Bitget Research: Mainstream Cryptocurrency Trends Weaken, Celsius Continues to Rise Through Token Burns

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

Overview

-

Sectors with strong wealth creation effects: Celsius (CEL) and AI (RNDR, LPT, ARKM).

-

Top searched tokens and topics: Jupiter Exchange, Bitlayer, and TRB.

-

Potential airdrop opportunities: MEZO and Bitlayer.

1. Market Environment

2. Wealth Creation Sectors

2.1 Sector Movements: Celsius (CEL)

-

Celsius business: While its desperate measures may result in impressive short-term gains, in the long term, Celsius' governance and team will need to achieve real business development to support the continuous and stable rise of the token's price. Investors should keep an eye on Celsius's company-level direction and make investment decisions based on its ability to actually advance its business.

-

Celsius bankruptcy reorganization progress: The soaring price of the CEL token reflects the market's optimistic expectations for the success and future potential of Celsius' reorganization. This change in sentiment is an indicator of investor confidence that crypto firms may regain market support through strategic adjustments, even after significant financial and legal difficulties.

2.2 Sector Movements: AI Sector (RNDR, LPT, and ARKM)

-

The crypto AI sector will continue to experience hype for new products, technologies, and partnerships from U.S. tech companies. The AI sector is a known hotbed for speculation. Investors should clearly distinguish between leading segments and keep an eye on relevant topics as they become available. However, the chances of substantial collaboration are relatively small, and investors also need to be aware of the risks.

-

The AI sector continues to witness the emergence of new projects with high valuations, which may impact the current competitive landscape. Investors should keep an eye on the sector's competitive landscape and lock investments in leading projects. Most other projects capitalizing on the concept have seen their popularity dissipate relatively quickly.

2.3 Sectors to Focus on Next — TON Ecosystem

-

Tonstakers: This project is the largest liquid staking service provider in the TON ecosystem. Users can stake their TON in the protocol to earn a 3.8% APY. Although the project has not yet launched its token, it presents potential airdrop opportunities.

-

STON.fi: This project is currently the largest DEX in the TON ecosystem, with some LP pools supported by the TON Foundation. Users can provide liquidity on DEXs to earn returns. Although the project has not yet launched its token, it presents potential airdrop opportunities.

-

EVAA Protocol: This project is currently the largest lending project in the TON ecosystem. Users can deposit tokens into this protocol to enjoy interest on their loaned assets. Although the project has not yet launched its token, it presents potential airdrop opportunities.

