Educational | How to Avoid Blindly Following the Crowd - A Beginner's Guide to Project Research

If you are a cryptocurrency newbie in need of a reliable hands-on approach, this article is prepared for you.

Original Title: How to do a good research?

Original Author: le.hl

Original Translation: Luffy, Foresight News

As an investor, the easiest way to lose money is to blindly follow the crowd, knowing nothing about the project, and simply enter the market based on others' advice. I have had such an experience, so I am sharing my project research experience here.

If you are a cryptocurrency newbie and need a reliable practical method, this article is prepared for you.

Define the Project Narrative

Narrative is one of the core elements of the cryptocurrency industry, and market trends often revolve around narratives. If you want to invest in a project, you must first understand the narrative logic behind it. If the project is still stuck in outdated narratives like the metaverse, GameFi, it is likely to have a hard time succeeding.

I usually look up the project narrative on certain well-known platforms.

Steps:

2. Enter the project name;

3. Scroll down to the "Tags" section to view the project's narrative.

After understanding the narrative, the next step is to identify the leading project in that sector. Observe its recent trading volume changes, assess the dynamics; and evaluate if the project you are interested in has the ability to compete with the leader. Remember, investing in the leader's competitors often has a better opportunity than chasing an already skyrocketed leader.

Choosing a currently trending narrative (such as AI, prediction markets, InfoFi, etc.) is the best path to profitability.

Verify the Project's Investors

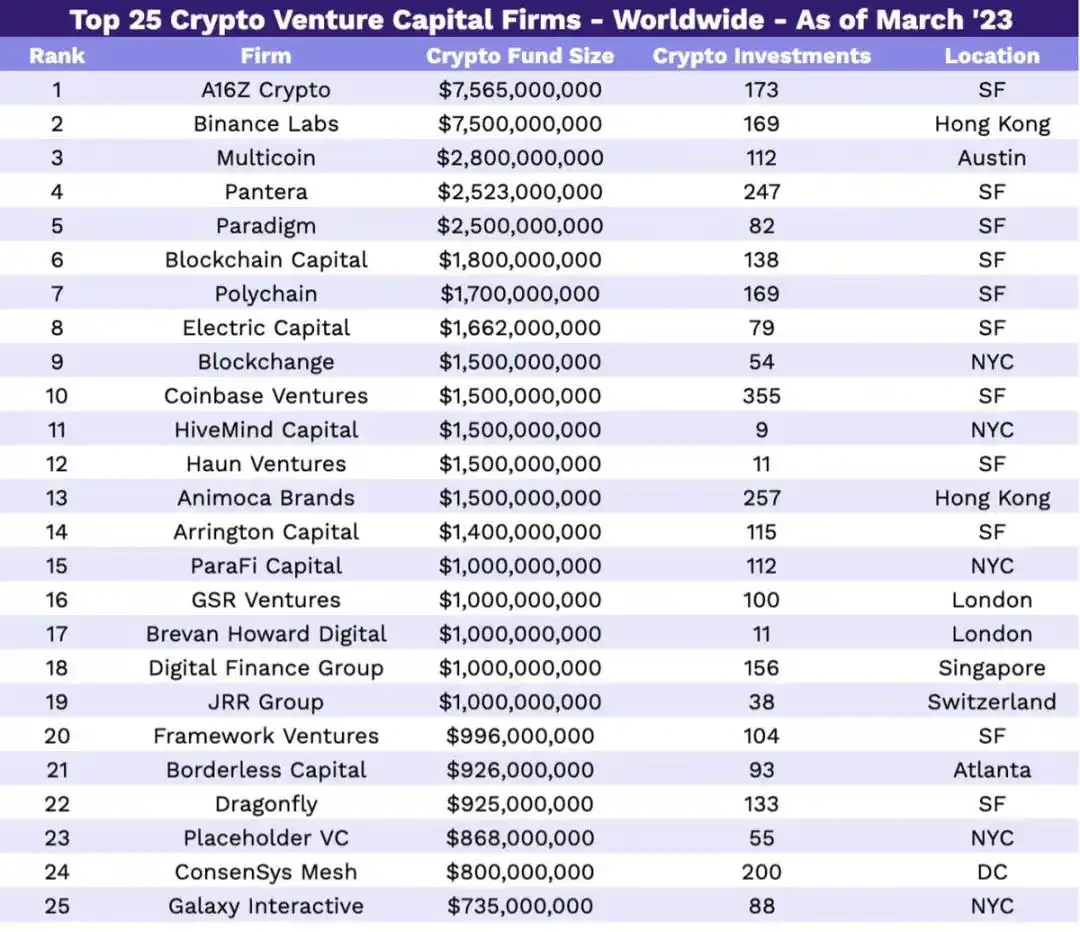

Today, many people are averse to the term 'venture capital' and prefer projects that self-fund. However, the fact is: If a project lacks excellent products, has a mediocre team, and is not the leader in any narrative, it needs reliable investors to drive its development.

