Bitget Research: Ethereum Gas Fees Drop to 2gwei, EigenLayer Opens Claims for EIGEN Airdrop

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

Overview

-

Sectors to focus on next: AI Sector and TON Ecosystem.

-

Top searched tokens and topics: Kaito, NOT, and TON.

-

Potential airdrop opportunities: UXLINK and Li.Finance

1. Market Environment

2. Wealth Creation Sectors

2.1 Sectors to Focus on Next — AI Sector

-

The AI and distributed computing sectors have shown strong consensus and bullish trends with smaller maximum drawdown compared to other sectors, providing some support. The AI sector experienced a pullback today, presenting a potential entry opportunity.

-

Rumors suggest Apple is close to finalizing a deal with OpenAI to integrate ChatGPT into the iPhone. Additionally, Apple's Worldwide Developers Conference is set to start on June 10, where Apple may announce plans to upgrade Siri using AI technology.

-

ChatGPT-5 is expected to be officially released as early as June.

2.2 Sectors to Focus on Next — TON Ecosystem

-

Pantera's investment in TON may exceed $250 million, marking its largest investment in cryptocurrency to date.

-

High-traffic projects within the TON ecosystem, such as Notcoin, have been listed on Binance, though the TON token itself has not yet been listed. It is widely anticipated that TON's listing on Binance is only a matter of time.

-

The infrastructure of the TON ecosystem is in its early stages, yet it has already produced high-traffic projects like Notcoin and Catizen, showcasing a substantial user base supported by Telegram.

-

The issuance of stablecoins within the ecosystem has infused it with financial vitality, with TON's on-chain USDT supply reaching 130 million in two weeks, making it the eighth-largest blockchain for USDT issuance.

