Bitget Daily Digest(October 31 (October 31) | US Spot Bitcoin ETFs Saw $490 Million Net Outflow Yesterday; Bitwise SOL ETF Recorded Nearly $70 Million Inflow on Its First Day; Ethereum Foundation Launches ‘Enterprise Ethereum’ Website

Today's Outlook

- The Sui ecosystem gaming protocol Jackson.io's $JACKSON token trading competition will launch on November 1, 2025, at 08:00;

- Blockchain Africa Conference 2025 will be held in Johannesburg, South Africa, on October 31, 2025;

- US Spot ETFs: Multiple ETFs—Solana, Litecoin, Hedera, etc.—were listed in the US. Bitwise SOL ETF saw nearly $70 million in inflows on its first day;

Macro & Hot Topics

- From December, the US Federal Reserve will roll over maturing Treasury securities, officially ending the balance sheet reduction process;

- US spot Bitcoin ETFs saw a net outflow of $490.43 million yesterday;

- The Ethereum Foundation officially launched the "Enterprise Ethereum" website to promote institutional Ethereum adoption, with over 1.1 million validators globally already participating;

- Web3 NFT project Capybobo completed an $8 million funding round, led by Pluto & Folius, with Animoca Brands, HashKey Capital, and Mirana Ventures as co-investors. The project aims to focus on global trends in collectibles and GameFi markets;

Market Trends

- BTC and ETH experienced short-term declines yesterday; BTC dropped below $106,300 and ETH fell below $3,700. Approximately $55.87 million in positions were liquidated in the past 4 hours, mainly long positions;

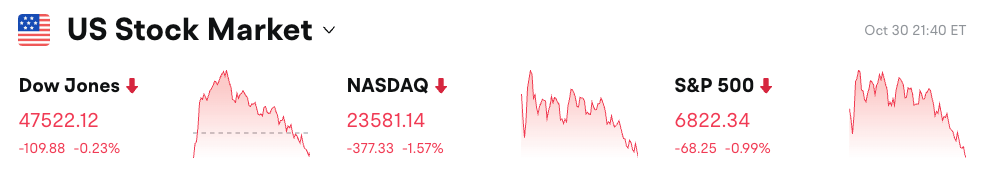

- All three major US stock indices closed lower on Thursday, with Nasdaq leading losses. Market concerns included AI spending by tech giants and disappointing results from Meta, along with uncertainties about the Fed's rate cut outlook;

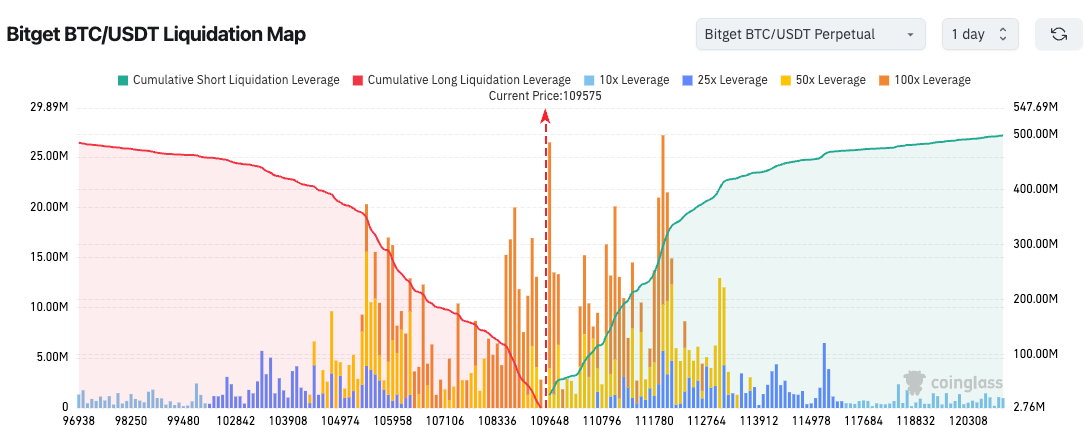

3.According to Bitget's BTC/USDT liquidation map, BTC is at $109,600. There is heavy long leverage in the $109,000–111,000 range; a break below could trigger large-scale cascading liquidations, significantly raising short-term risk;

