Bitget Research: Notcoin Trading Volume Surpasses $4.6 Billion, Ton Ecosystem Memecoins Surge

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

Overview

-

Sectors with strong wealth creation effect: TON ecosystem memecoins, and GameFi sector.

-

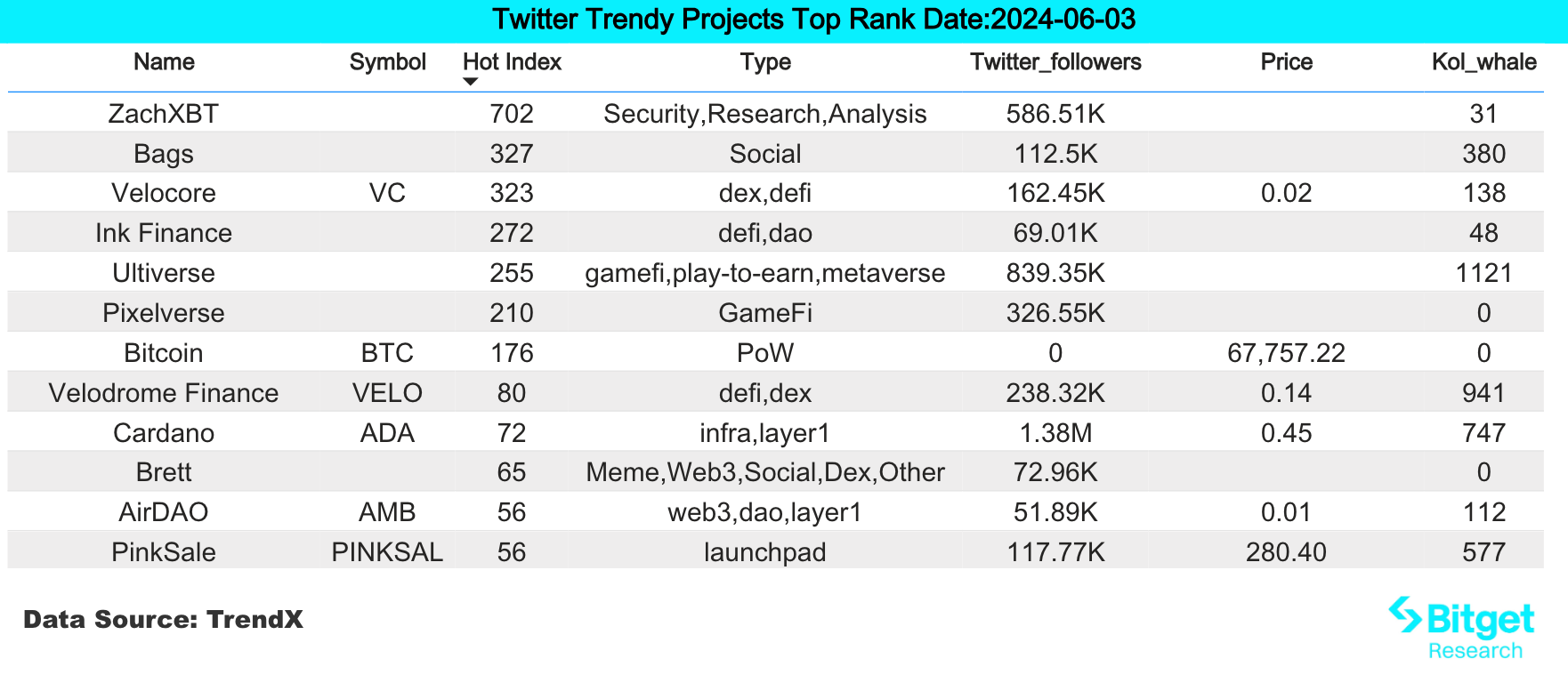

Top searched tokens and topics: MON Protocol, Ultiverse, NOT, and Monad.

-

Potential airdrop opportunities: Tonstakers and MYX Finance.

1. Market Environment

2. Wealth Creation Sectors

2.1 Sector Movements – Ton Ecosystem Memecoins (FISH and REDO)

-

Future trading activity: Currently, a major shortcoming in the Ton ecosystem is the relatively fewer active traders compared to other chains, which results in significantly lower trading volumes. If trading volumes continue to rise due to NOT's influence, the wealth effect could become more pronounced.

-

Future support from Pantera for the Ton ecosystem: Dan Morehead, founder of Pantera Capital, mentioned on social media that Pantera recently made its largest investment in the Telegram TON blockchain project, increasing attention to the Ton ecosystem. If project financing and product launches can be implemented promptly, the prosperity of the Ton ecosystem could arrive sooner.

2.2 Sector Movements – GameFi Sector (NYAN and ALICE)

-

Last week saw a total of 22 funding rounds, slightly down from the previous week, with a total amount of approximately $794.48 million and an average funding amount of $28.7036 million. The majority of financing occurred in other sectors, with significant investments in asset management payments, DeFi, and infrastructure. An increase in funding for the Metaverse/GameFi sectors could continue to support the popularity of GameFi.

-

Guild development and user growth: Over time, some blockchain gaming guilds have developed unique business models, offering services such as leasing blockchain game NFT assets, training in gaming skills, and spreading knowledge about blockchain transactions. The expansion of guild business models and user base contributes to the increased activity in blockchain gaming.

2.3 Sectors to Focus on Next — Bitcoin L2 Chains

-

CKB: A Bitcoin Layer 2 project based on the RGB++ scaling protocol, CKB has stayed true to its original vision as a Layer 2 solution. It adopts isomorphic binding with Bitcoin and further improves the Bitcoin ecosystem.

-

BB: BounceBit is a BTC restaking chain. BB has a maximum supply of 2.1 billion, with an initial circulation of 409.5 million, and is a project with investments from Binance Lab. Binance will list BB after the Megadrop is completed.

-

MERL: A Layer 2 project based on the Bitcoin network. Merlin Chain's on-chain TVL has reached $3.1 billion, the highest TVL among Bitcoin Layer 2 projects.

3. Top Searches

3.1 Popular DApps

3.2 X (former Twitter)

3.3 Google Search (Global and Regional)

4. Potential Airdrop Opportunities

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Signs Potential Mid-Cycle Bottom As Fear Grips the Market

The "Black Tuesday" for US stock retail investors: Meme stocks and the crypto market plunge together under the double blow of earnings reports and short sellers

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Crypto Market Macro Report: US Government Shutdown Leads to Liquidity Contraction, Crypto Market Faces Structural Turning Point

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

Market volatility intensifies: Why does Bitcoin still have a chance to reach $200,000 in Q4?

Institutional funds continue to buy despite volatility, targeting a price level of $200,000.