3. Top Searches

3.1 Popular DApps

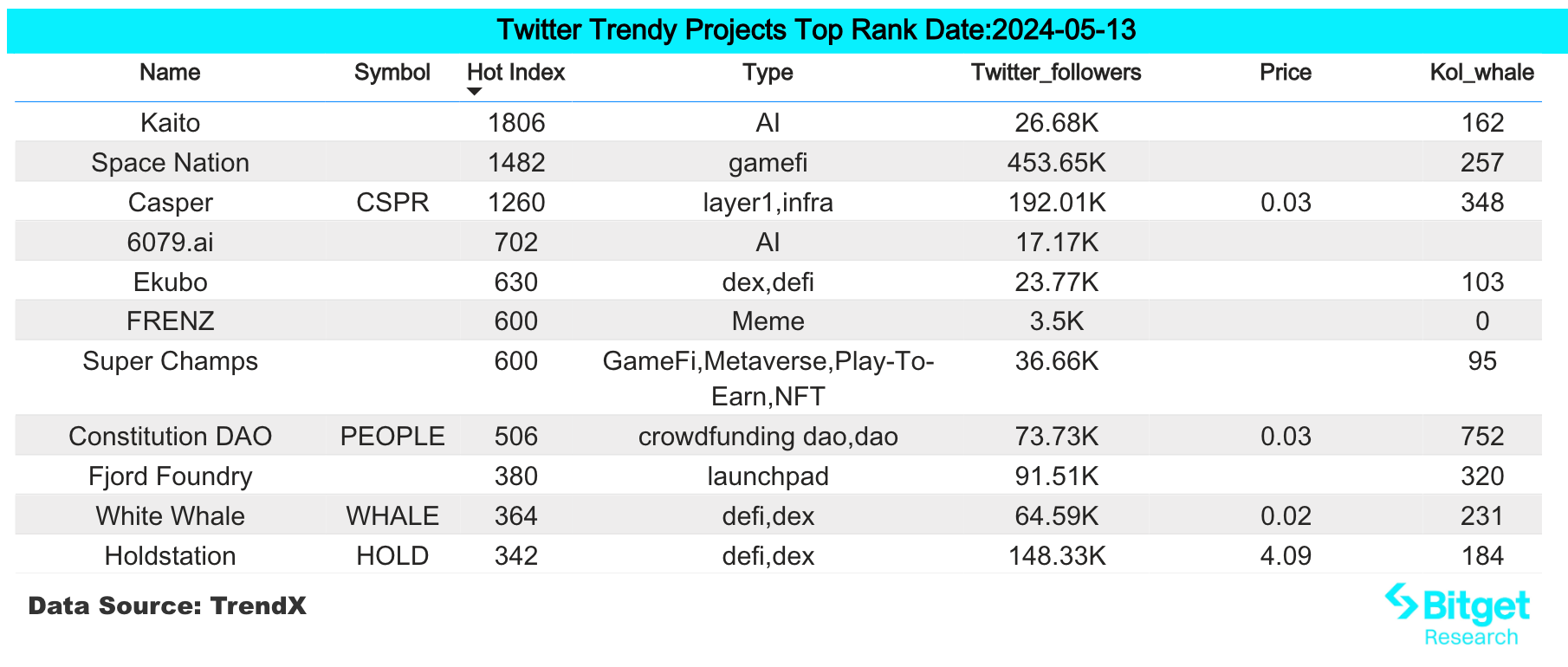

3.2 X (former Twitter)

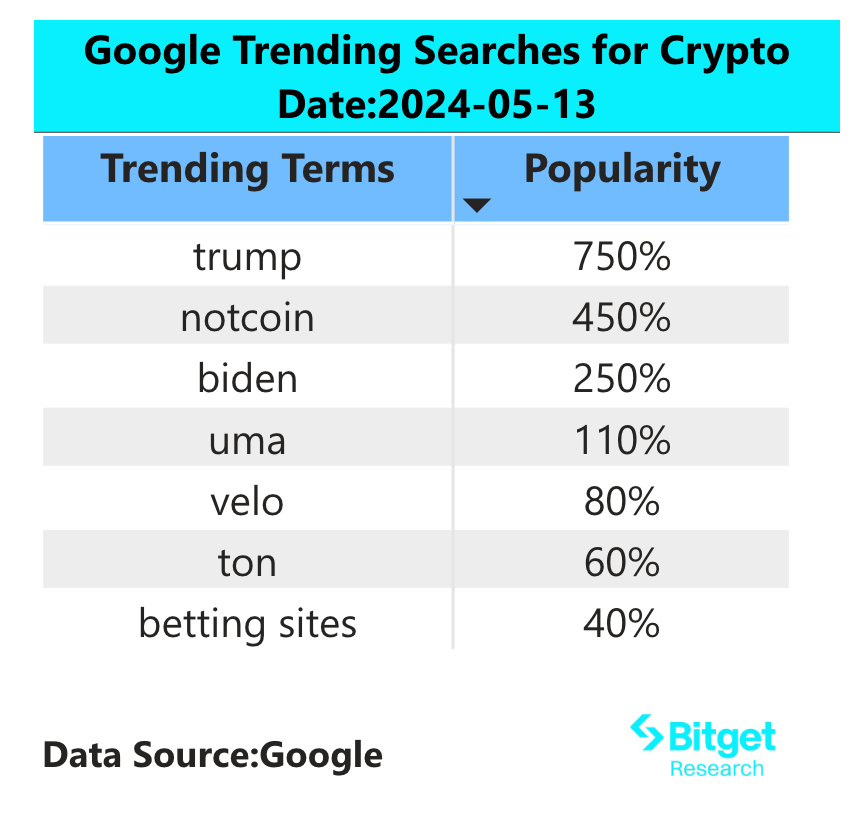

3.3 Google Search (Global and Regional)

4. Potential Airdrop Opportunities

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Signs Potential Mid-Cycle Bottom As Fear Grips the Market

The "Black Tuesday" for US stock retail investors: Meme stocks and the crypto market plunge together under the double blow of earnings reports and short sellers

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Crypto Market Macro Report: US Government Shutdown Leads to Liquidity Contraction, Crypto Market Faces Structural Turning Point

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

Market volatility intensifies: Why does Bitcoin still have a chance to reach $200,000 in Q4?

Institutional funds continue to buy despite volatility, targeting a price level of $200,000.