SOL Rallies on ETF Hype, TON Faces Pressure, & BlockDAG’s $435M+ Presale Inspires Market Confidence

The spotlight remains on Solana (SOL) price trend, which is attempting a breakout on ETF speculation, while the Toncoin (TON) price dip continues to weigh on market sentiment due to whale dominance. Yet beyond these fluctuations, long-term investors are seeking projects built on verified fundamentals and transparent growth.

Points Cover In This Article:

ToggleThat pursuit leads to BlockDAG (BDAG), which has already raised over $435 million from 312,000+ holders, forming a robust capital base that secures its upcoming launch. This “war chest” supports liquidity development, global marketing efforts, and exchange listings, including a partnership with Formula 1®.

Guided by CEO Antony Turner, this funding ensures that BlockDAG’s launch at $0.05 will follow a strategic climb from the current $0.005 Batch 32 price, reflecting a clear 900% upside for early participants.

BlockDAG’s Recent Fundraising Marks a Turning Point in Market Confidence

The scale of BlockDAG’s fundraising demonstrates its credibility. Raising over $435 million from 312,000+ verified holders is a reflection of global investor confidence in the project’s integrity and long-term vision. This capital influx has laid the groundwork for deep liquidity, premium exchange listings, and sustained infrastructure development, ensuring that BlockDAG’s ecosystem is focused on enduring growth and scalability.

Funds raised serve as a strategic driver in BlockDAG’s roadmap, supporting technological advancements, community incentives, and network expansion. The project’s Formula 1® partnership further demonstrates its presence in the mainstream, signaling to both crypto enthusiasts and traditional investors that BlockDAG is reaching global brand recognition and institutional appeal.

Currently in Batch 32, priced at $0.005, and with only 4.5 billion coins left, early participants are securing positions ahead of the February 10, 2026, launch, when the token’s value will rise to $0.05. Each batch not only marks a price progression but also represents a milestone in investor confidence and ecosystem strength.

By combining transparent fundraising, real-world partnerships, and a scalable hybrid architecture, BlockDAG continues to prove that it’s not just another crypto project; it’s a movement shaping the future of decentralized finance.

Solana (SOL) Price Trend Gains Strength With ETF Momentum

The Solana (SOL) price trend is gaining traction, powered by institutional optimism. The upcoming Bitwise Solana Staking ETF (BSOL), set to debut on the NYSE, is expected to inject between $3 billion and $6 billion in its first year. This ETF listing not only provides regulatory validation but also paves the way for significant institutional inflows.

Technically, SOL is currently battling resistance between $200 and $210. A confirmed breakout above this level could propel it toward $230–$260 in the short term. Meanwhile, whale accumulation and a forming inverse head-and-shoulders pattern support the growing bullish outlook.

Solana’s Alpenglow upgrade will further enhance its efficiency by reducing block finality time from 12 seconds to just 150 milliseconds, significantly improving scalability. This blend of institutional recognition and technical innovation suggests the Solana (SOL) price trend is well-positioned for a strong rally heading into Q4.

Toncoin (TON) Price Dip Reflects Short-Term Pressure, Long-Term Potential

The Toncoin (TON) price dip, with the token losing around 16.1% over the past month, highlights its current market pressure. Trading near $2.21 to $2.24, TON remains well below its 200-day moving average of $3.03. The key issue lies in supply concentration; over 68% of all TON is held by large wallets, leaving low liquidity depth and heightened sensitivity to whale-driven movements.

The recent $80 million token unlock on October 23, 2025, intensified this pressure, leading to a break below the $2.50 support level. However, institutional accumulation provides a silver lining. The TON Foundation has secured over $149 million TON (around $328 million) in corporate treasuries, mirroring MicroStrategy’s accumulation strategy to reduce circulating supply.

Combined with TON’s expansive Telegram-based user ecosystem, this strategic hoarding could transform the current Toncoin (TON) price dip into a future recovery opportunity. Technical indicators, including oversold RSI levels, hint that a potential rebound may be on the horizon.

Why BlockDAG Leads the Next Crypto Growth Cycle

While the Solana (SOL) price trend continues its ETF-fueled rise and the Toncoin (TON) price dip reflects short-term concentration risks, one project has decisively earned the market’s trust. The more than $435 million raised by BlockDAG stands as proof of its legitimacy, transparency, and potential.

