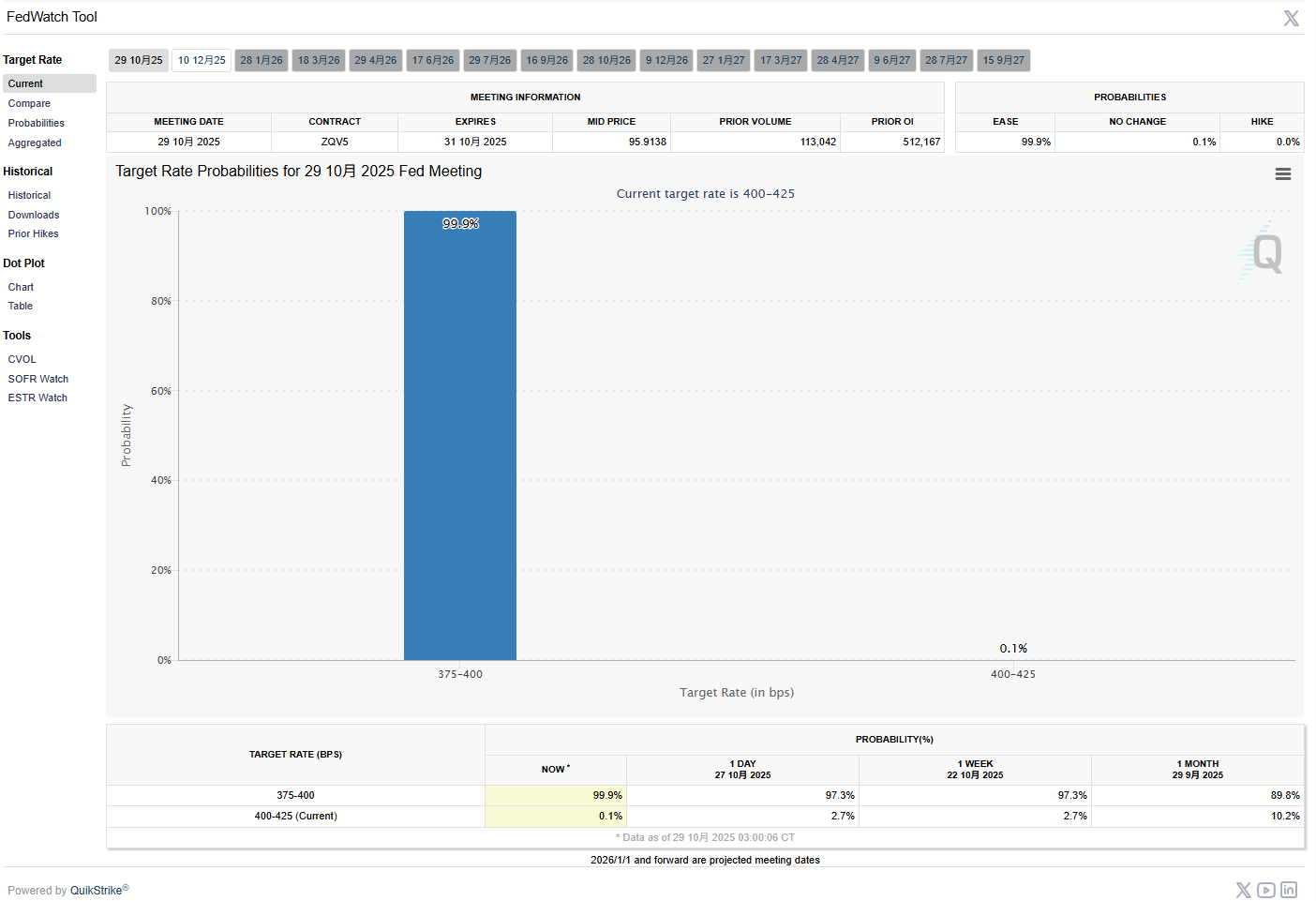

I. An Unquestionable Rate Cut

At 02:00 on October 30th, Beijing time, the Federal Reserve will announce its interest rate decision. The market's expectation for a 25 basis point rate cut is as high as 99.9%, making it almost a foregone conclusion. If implemented, the federal funds rate range will drop from 4.00%-4.25% to 3.75%-4.00%.

For cryptocurrency investors, the rate cut itself has long been priced in by the market. The real game lies in the press conference starting at 02:30—how Federal Reserve Chairman Powell balances intensifying internal contradictions and sets the tone for future policy paths.

Economist Wang Lei pointed out: "Powell must avoid hawkish remarks to maintain market confidence in a soft landing for the economy. But being too dovish may trigger concerns about asset bubbles—it's a tightrope performance."