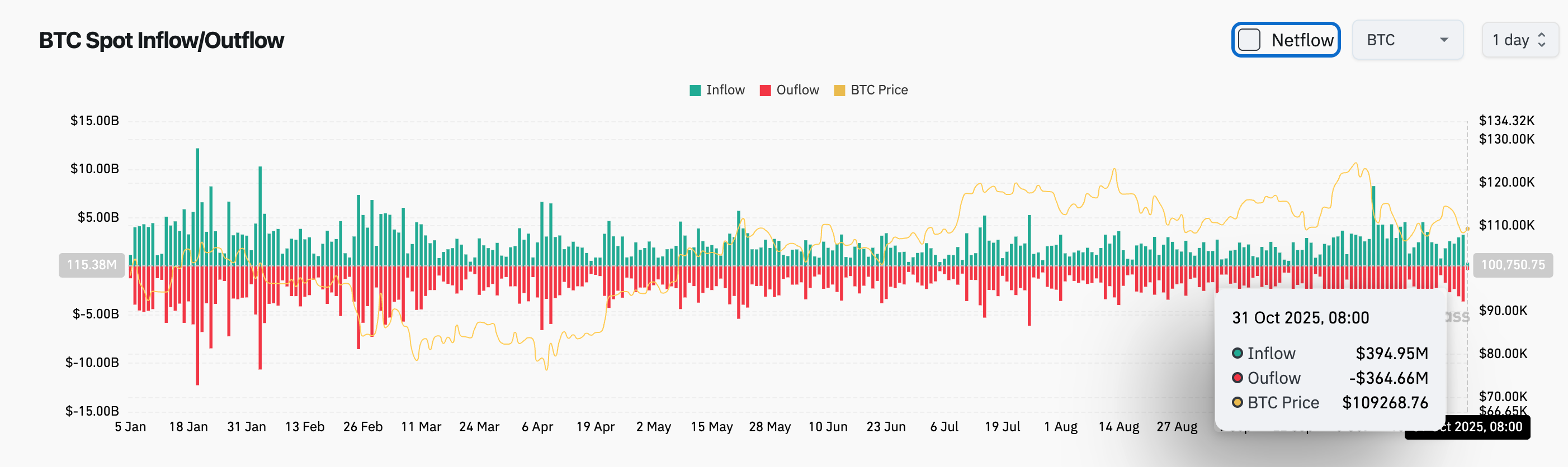

4.In the past 24 hours, BTC spot inflow was $394 million, outflow was $364 million, net inflow $30 million;

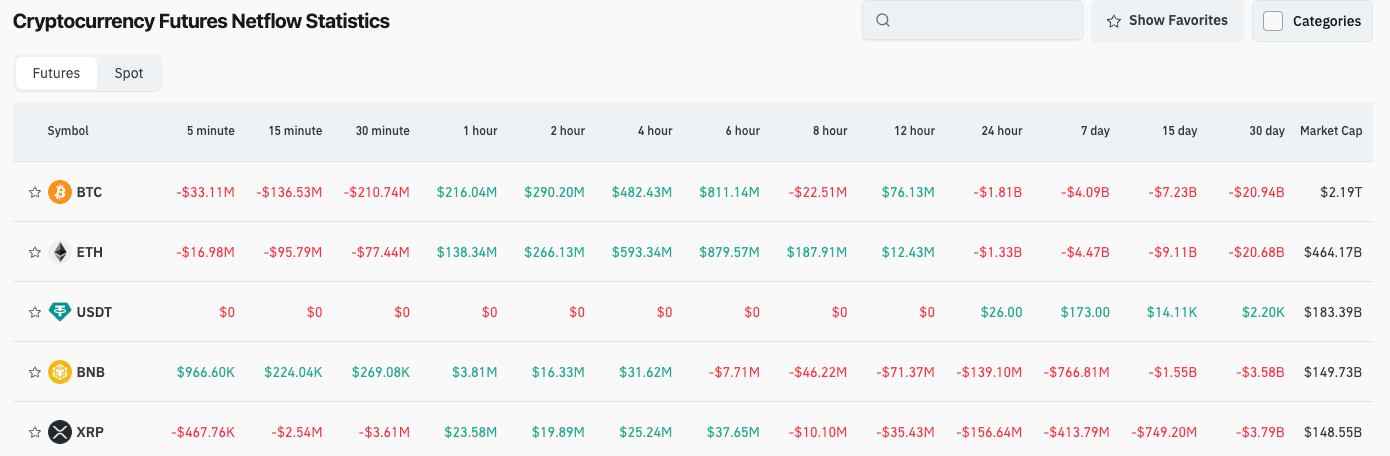

5.Over the past 24 hours, net contract outflows for BTC, ETH, USDT, BNB, and XRP led the market, hinting at possible trading opportunities;