Led by CEO Antony Turner, the project’s growth has evolved into a full-scale ecosystem backed by verified capital and a clear launch timeline. The Batch 32 price of $0.005 presents the final opportunity to enter before its February 10, 2026 listing at $0.05, a 900% growth window for those who act early.

In a market defined by volatility and speculation, BlockDAG exemplifies what investors seek: a vision built on accountability, structure, and technological progress. As Solana and Toncoin navigate their respective turning points, BlockDAG is already charting a future that positions it among the top crypto projects of the decade.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

That summer, I sniped altcoins on DEX and made 50 million dollars.

Starting from just $40,000, we ultimately sniped more than 200 altcoins across over 10 different blockchains.

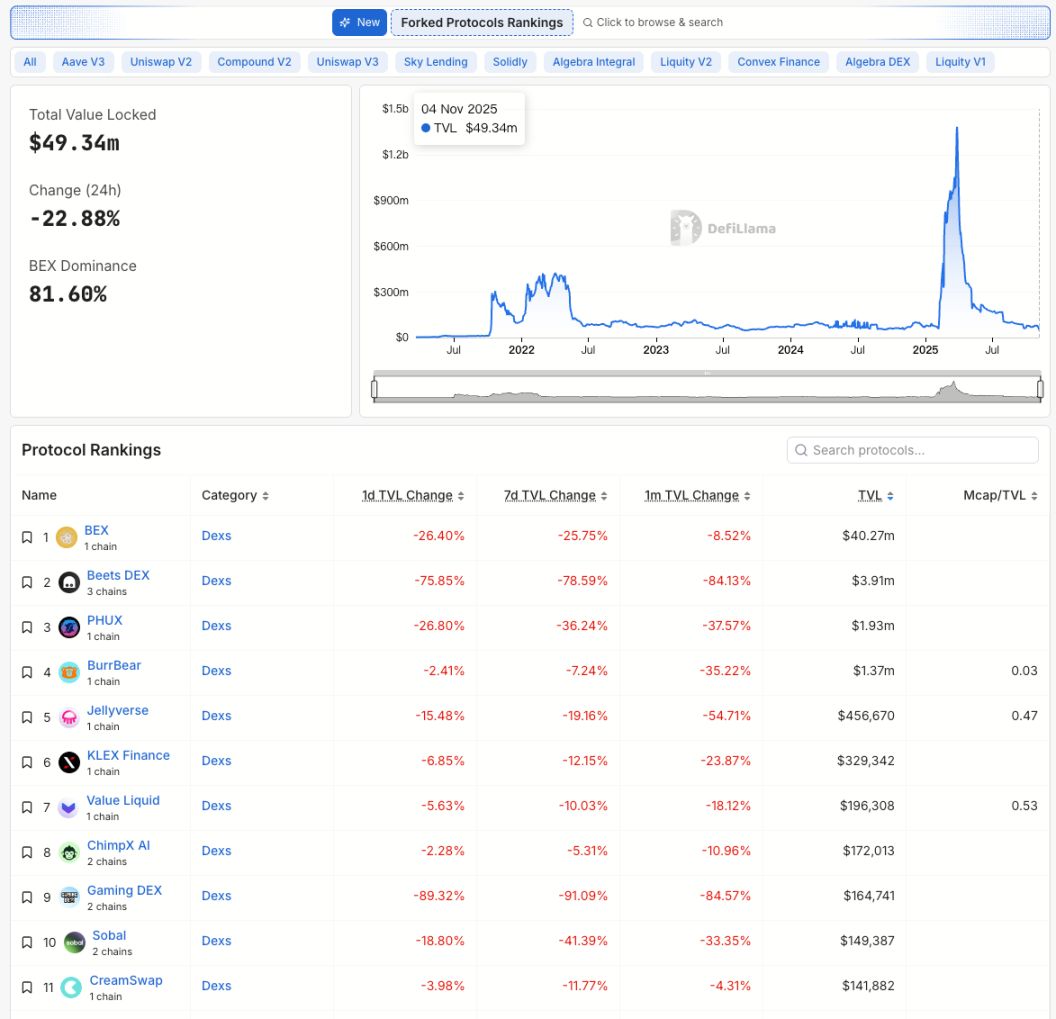

From Balancer to Berachain: When Chains Hit the Pause Button

A single vulnerability exposes the conflict between DeFi security and decentralization.

Berachain: All funds stolen due to the vulnerability have been recovered.

The Butterfly Effect of the Balancer Hack: Why Did $XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.