Solana Price Prediction: Is a Major Rebound on the Horizon?

As Solana (SOL) consolidates near key levels following a recent downturn, investors are keen to know: has the selling pressure created a fresh opportunity? By examining on-chain activity, technical signals, and wider institutional sentiment, we can gain a comprehensive view on where Solana’s price could head next.

Source: CoinMarketCap

Solana’s Recent Price Movements: Signs of Stabilization?

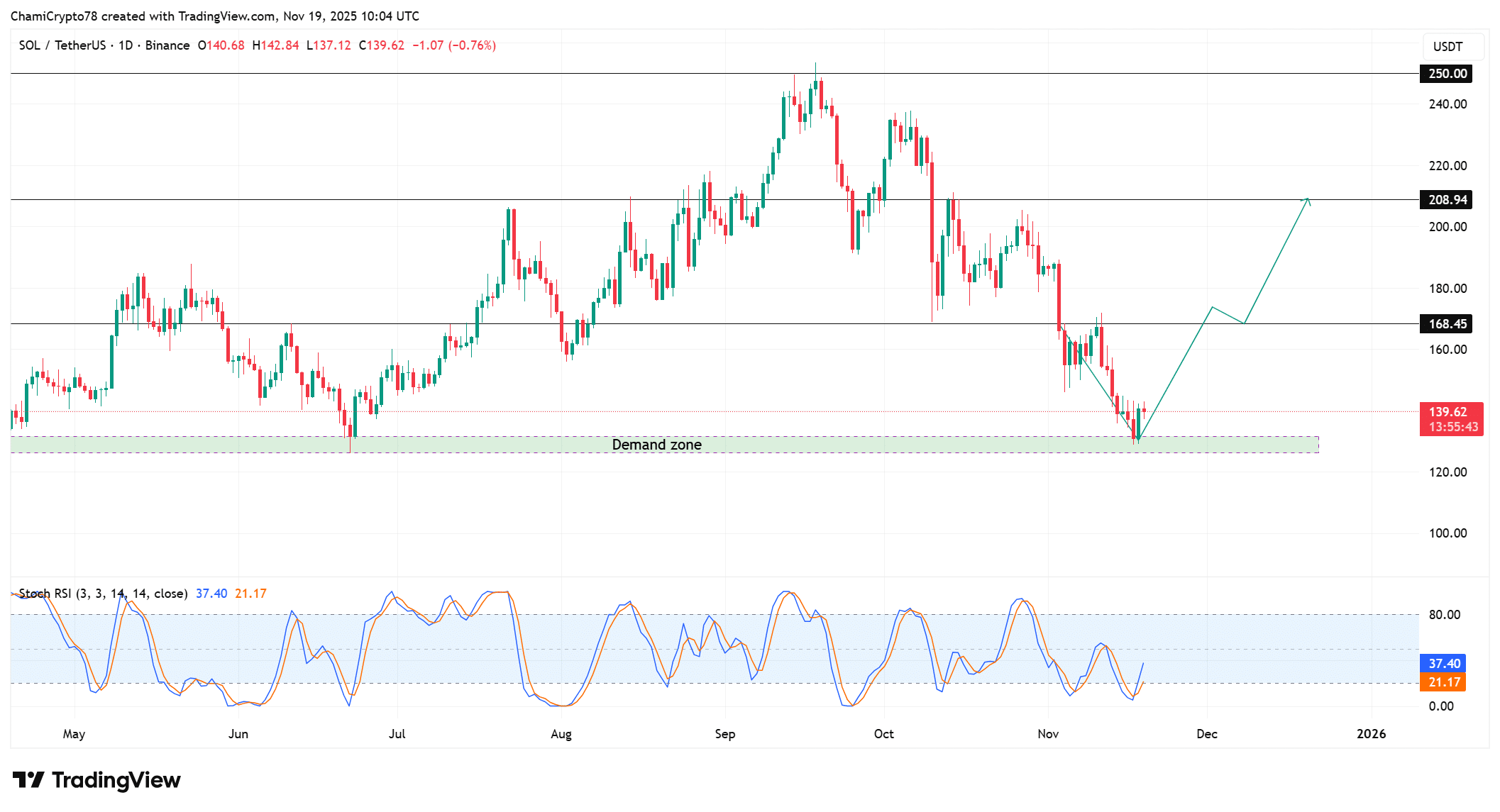

Following a substantial pullback, Solana is currently rebounding off the crucial $130 support zone. This area historically attracts strong buyer interest, and price action shows clear commitment from bulls as sellers fade. Notably, Solana’s chart is forming a higher-low structure—often a precursor to trend reversals—while the Stochastic RSI has just lifted from oversold territory, indicating renewed buyer momentum.

Immediate resistance lies at $168. A decisive break above this level could pave the way for a move to $208, the next major resistance and potential confirmation of a new uptrend.

Whale Activity: Are Big Investors Quietly Accumulating SOL?