II. Where Will the Crypto Market Go After the Rate Cut?

1. Four Scenarios and Crypto Market Reactions

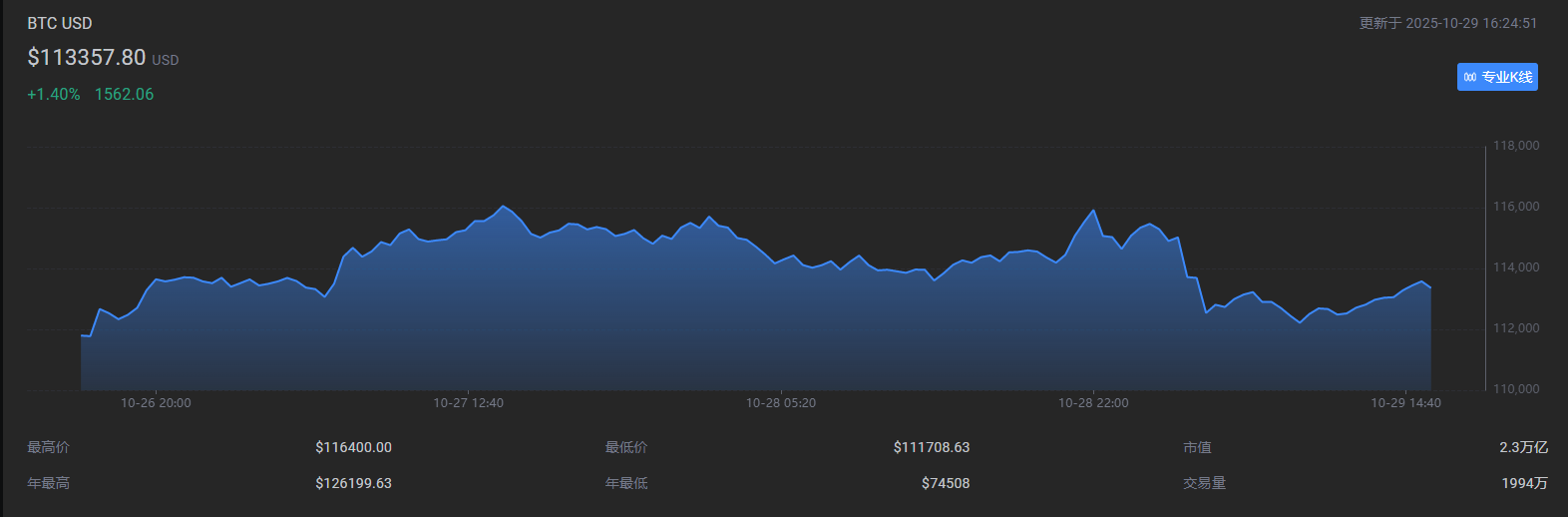

| Scenario | Policy Characteristics | Short-term Bitcoin Trend | Altcoin Risk |

| Dovish Rate Cut | Rate cut + hints of future easing | Breaks through $115K, targets $118K | General rise, MEME coins active |

| Hawkish Rate Cut | Rate cut + emphasis on inflation concerns | $112K-114.5K oscillation | Sharp correction |

| Super Dovish | 50 basis point cut + signal to end QT | Violent surge to $130K | Full-blown rally |

| Hold Rates | Unexpectedly stays put | Flash crash below $100K | Bloodbath |

2. On-chain Data Reveals Major Players' Moves

- Stablecoin Ammo Abundant: As of October 29, the total market cap of stablecoins surpassed $308 billions, with a net increase of 1.2% over the past 30 days, indicating potential buying power is accumulating.

- BTC Continues to Flow Out of Exchanges: In the past week, exchange bitcoin balances decreased by 18,200 coins, showing strong reluctance to sell among long-term holders.

- DeFi Rates Under Pressure: After the September rate cut, Aave's USDC deposit rate fell from 4.8% to 4.3%. If another cut happens, yields may be further compressed.

III. Market Divergence Lies in the Details

1. "Cautious" Representatives: U.S. consumer spending remains strong, and sticky inflation may force the Fed to keep the terminal rate above 3.5%, meaning the degree of easing will be less than market expectations.

2. "Data-driven" Representatives: The real bet tonight is whether there will be another 50 basis point cut in December, and the timing of QT's end. These two points will determine whether funds dare to rush to the end of the risk curve.

3. "Optimistic" Representatives: Federal funds futures show the market is pricing in a probability of over 90% for consecutive rate cuts at the remaining two meetings this year. If inflation rebounds, there could be an additional 2-3 cuts next year.

IV. Three Hidden Risks Behind the Rate Cut

Risk 1: Policy "Expectation Gap" Slaughters Leverage

The current crypto Fear & Greed Index is at 38 (fear zone), but bitcoin perpetual contract funding rates remain positive, indicating that long leverage has not been fully withdrawn. If Powell signals "this is a one-off," it could trigger a liquidation wave similar to that after the September rate cut.

Risk 2: Liquidity Trap Quietly Approaching

Although the Fed may cut rates, the timeline for ending quantitative tightening (QT) remains unclear. Barclays analysis suggests the Fed may delay giving clear guidance until December. During this period, data gaps caused by a U.S. government shutdown will leave the market "feeling the elephant in the dark," amplifying noise trading.

Risk 3: Regulatory Sword Suddenly Drawn

Fed governors have recently claimed to "actively embrace payment innovation," but the "streamlined main account" plan has yet to be implemented. If Powell adopts a cautious stance on crypto regulation after the meeting, it could dampen market expectations for traditional capital inflows.

V. Keep a Close Eye on These Two Key Developments

1. Powell's "Lip Service" (after 02:30 on the 30th), with a focus on whether he mentions:

- "Data dependence" (hawkish)

- "Labor market risks" (dovish)

- "Disappointing inflation progress" (extremely hawkish)

2. Clues to Ending QT (Next Week)

If the Fed adds language such as "approaching discussions to end balance sheet reduction" in its statement, it will ignite market expectations for liquidity to return, becoming a catalyst for bitcoin to break through previous highs.