Date: Fri, Aug 22, 2025 | 06:25 PM GMT

The cryptocurrency market turned bullish in the last hour after Jerome Powell hinted at potential rate cuts in September during today’s Jackson Hole event. Following the remarks, Ethereum (ETH) surged over 7% past $4,600, fueling strong momentum across altcoins , including Polygon (POL).

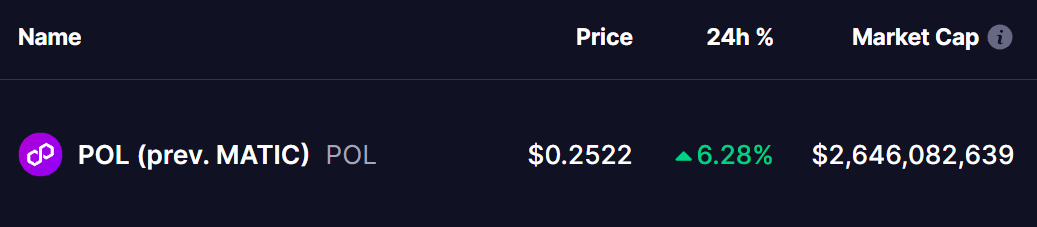

POL has gained 6% in the past 24 hours, and its chart is now showing a bullish fractal structure that closely mirrors the breakout recently witnessed in Bio Protocol (BIO).

Source: Coinmarketcap

Source: Coinmarketcap

POL Mirrors BIO’s Breakout Structure

BIO’s earlier price action offers a roadmap for POL’s potential. Earlier this year, BIO broke out of a falling wedge pattern, a classic bullish reversal setup. After the breakout, BIO consolidated just under a major resistance zone (highlighted in red). Once it cleared this barrier, the token accelerated sharply, reclaiming multiple resistance levels and ultimately delivering a 240% rally.

BIO and POL Fractal Chart/Coinsprobe (Source: Tradingview)

BIO and POL Fractal Chart/Coinsprobe (Source: Tradingview)

POL appears to be tracing the same trajectory.

The token has already broken out of its own falling wedge formation and is currently pressing against a critical resistance zone near $0.2635, marked in red on the chart.

What’s Next for POL?

If this fractal continues to play out, a decisive breakout above $0.2635 could be the spark for a new bullish wave. The next upside targets sit at $0.3345 and $0.5170, representing a potential 104% move higher from current levels, should POL replicate BIO’s explosive pattern.