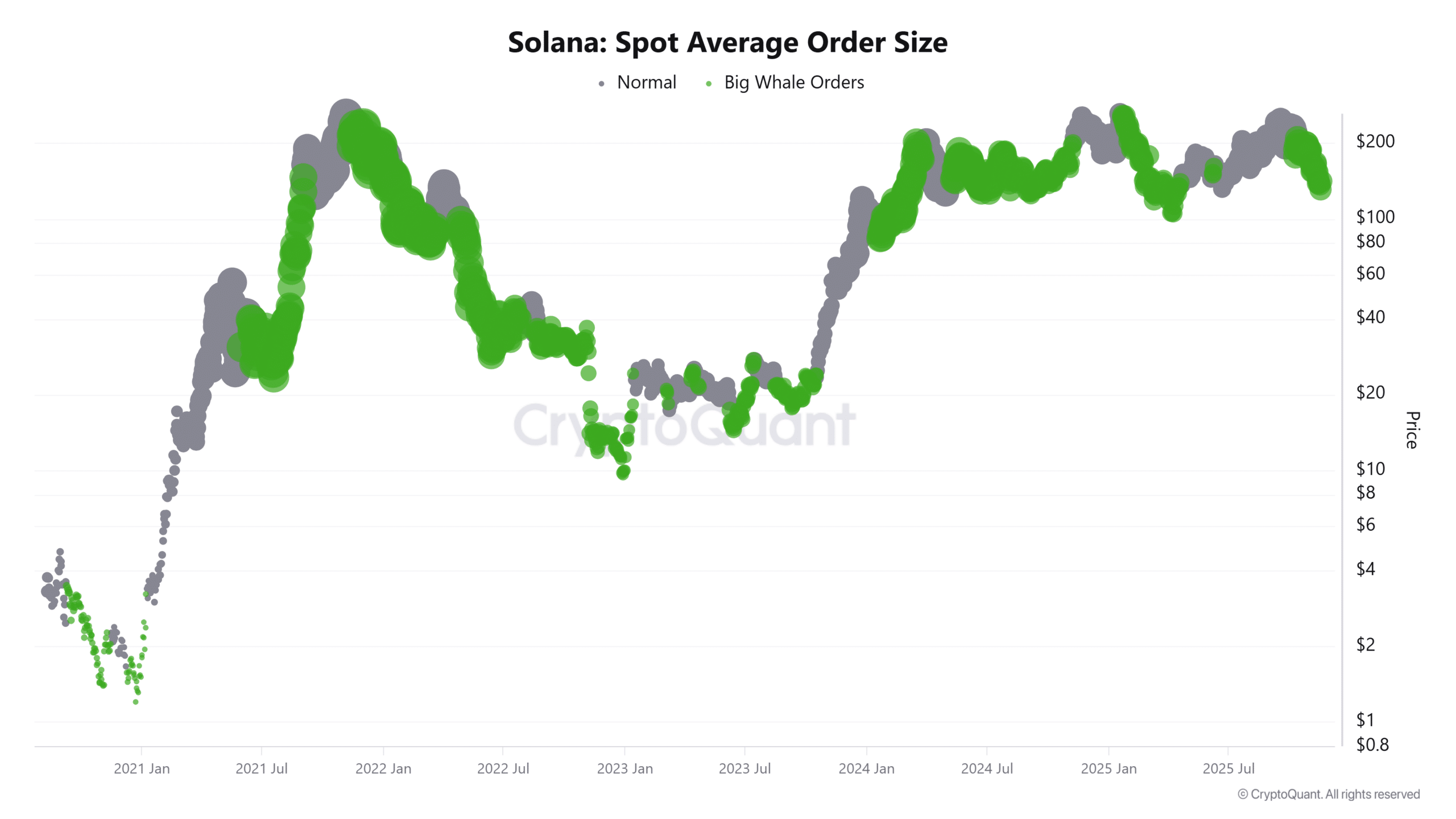

On-chain data reveals significant whale activity during this market dip. Recently, two newly created wallets withdrew 70,000 SOL from one exchange, while another removed over 100,000 SOL across four leading exchanges. These swift, sizable moves reflect purpose-driven accumulation rather than routine transfers, with aggressive buyers moving SOL into self-custody. Historically, such behavior often foreshadows price recoveries, as sophisticated actors seek to buy at optimal points of risk and reward.

Average spot order sizes have also surged, underlying this accumulation narrative.

Source: CryptoQuant

Trader Sentiment: Is the Market Ready for a Bullish Move?

Derivatives market data underscores a bullish turn in sentiment. 77.71% of positions across major exchanges are long, with a Long/Short Ratio of 3.49—a clear sign that the majority of traders are betting on further upside. This leveraged positioning reflects greater confidence, especially as price bounces from established demand zones.

Meanwhile, open interest in SOL futures has climbed 5% in just 24 hours, reaching $7.3 billion, according to CoinGlass. Funding rates, which turned positive, further indicate that traders are willing to pay a premium to maintain long exposure—a traditional marker of strengthened bullish conviction.

Spot market data also shows rising Cumulative Volume Delta (CVD), reinforcing that real buyers, not just speculators, are supporting the rally.

Institutional Flows: SOL ETFs Are Seeing Continuous Inflows

