Bitget Research: Mt.Gox States No Repayments in the Short Term, Crypto Market Stabilizes with Narrow Fluctuations

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

Overview

-

Sectors with strong wealth creation effects: RWA sector and Ethereum Layer 2 sector.

-

Top searched tokens and topics: Particle network, Atomicals Protocol, and Celestia.

-

Potential airdrop opportunities: Espresso and Morph.

1. Market Environment

2. Wealth Creation Sectors

2.1 Sector Movements – RWA Sector (ONDO, TRU, and POLYX)

-

Changes in macroeconomic monetary policy: From a macroeconomic perspective, the rise in U.S. 10-Year Treasury Bond Yields supports the fundamentals of the RWA sector. It is essential to monitor subsequent changes in the dollar index, treasury yields, and the cryptocurrency market to adjust trading strategies dynamically.

-

TVL changes in projects: RWA sector projects are generally supported by TVL, making it essential to monitor the changes in this metric. If a project's TVL rises continuously or suddenly, it is usually a signal to buy.

2.2 Sector Movements – Ethereum Layer 2 Sector (ARB, OP, and STRK)

-

Approval of Ethereum ETFs: The market has largely priced in the approval of the Ethereum ETF. Should there be unexpected developments in the ETF approval tomorrow morning, a trend reversal might occur.

-

Development of Layer 2 projects: As a widely used chain ecosystem, the future development of Layer 2 depends on its collaboration with projects and user growth.

2.3 Sectors to Focus on Next — AI Sector

-

OpenAI launched its flagship AI model, capable of real-time audio, visual, and text reasoning processing. The release of the text-to-video model Sora by OpenAI in February drove up valuations across the sector. The launch of GPT-4o highlights the importance of maintaining focus on the AI sector.

-

According to Cointelgraph, tech giant Microsoft is closely monitoring the crypto industry, including ways blockchain technology and artificial intelligence might support each other.

-

TAO: Bittensor is an open-source protocol that powers a blockchain-based machine learning network. Machine learning models train collaboratively and are rewarded in TAO according to the informational value they offer the collective.

-

NEAR: Recently, many AI projects within the NEAR ecosystem are in the development or funding stage, positioning NEAR to potentially become a future AI Hub.

