3 Altcoins Benefiting Most from Trump’s Surprise CZ Pardon

WLFI, ASTER, and 4 are seeing renewed accumulation following Donald Trump’s pardon of CZ. The move reignited confidence across Binance-linked projects, driving double-digit gains and whale accumulation.

Donald Trump has officially granted a presidential pardon to Changpeng Zhao (CZ), the former CEO of Binance, wiping away his criminal charges related to the Bank Secrecy Act. The news sparked a wave of optimism across the Binance ecosystem, leading to strong accumulation in several altcoins.

Which altcoins are seeing this surge, and how might it affect their prices?

1. WLFI – Number of Holders Surges After the News

The pardon acts as a political endorsement of crypto, particularly benefiting projects linked to Trump. WLFI’s USD1 stablecoin is involved in a $2 billion Abu Dhabi–Binance deal, creating revenue streams tied to Binance’s growth.

Critics warn that such political ties could blur the line between finance and politics. Still, markets reacted positively. WLFI’s price jumped nearly 14% within 24 hours, while daily trading volume exceeded $300 million — double its previous average.

The simultaneous rise in price and volume signals renewed accumulation. Data also shows that the number of holders began to recover after a month-long decline.

World Liberty Financial Holders. Source:

World Liberty Financial Holders. Source:

Charts indicate WLFI’s holder count fell from 124,520 to 124,380 over the past week, but the news helped it rebound to 124,450. This small uptick marks an early sign of returning investor confidence after WLFI had dropped nearly 30% since last month.

2. Aster (ASTER) – Nearly 10 Million Tokens Withdrawn From Exchanges in 24 Hours

Aster is a perpetual DEX built on the BNB Chain. YZi Labs (formerly Binance Labs) supports the project, and CZ has publicly endorsed Aster on X.

Positive news surrounding CZ has revived bullish sentiment among Aster investors. On-chain data reflects clear accumulation through exchange outflows and price movement.

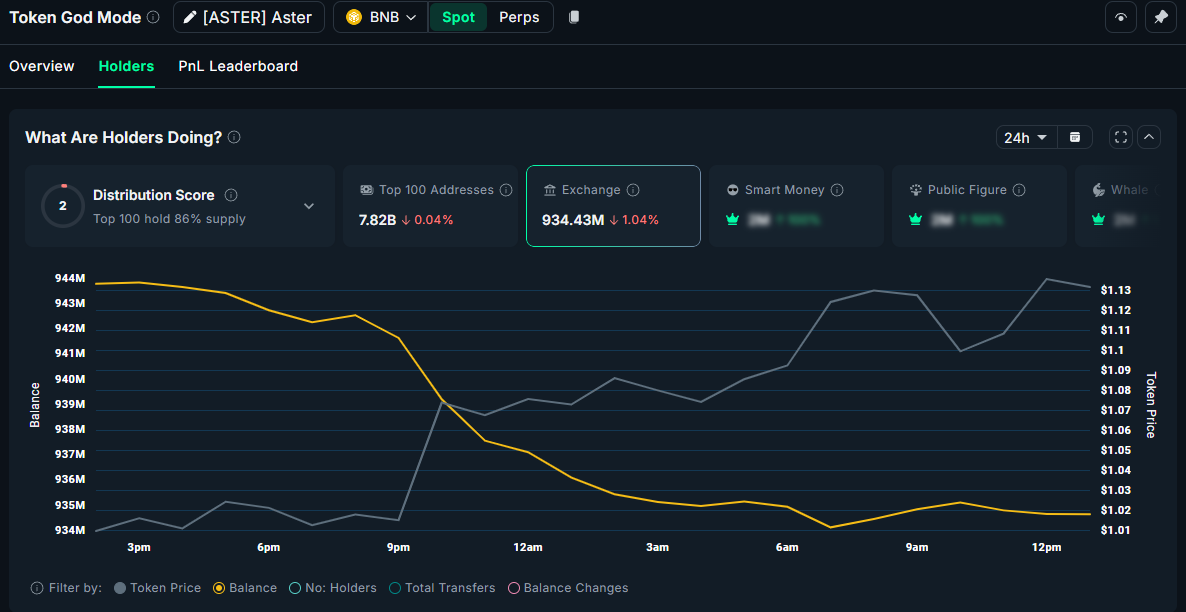

ASTER Exchange Reserve. Source:

ASTER Exchange Reserve. Source:

According to Nansen, ASTER’s price rose by more than 12%, while nearly 10 million ASTER tokens were withdrawn from exchanges. Following the news, many investors appear motivated to hold their ASTER long-term.

“Just withdrew 50 ASTER again from my profits to my personal wallet for long-term holdings and will keep doing this until it reaches $5–$10. Is anyone else doing this, or is it just me? I’m extremely bullish on ASTER because of CZ,” investor AltcoinsGuy said.

On October 23, Aster also launched its Rocket Launch campaign, a liquidity initiative combined with a buyback plan. The campaign, coupled with the pardon news, has boosted investor confidence even further.

3. 4 – Whales Accumulate Amid Falling Exchange Balances

4 is a meme token created on the four.meme platform with a market capitalization of roughly $120 million.

The recent “BNB Season” sentiment has driven investors toward small-cap tokens within the Binance ecosystem for higher returns. The positive news about CZ’s pardon has further strengthened confidence among meme investors on four.meme.

4.4 means ignore FUD, but that's not all….4 is a mindset and a movement,4 is tokenized support for CZ & all builders, 4 is the ultimate sign to never stop believing,We never had a doubt…Congratulations on the news!

