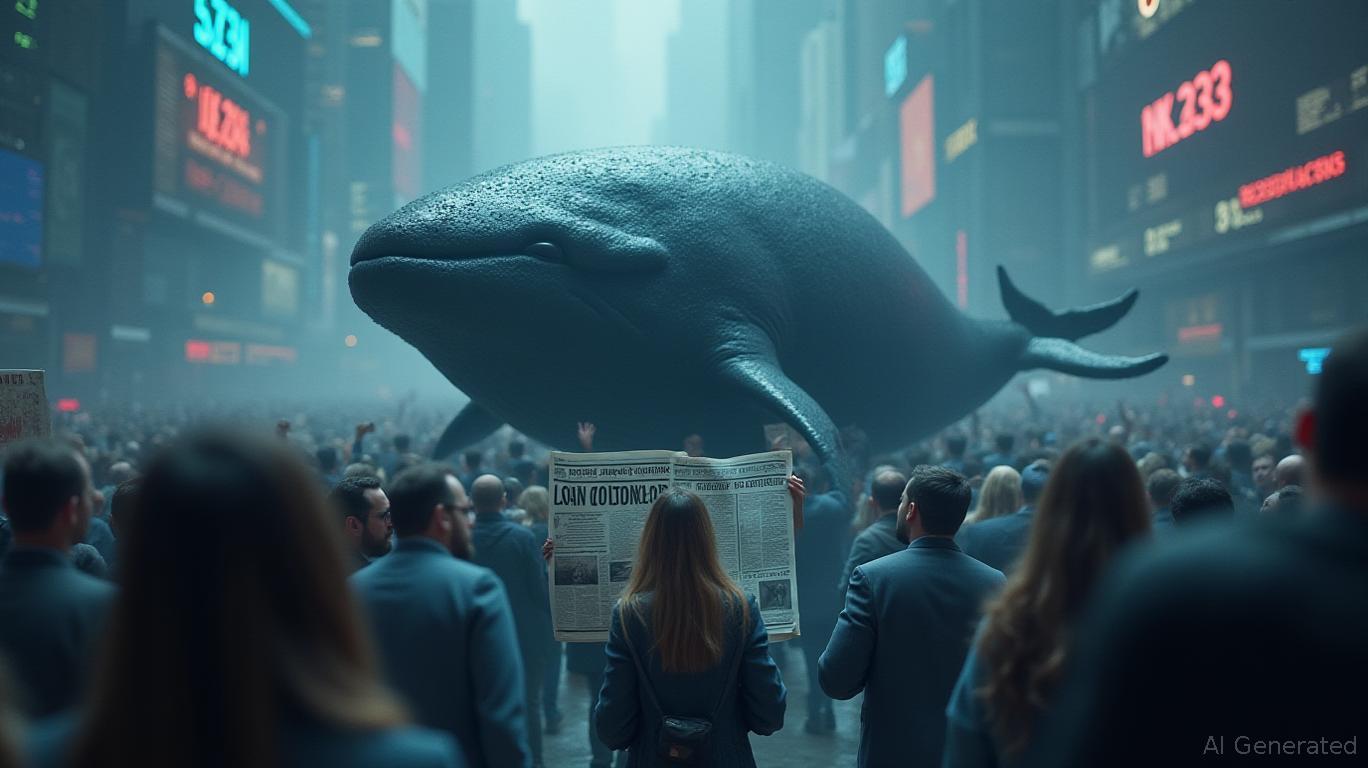

Crypto’s Ideal Whale: Absorb a $7M Deficit or Weather the Turbulence?

- A top crypto whale with 100% historical trade success now faces $7M in losses amid market shifts. - Analysts link the downturn to macroeconomic pressures, regulatory risks, and reduced speculative trading. - The whale's position volatility highlights risks even seasoned traders face in crypto's unpredictable market. - Market observers watch whether this whale will adjust strategies, potentially signaling broader sentiment changes.

An influential crypto whale, previously recognized for an unbroken streak of successful trades, is now facing substantial unrealized losses exceeding $7 million based on the most recent market figures, as reported by

The whale’s long-standing position, once regarded as a model for effective trading, is now being tested as market dynamics evolve. Experts point to several contributing elements, such as global economic challenges, regulatory ambiguity, and a decline in speculative trading, as noted by

Industry watchers are paying close attention to see if this well-known investor will alter their strategy or remain steadfast during the downturn. Should the whale reverse their position, it could indicate a broader change in market sentiment; holding steady, however, may strengthen belief in the long-term prospects of cryptocurrencies. This scenario highlights the difficulties that even veteran traders encounter in a market renowned for its volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zero Knowledge Proof (ZKP) Whitelist Is Coming Soon – The Top Presale Crypto of 2025 Starts Here

Trump-Xi Seoul Meeting Could Ease Bitcoin Tariff Pressures

Bitcoin and Ethereum Fall After Fed Signals Final 2025 Rate Cut

40M LINK Grabbed & $46M in ETH Snapped Up, While BlockDAG’s Early Buyers Secure Massive ROI of 2,940%