3. Top Searches

3.1 Popular DApps

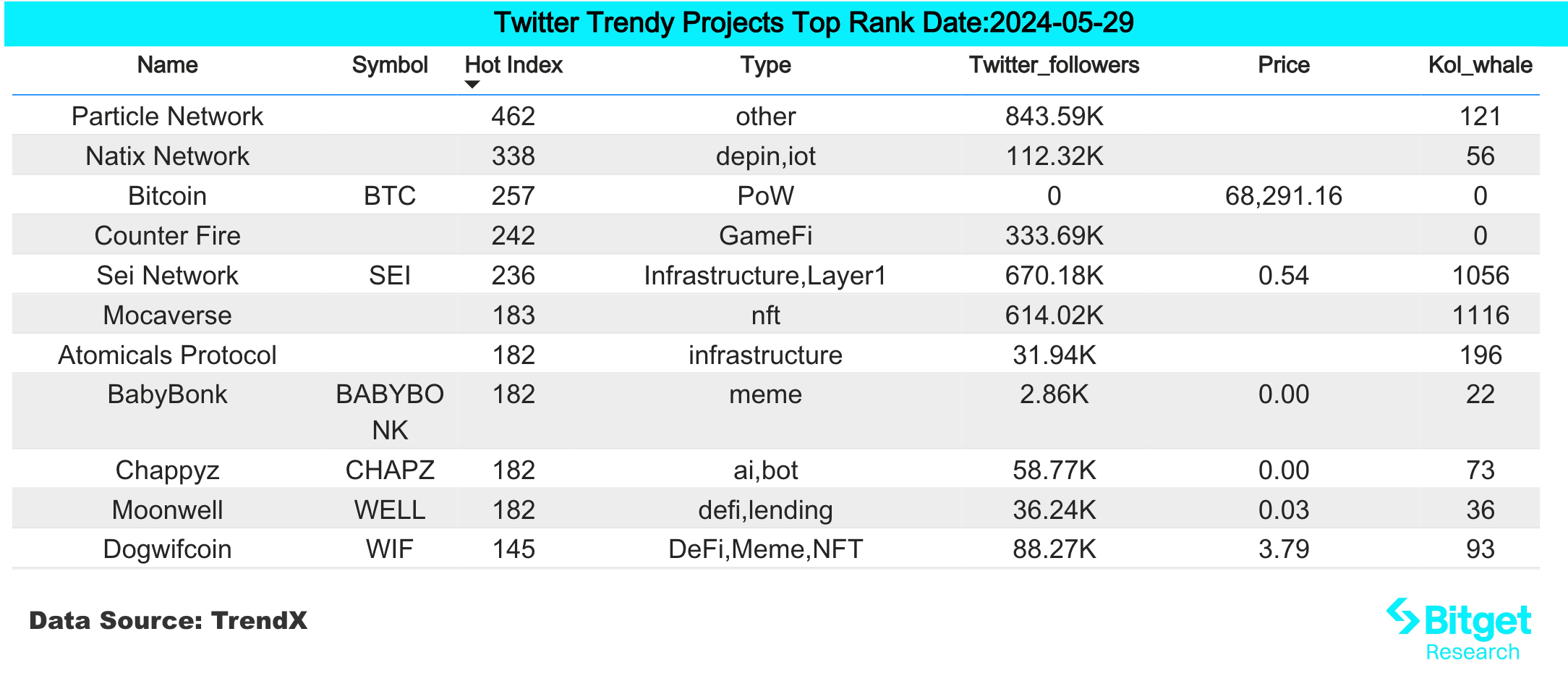

3.2 X (former Twitter)

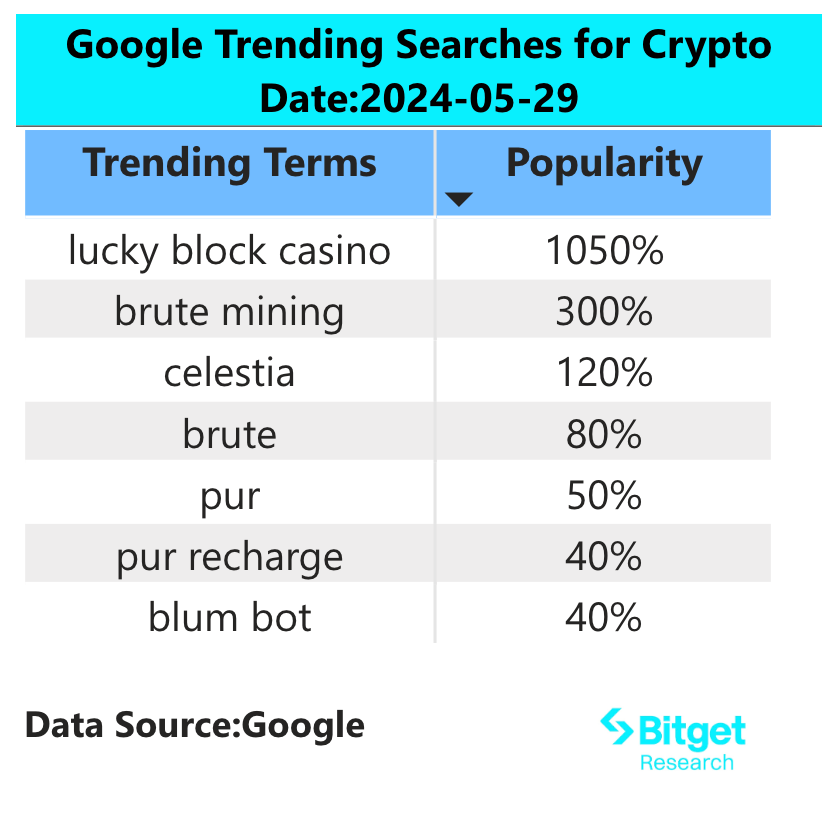

3.3 Google Search (Global and Regional)

4. Potential Airdrop Opportunities

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Signs Potential Mid-Cycle Bottom As Fear Grips the Market

The "Black Tuesday" for US stock retail investors: Meme stocks and the crypto market plunge together under the double blow of earnings reports and short sellers

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Crypto Market Macro Report: US Government Shutdown Leads to Liquidity Contraction, Crypto Market Faces Structural Turning Point

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

Market volatility intensifies: Why does Bitcoin still have a chance to reach $200,000 in Q4?

Institutional funds continue to buy despite volatility, targeting a price level of $200,000.