Matrixport: Bitcoin is at a critical juncture, with long-term holders slowly transferring their holdings to a new generation of institutional buyers.

Matrixport released a daily chart analysis stating, "In recent reports, we have pointed out that Bitcoin is approaching a key threshold - a typical 'bull and bear divide point', historically this signal has been very reliable.

Multiple structural indicators are issuing warning signals: futures open interest is starting to decline relative to the 90-day moving average, our trend model has turned bearish, and the price has dropped below the 21-week moving average - a level that historically marks the watershed between 'continue to go long' and 'shift to neutral' market conditions.

On the surface, Bitcoin seems very calm. Price movements are stagnant, volatility is gradually diminishing, and most investors believe the current range is just a 'normal consolidation phase'.

But this interpretation overlooks a deeper structural change: Bitcoin is not quietly consolidating, but is quietly undergoing a transfer of ownership - and this transfer is taking place in the most critical price range of this cycle.

Beneath the calm surface, long-term holders are gradually distributing chips to a new batch of institutional buyers, this transition brings a rare 'stagnation'. In addition, Bitcoin has fallen below the short-term realized price, increasing liquidation risks.

Individually, these are warning signals; but when they appear together, they constitute a clear risk warning."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Due to uncertainty over Federal Reserve rate cut expectations, the crypto market seeks support downward

Federal Reserve Chairman Powell stated that a rate cut in December is not inevitable, leading to a significant decrease in market expectations for rate cuts and a decline in risk assets. The crypto market also dropped as a result, with bitcoin falling below $110,000. The trading volume of Bitwise Solana ETF continues to grow. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively updated.

Weekly Hot List Selection: Fed Rate Cut Announced but Hawkish Signals Emerge! Improvement in International Trade Sentiment

Powell clearly indicated that a rate cut in December is not certain, with hawkish sentiment "awakening"! International trade sentiment is improving, and gold prices remain highly volatile. The Gaza ceasefire remains fragile, while Japan-U.S. relations are entering a "golden era." Nvidia's market value surpasses 5 trillions! Which exciting market moves did you miss this week?

Jensen Huang's fried chicken meal sends Korean "chicken stocks" soaring

Jensen Huang appeared at the Kkanbu Chicken restaurant in Seoul and had a fried chicken dinner with the heads of Samsung Electronics and Hyundai Motor, unexpectedly sparking a frenzy in Korean "meme stocks."

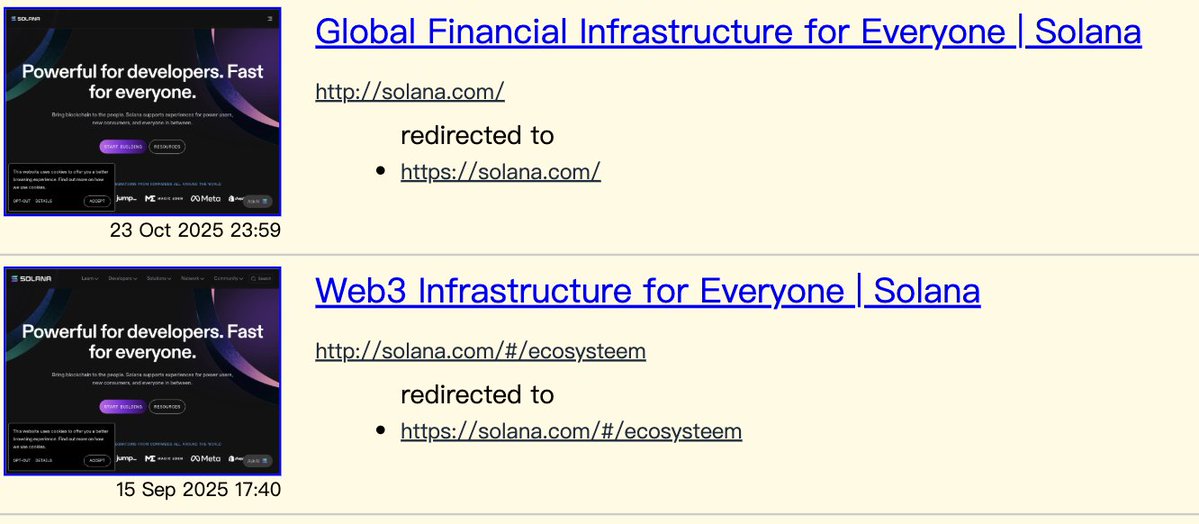

Will Solana's latest slogan ignite a financial revolution?

Solana is actively transforming "blockchain technology" into foundational infrastructure, emphasizing its financial attributes and capacity to support institutional applications.