CIMG Inc. Completes $55M Bitcoin Purchase via Share Sale

- CIMG Inc. completes $55M Bitcoin acquisition.

- 500 BTC purchased through share sale, strategic focus noted.

- Stock sees slight decline, long-term holding plans emphasized.

CIMG Inc. completed a $55 million Bitcoin acquisition through a share sale, purchasing 500 BTC to enhance its digital asset reserve strategy.

This purchase signals a growing trend among companies adopting Bitcoin as a treasury asset, influencing market dynamics and showcasing institutional interest in digital currencies.

CIMG Inc. finalized a $55 million Bitcoin purchase by issuing 220 million shares priced at $0.25 each. This acquisition aligns with their long-term digital asset strategy, acquiring 500 BTC to strengthen their position in the crypto market.

Company leadership, including CEO Wang Jianshuang and the corporate board, endorsed the move. CIMG positions itself within blockchain and AI sectors. They emphasize expanding digital asset holdings, collaborating with entities like Merlin Chain .

This transaction shows CIMG’s commitment to increasing its crypto reserves. The strategy impacts investor perspectives as part of broader blockchain interest. CIMG’s stock fell 3.53%, marking a market response to their announcement.

Financial implications include diversification into crypto assets, echoing corporate treasury trends seen with firms like MicroStrategy. Market dynamics reflect shifting interest toward Bitcoin-based assets within corporate finance sectors.

Potentially influential, CIMG’s strategy could prompt similar actions among firms. The approach may affect crypto asset valuations, instigating broader market actions. Compounded by sector pressures, long-term effects remain to be seen.

The move aligns with historical Bitcoin treasury expansions by other corporations. Industry trends evidence increasing crypto adaptation within financial ecosystems, suggesting possible regulatory focus shifts, especially regarding corporate digital asset management strategies.

“The Company intends to continue to increase its digital asset reserves and pursue collaborations across AI and crypto ecosystems, such as Merlin Chain.” – Wang Jianshuang, Chairman & CEO, CIMG Inc.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ConsenSys-backed Intuition launches mainnet and $TRUST token, aiming to build a public trust layer for the internet

Mt. Gox delays $4B Bitcoin repayments: Bullish or bearish for BTC price?

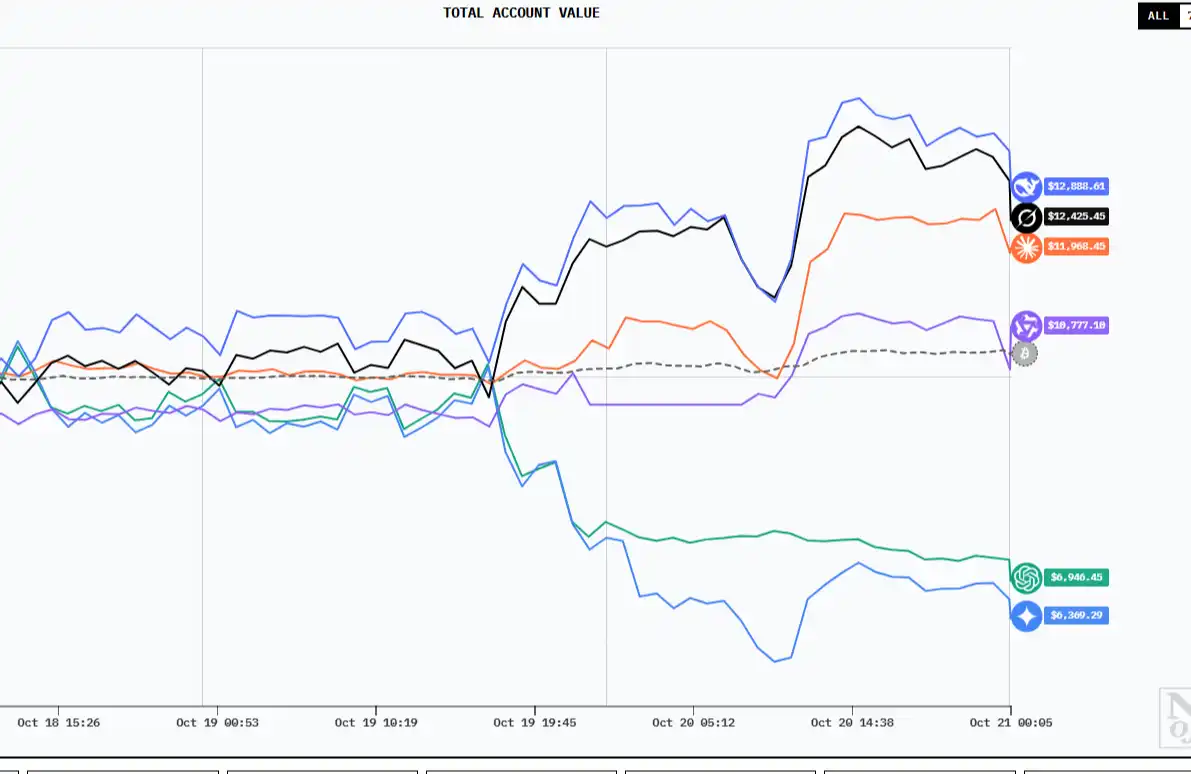

Six major AI "traders" ten-day showdown: Who can survive in a market with "no information asymmetry"?

AI is shifting from being a "research tool" to becoming a "frontline trader." So, how do they think?

Financial Black Hole: Stablecoins Are Devouring Banks

Stablecoins, acting as "narrow banks," are quietly absorbing liquidity and reshaping the global financial architecture.