filed for a Lido stETH ETF, becoming the first ETF with stETH as its underlying asset, marking a new phase for institutional-level liquid staking.

🔘 SSV Network launched multi-client DVT (Distributed Validator Technology) on mainnet, significantly enhancing the risk resistance and decentralization of the Ethereum validation network.

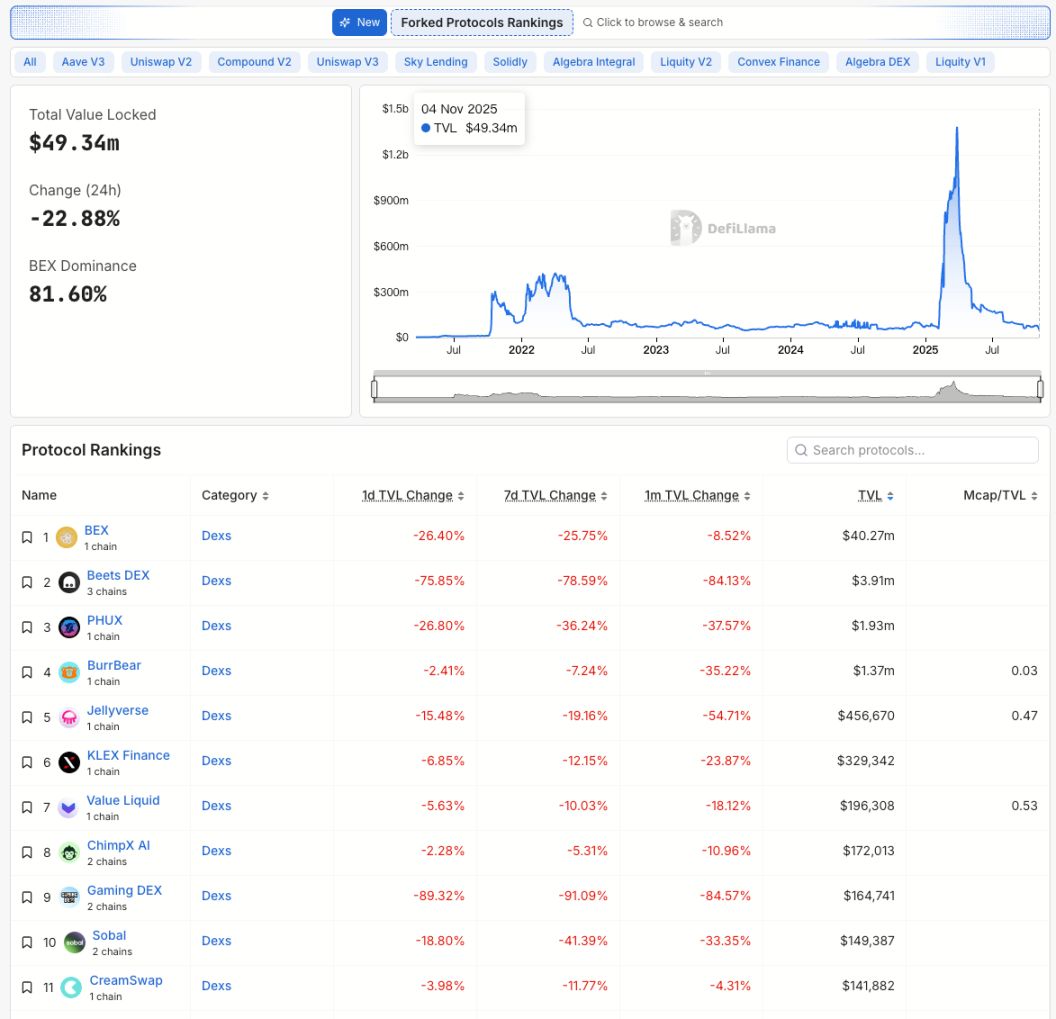

🔘 DeFi protocol Balancer suffered a major attack, with approximately $128.6 millions in assets stolen, including $70.9 millions in staked ETH.

🎾 Layer2

🔘 Coinbase's x402 protocol saw a 10,000% surge in trading volume over the past month; the protocol allows AI agents to autonomously execute on-chain transactions.

🔘 Coinbase's Q3 financial report showed a 37% quarter-on-quarter increase in revenue, with Ethereum trading volume accounting for a significantly higher proportion of overall trading.

🔘 Ethereum vault company SharpLink, supported by Consensys, deployed $200 millions in ETH on the Linea Layer2, enhancing ecosystem liquidity and scalability.

About Ebunker

One of Asia's largest node operators, managing over $1.5 billions in assets, providing node operation services for protocols including Lido, EtherFi, and SSV, and offering both custodial and non-custodial staking solutions for Ethereum and other assets to large institutions and high-net-worth individuals.

🔗 Related links:

🔗 Ebunker official website

🔗 Ebunker Twitter

🔗 More updates and discussions

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

That summer, I sniped altcoins on DEX and made 50 million dollars.

Starting from just $40,000, we ultimately sniped more than 200 altcoins across over 10 different blockchains.

From Balancer to Berachain: When Chains Hit the Pause Button

A single vulnerability exposes the conflict between DeFi security and decentralization.

Berachain: All funds stolen due to the vulnerability have been recovered.

The Butterfly Effect of the Balancer Hack: Why Did $XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.