News Updates

- The European Central Bank announced it will keep the deposit facility rate unchanged at 2%, the third consecutive meeting with stable rates;

- US Hedera spot ETF had a record single-day net inflow of $29.9 million; Litecoin spot ETF had neither net inflow nor outflow;

- The global crypto ETF market is expanding, with Solana, Litecoin, and Hedera ETFs listed in the US, drawing ongoing market attention;

- Mt. Gox creditor repayment deadline extended to October 31, 2026; affected users should monitor subsequent arrangements;

Project Updates

- Artery Chain: Officially issued the $ARTERY token on Avalanche C-Chain via TGE;

- Listed company SEGG Media plans to launch a $300 million digital asset plan, with an initial focus on Bitcoin;

- Polygon: Partnered with Flutterwave to leverage Polygon PoS for cross-border payments in over 30 African markets;

- UFC’s partner project FIGHT token public offering raised $183 million, exceeding its target by over 100 times;

- Ethereum: Fusaka upgrade completed final testing on the Hoodi testnet. Mainnet release is scheduled for December 3;

- Solana Company: Added $20 million worth of SOL holdings, bringing total holdings to over 2.3 million tokens;

- OORT: Released DataHub Launchpad, aiming to build the world’s first fully on-chain data task platform;

- Standard Chartered: Predicts tokenized RWA (Real World Assets) to reach $2 trillion by 2028, with the “vast majority” on Ethereum;

- Capybobo: Announced completion of $8 million financing, focusing on collectible IP and NFT innovation;

- Layer2 network Unichain added support for non-EVM assets such as DOGE, XRP, and Zcash; Disclaimer: This report is AI-generated and manually fact-checked for information only. It does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum’s Expansion and Investor Commitment Drive Altcoin Rarity, Indicating a Mature Market

- Altcoins like Pepe (PEPE) and Chainlink (LINK) show record-low exchange-held supplies, signaling strong institutional/retail accumulation. - Ethereum's institutional adoption (e.g., Tom Lee's $320M ETH purchase) and expanding staking infrastructure reinforce crypto market maturity. - PEPE's 20% exchange supply drop and LINK's 98.9% holder accumulation ratio highlight scarcity-driven bullish sentiment ahead of potential price breakouts. - Regulatory uncertainty (e.g., Trump crypto trading ban) risks short

Billie Eilish's Daring Wealth Stunt Faces Off Against Zuckerberg's Changing Riches

- Billie Eilish urged billionaires to redistribute wealth at the WSJ event, pledging $11.5M from her tour to climate and food insecurity causes. - Mark Zuckerberg, a Giving Pledge signatory, faces financial challenges as Meta's stock drops, reducing his net worth by $29.2B. - Eilish's advocacy highlights growing public discourse on wealth inequality, contrasting with gradual philanthropy approaches. - Her modest lifestyle and climate activism contrast with Zuckerberg's fluctuating fortune, underscoring ten

Aon's Key Strategies Propel 12% EPS Increase, 2026 Expansion Secured

- Aon reported Q3 2025 results exceeding forecasts, with 7% organic revenue growth and 12% higher adjusted EPS driven by its Aon United strategy and 3×3 Plan. - Risk Capital and Human Capital segments fueled performance, generating $2.5B and $1.5B in revenue respectively, supported by North American/EMEA operations and regulatory advisory work. - Operating income surged 31% to $816M with 20.4% margin, while $250M share repurchases and 13% free cash flow growth reinforced capital allocation discipline. - CE

Deutsche Telekom's Theta Initiative Marks Telecom and Blockchain Integration in the Age of AI

- Deutsche Telekom joins Theta Network as a strategic validator, expanding blockchain's institutional presence. - As the first telco, it validates transactions on Theta's AI-focused blockchain, partnering with tech giants. - The move highlights Theta's role in decentralized cloud services, leveraging distributed GPU resources. - Deutsche Telekom's blockchain expertise strengthens Theta's credibility in edge computing and AI markets. - The collaboration reflects telecoms and tech firms adopting decentralize