3. Top Searches

3.1 Popular DApps

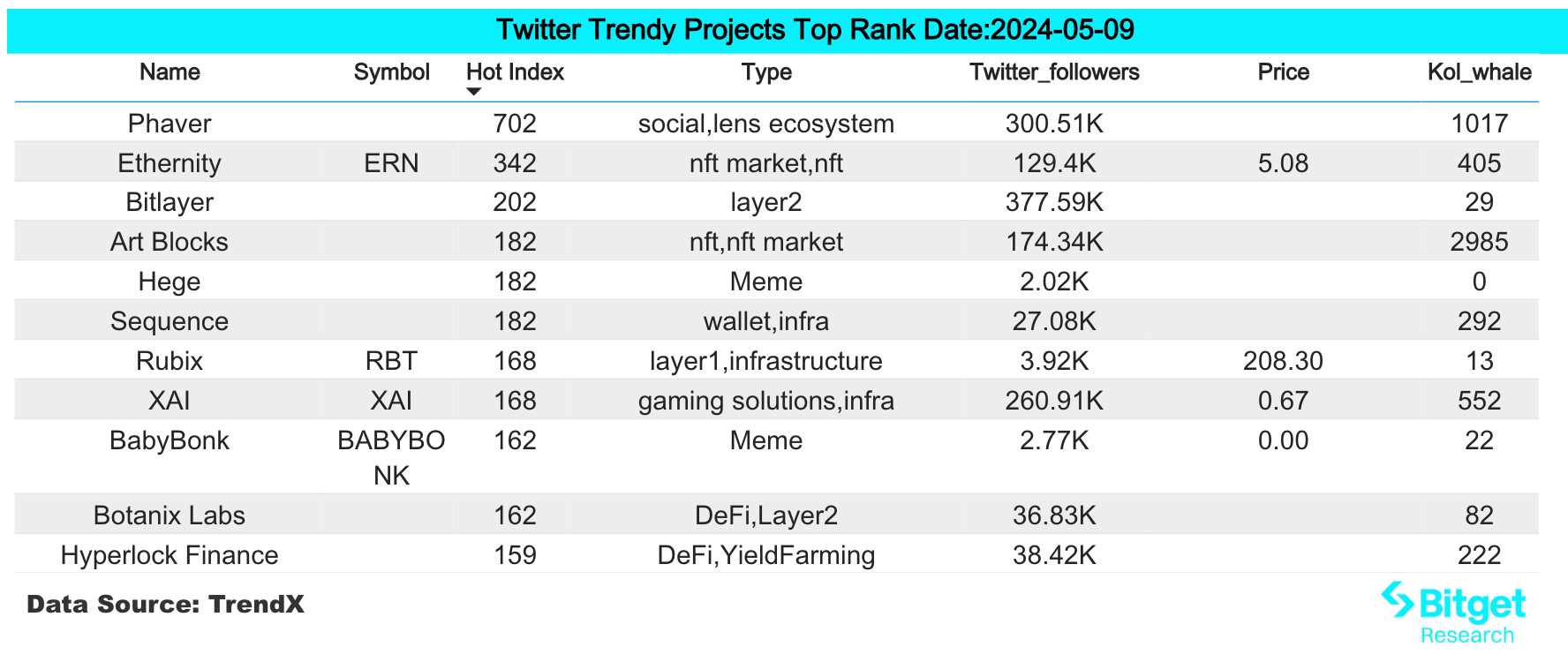

3.2 X (former Twitter)

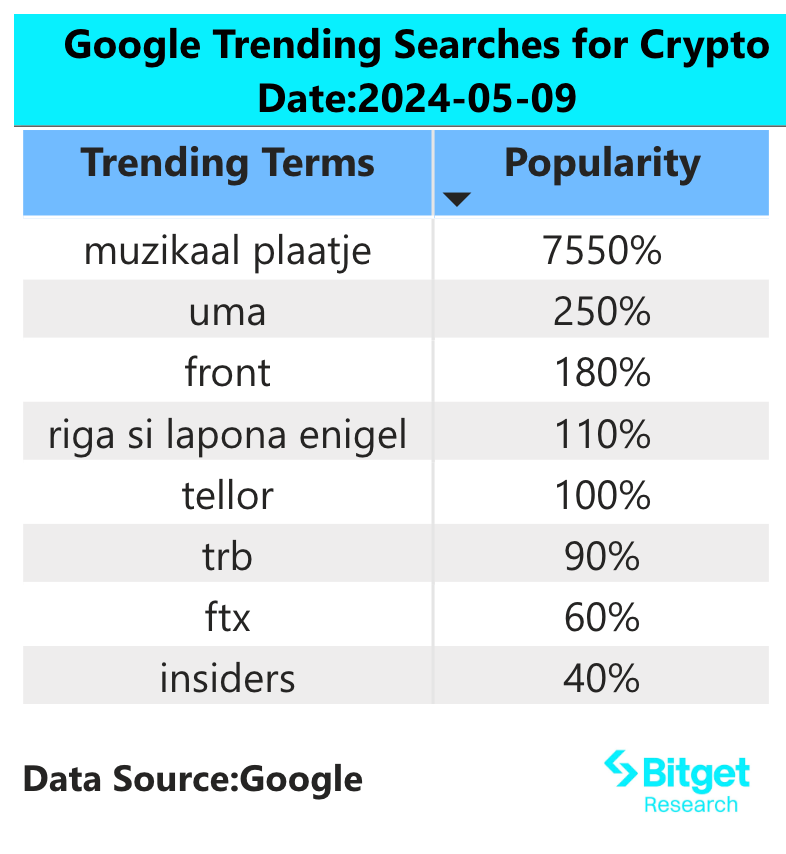

3.3 Google Search (Global and Regional)

4. Potential Airdrop Opportunities

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Signs Potential Mid-Cycle Bottom As Fear Grips the Market

The "Black Tuesday" for US stock retail investors: Meme stocks and the crypto market plunge together under the double blow of earnings reports and short sellers

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Crypto Market Macro Report: US Government Shutdown Leads to Liquidity Contraction, Crypto Market Faces Structural Turning Point

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

Market volatility intensifies: Why does Bitcoin still have a chance to reach $200,000 in Q4?

Institutional funds continue to buy despite volatility, targeting a price level of $200,000.