— 4🔸

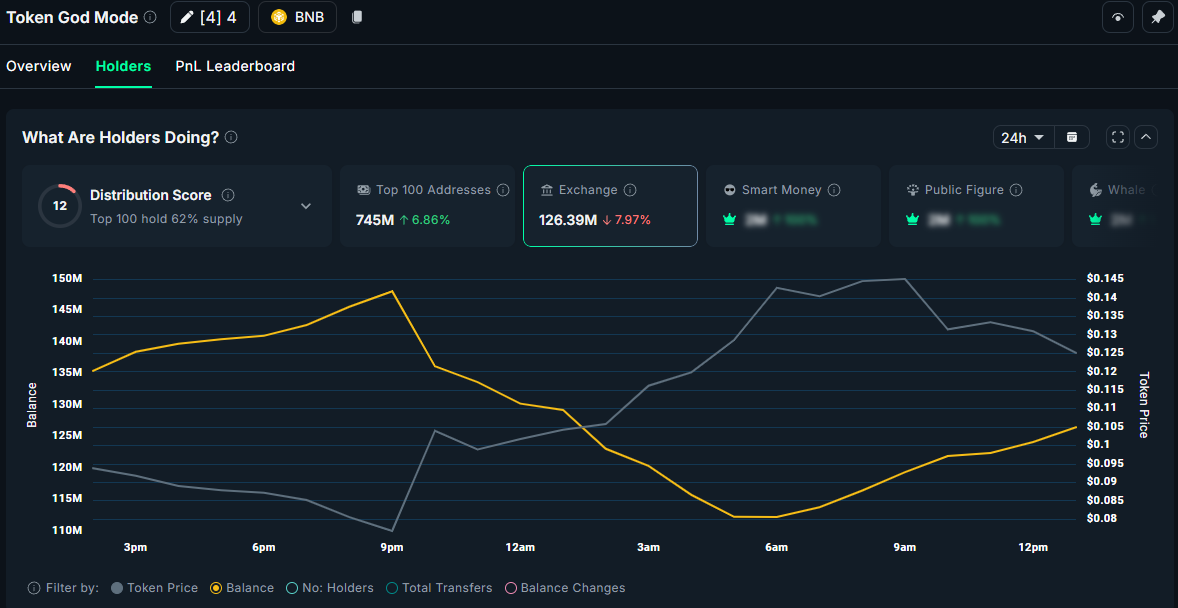

Nansen data shows that the top 100 wallets holding 4 increased their balances by 6.86%, while exchange reserves fell by nearly 8% following the pardon announcement. The token’s price surged more than 30% in the last 24 hours.

4 Exchange Reserve. Source:

4 Exchange Reserve. Source:

Additionally, 4 has appeared on the Binance Alpha listing, raising speculation that it might soon debut on Binance Spot. Current accumulation by holders could represent a strategic position if a listing does occur.

These three altcoins share direct or indirect connections to the Binance ecosystem and CZ. As October’s market remains largely subdued, BNB and its surrounding projects stand out as rare bright spots in the broader crypto landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

USD1 puts users at the center with innovative rewards, reshaping how stablecoins are embraced in the DeFi landscape

- World Liberty Financial (WLFI) distributed 8.4 million tokens to USD1 stablecoin users via its Points Program, aiming to boost adoption and DeFi utility. - The initiative generated $500M in trading volume across six exchanges, with USD1 now ranking as the sixth-largest stablecoin at $2.98B market cap. - Future plans include Apple Pay-compatible debit cards and real-world asset tokenization, despite regulatory challenges and competition from USDT/USDC.

Cardano News Update: The Reason Investors Are Flocking to Mutuum Finance's Presale Ahead of Price Increases

- Mutuum Finance (MUTM) has raised $18.1M in presale with 17,500 holders, nearing 80% allocation at $0.035 per token before Q4 2025 launch. - Its roadmap includes Ethereum-based lending protocols, mtToken yields, and Chainlink integration, supported by a 90/100 CertiK audit and $50K bug bounty. - Whale activity and bullish forecasts suggest MUTM could mirror SHIB/XRP's growth, with price targets up to $0.70 (15-20x returns) if adoption matches early momentum. - Risks include regulatory challenges and liqui

Bitcoin News Update: Institutional Trust Rises as Litecoin ETF Validates Digital Currencies

- U.S. crypto markets see institutional growth with first Litecoin ETF (LTCC) launching after SEC approval, offering regulated exposure to LTC. - T. Rowe Price and Fidelity expand crypto offerings, highlighting Litecoin's "digital silver" role alongside Bitcoin's dominance. - Ethereum ETFs outperformed Bitcoin in October inflows ($246M vs. $202M), while DBS/Goldman executed first interbank crypto options trade. - Global challenges persist: Georgia's ex-PM faces 12-year sentence for $6.5M money laundering,

Capstone's Bold M&A Strategy: Expansion Amid Financial Challenges

- Capstone Holding Corp. raised $3.25M via convertible notes to acquire a $15M/year stone distributor, advancing its 2026 $100M revenue target through aggressive M&A. - The $10M financing facility features 7% interest, 8.34% discount, and $1.10 conversion price, enabling strategic flexibility while maintaining balance-sheet strength. - Despite four accretive acquisitions this year, Capstone faces financial risks: -8.06% net margin, 0.43 quick ratio, and a -4.49 Altman Z-Score signaling potential bankruptcy