My most frequently used platform to look up project investors is CryptoFundraising, which can display all key information about a project's investors, team, social accounts, official website, and more, all completely free of charge.

Operating steps:

2. Search for the target project;

3. Check the funding amount and venture capital level.

I have found that projects with lower funding amounts, supported by only 2-3 VCs, usually perform better than those with 20 or more VCs. It’s like a cake being divided among too many people; the team needs to get approval from all VCs when making decisions, which can be restrictive.

The VC level is also crucial. I personally prefer projects supported by VCs such as Coinbase VC, a16z, Polychain Capital, Paradigm, and GSR.

Examine Project Social Dynamics

This step is very crucial. If a project disables comments or frequently changes its social account nickname, it’s best to avoid it directly.

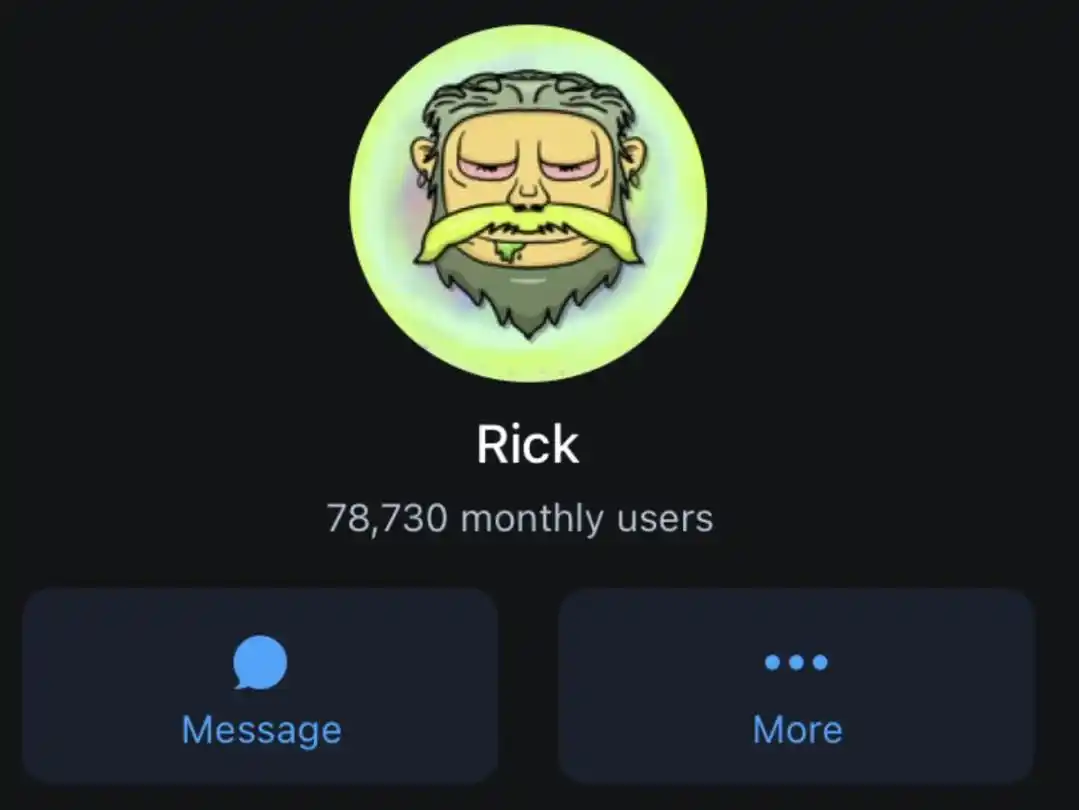

The "number of well-known individuals who follow each other" is also worth considering: If there are over 20 industry celebrities following the project, it is usually a positive sign.

