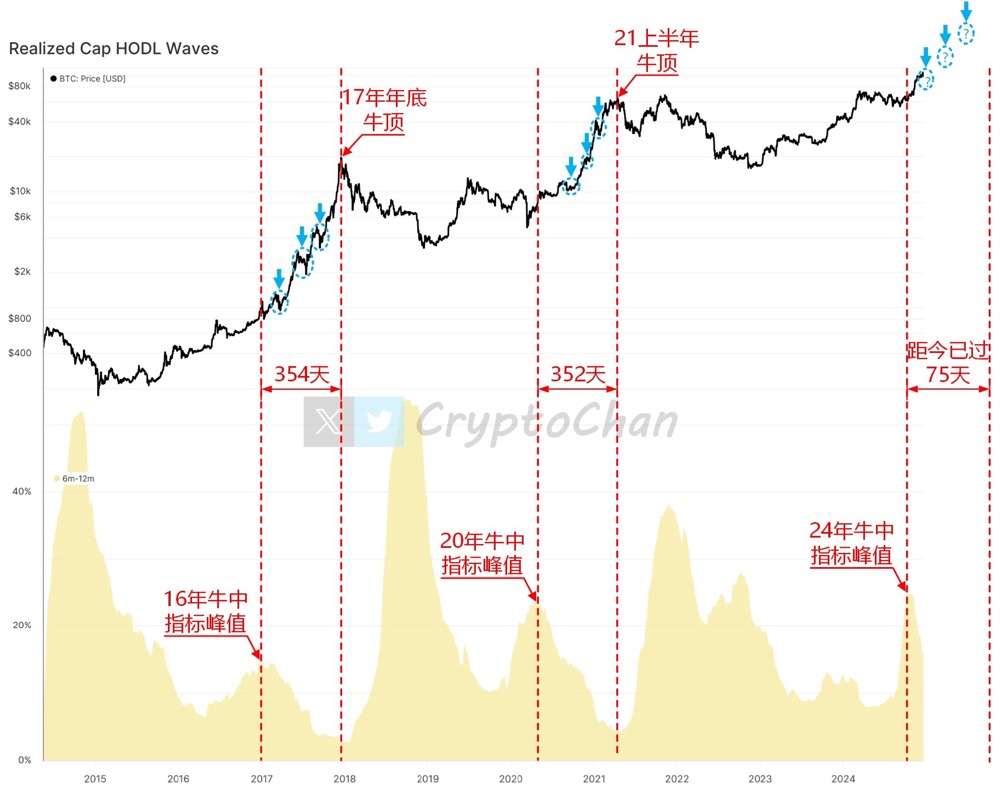

According to on-chain analyst Cryptochan's analysis, the current Bitcoin bull market has entered a critical stage. An important indicator - the proportion of BTC that has not moved for 6-12 months on the chain (weighted by Realized Cap and using 7-day MA) - has reached its peak in the mid-2024 bull market, which is highly consistent with the bull market trends in 2016 and 2020.

Data details:

Mid bull market 2016

After the index reached its peak, 354 days ushered in the end of 2017 bull peak.

During this period, there were three significant pullbacks (circled in blue in the figure).

Mid-year bull market 2020

After the index reaches its peak, 352 days will usher in the first half of 2021 bull peak.

There were also three major pullbacks, and the currency price fluctuated violently.

Mid-term bull market 2024

This indicator peaked 75 days ago, about 280 days away from the historical peak time.

The blue circle in the figure predicts the risk of three possible short-term corrections.

Chart interpretation:

The black curve above represents the price trend of Bitcoin, showing a steady upward trend from the middle of the bull market to the top of the bull market, but often accompanied by obvious price corrections in the middle.

The yellow fluctuation area below represents the change in the proportion of unmoved BTC on the chain for 6-12 months. There is a significant time correlation between the peak of the indicator and the top of the market.

Risk Warning:

Historical patterns show that during the upward process of

Bitcoin price at this stage, it will be impacted by three major pullbacks, which provides short-term traders with opportunities for short-term trading, but also poses risk management challenges for highly leveraged investors.

Investors should remain cautious, pay attention to changes in on-chain data, and make decisions based on market sentiment and macro environment. After all, although bull markets have patterns, each one carries different market variables and uncertainties.