Institutional adoption is playing a growing role in the Solana price narrative. Solana-based spot ETFs have logged 15 consecutive days of net inflows, with US-based funds alone attracting over $8 million in a single session and $390 million in total inflows, according to SoSoValue. Assets under management now exceed $593 million.

In a landmark move, 21Shares launched its spot Solana ETF (TSOL) with $100 million in initial assets. Bloomberg data highlights that the broader Solana ETF universe is attracting daily inflows, even amidst periods of volatility and extreme market fear. Furthermore, major asset managers like VanEck are now offering SOL ETFs, enhancing credibility and liquidity for the asset.

Conclusion: Will Solana’s Price Recover from Here?

Multiple signals point to a potential rebound for Solana:

-

Technical structure: SOL is holding key demand zones and building a higher-low formation, with early momentum returning.

-

On-chain and spot market data: Whales are aggressively accumulating, and average trade sizes are rising, indicating strategic entry by high-value investors.

-

Trader positioning: Long bias in the derivatives market, coupled with increasing open interest and positive funding rates, supports a bullish outlook.

-

Institutional flows: Continuous spot ETF inflows highlight strong demand from both individual and institutional investors.

While risks such as market volatility and over-leveraged positions remain, this confluence of technical, on-chain, trading, and institutional support creates a compelling case for a Solana price recovery. If bulls can reclaim $168 and sustain momentum, the path toward $208—and a fresh uptrend—becomes increasingly likely.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.