To verify the legitimacy of a project, you can also use some network platforms with information verification features.

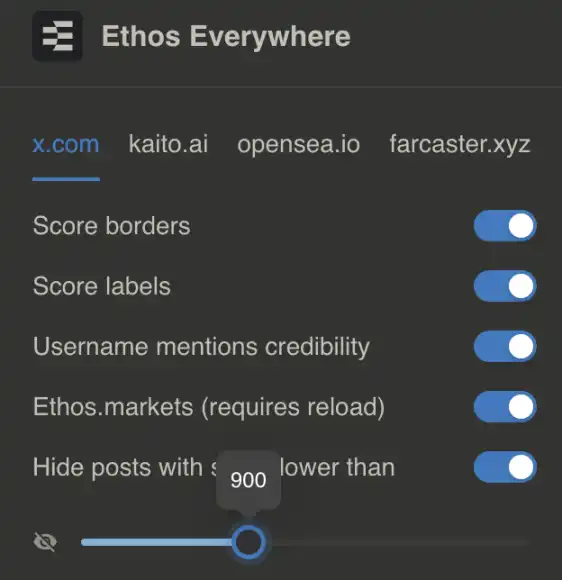

2. Install the Chrome browser extension;

3. Make the following settings: If a project has negative feedback, block it to avoid seeing related disruptive data on X.

No invitation code is needed, you can also use this plugin for free.

Deep Research Core Dimensions

Founder

I prefer to invest in projects where the founder is actively involved in the cryptocurrency community on a daily basis and engages with the community. Outstanding founders have a strong belief in their project and are willing to admit mistakes.

Avoid founders who claim that the community is everything but then behave arrogantly, are disconnected from users, or are anonymous.

The founder's actions often determine the project's direction after launch.

Product

Usability is the key metric I value the most. Only a simple, user-friendly product can attract real users and generate revenue.

Even the most amazing concept (like "Quantum Blockchain Solves Global Hunger") will not receive attention if it is complex to operate and challenging to use.

Tokenomics

For projects with issued tokens, be cautious if the following situation occurs: distributing tokens to groups not related to the project (e.g., distributing tokens to platforms like Binance Alpha for short-term hype without receiving any substantial support). This behavior often leads to a failed Token Generation Event (TGE) and a dismal price trend thereafter.

A tokenomics model does not need to allocate all tokens to the community, but it must establish a clear, transparent unlocking schedule for all stakeholders (including the team). Team transparency is always paramount.

To investigate a project's tokenomics and unlocking schedule, you can use certain progress tracking tools to search for the target project; examine the price trend after the project's last token unlock to assess the unlocking's impact on the price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Capybobo Connects Web3 and Real-World Collectibles through a Combined NFT and Toy Platform

- Capybobo’s NFT project enters final TGE airdrop phase with November 1 snapshot. - Project merges Web3 gaming with physical toys via NFT-linked doll outfits and "farming gameplay" rewards. - Global expansion plans include 2026 Hong Kong flagship store and region-specific design adaptations. - Challenges include scaling physical supply chains and navigating TON ecosystem changes. - Utility token prioritizes community engagement over speculation, bridging digital and physical collectibles.

Bitcoin News Update: RentStac Establishes a New Crypto Base Rooted in Real Estate Rather Than Speculation

- RentStac, a real estate tokenized platform, offers inflation-resistant crypto returns via property-backed income streams, contrasting Bitcoin's volatility. - Its presale model allows early investors to buy RNS tokens at $0.025, with potential 40x returns if the token reaches $1, driven by tiered pricing and deflationary mechanics. - The project aligns with crypto trends like DEX growth, anchoring digital assets to physical real estate to address liquidity and utility demands in volatile markets. - Risks

Aerodrome price surges 10% after Animoca Brands announces strategic investment

Ethereum News Today: Fusaka Upgrade for Ethereum: Achieving Scalability While Maintaining Security and Decentralization

- Ethereum's Fusaka upgrade completes final testnet phase, set for December 3 mainnet launch to enhance scalability and compete with high-throughput blockchains. - Key EIPs like PeerDAS reduce node costs and enable 12,000 TPS, with phased deployment prioritizing security while expanding data capacity and parallel execution. - Upgrade aligns with Ethereum's "Surge" roadmap to resolve the blockchain trilemma, following Pectra's staking improvements and preceding 2026's Glamsterdam phase. - Market analysts pr