Smart Money tracking strategies in the crypto market

This article provides a systematic study of how to identify, analyze, and track "Smart Money" in the cryptocurrency market. By building an on-chain data-based quantitative screening model, this framework provides affiliates with a three-stage approach to monitoring investor behavior: discovery, analysis, and tracking. Using tool-based methods to identify high-win-rate wallet addresses and execute copy trades under risk control is theoretically feasible, but this strategy carries high risk and requires full risk awareness.

Core insights:

• Smart money can be grouped into two types: institutional whale addresses and high-win-rate retail wallets.

• It is recommended to use a multi-dimensional validation mechanism, with screening criteria set as a win rate no lower than 65% and a historical PnL exceeding $300,000.

• The size of each trade copying Smart Money should be capped at 1% of your total assets.

• Use contract security checks and social trend analysis tools together with this approach.

Risk warning: The cryptocurrency market is highly volatile and carries risks of total asset loss, smart contract vulnerabilities, and fraud. This content does not constitute investment advice.

1. Definition and classification of Smart Money

"Smart Money" refers to the funds controlled by market participants who consistently earn excess returns in the cryptocurrency market. Such funds typically show strong market awareness, information access, or exceptional trade execution capabilities. Based on fund size and participant profile, Smart Money can be divided into two categories:

Category 1: Institutional whale wallets

• Participants: Investment institutions, crypto funds, and key opinion leaders (KOLs)

• Traits: Large single transactions and significant market influence

• Limitations: Due to widespread tracking, some of them have divided their capital to several wallets to avoid monitoring.

Category 2: High-win-rate retail wallets

• Participants: Individual investors with strong trading skills

• Traits: Demonstrates strong performance across spot trading, yield farming, staking, and airdrops.

• Advantage: Lower market visibility makes their behavioral patterns more informative as references.

2. How to identify Smart Money

This article builds an analysis framework that combines paid and free tools:

| Tool type |

Example |

Core features |

Cost |

|

| Comprehensive tracking platform |

Nansen |

Smart Money tagging and fund flow analysis |

Paid |

|

| On-chain data analytics |

Dune Analytics |

Whale address filtering and custom queries |

Free |

|

| Wallet tracking tools |

DeBank / Arkham |

Trading history and portfolio analysis |

Free |

|

| DEX trading data |

DEXTools / Dex Screener |

Early trader identification and PnL rankings |

Free / paid |

|

Initial screening – identifying potential Smart Money wallets

Steps (taking Solana as an example):

1. Select a pool of high-growth assets

○ Log in to the DEXTools platform

○ Choose a target public blockchain (e.g. Solana)

○ Sort by price increase (Gainers) to filter active tokens

2. Identify early traders

○ Open the token details page

○ Check the "Trade history" module

○ Sort by date to lock in the earliest transaction addresses

3. Perform quantitative analysis of PnL

○ View the number of transactions for each address in the "Others" section

○ Extract the PnL (profit and loss) data

○ Copy the addresses with a high PnL (use the "Maker" button)

Free alternatives:

Use the "Top Traders" feature on Dex Screener. This ranks trader wallets sorted by PnL, improving screening efficiency.

Reason:

For high-performing tokens, the earliest trading addresses typically fall into two categories:

• Project insiders (with information advantage)

• Professional traders (with discovery capabilities)

Quantitative validation – analyzing the wallet's historical performance

Key indicator system:

| Indicator name |

Threshold |

Data source |

Implication |

| Win rate |

≥65% |

Solsniffer |

Percentage of profitable trades |

| Total PnL |

>$300,000 |

Solsniffer |

Historical profitability |

| Portfolio structure |

Qualitative analysis |

CoinStats |

Current portfolio composition |

| Entry cost |

Qualitative analysis |

CoinStats |

Cost advantage assessment |

1. Use Solsniffer to verify historical win rate and total PnL data.

2. Use CoinStats to analyze the current portfolio's composition and cost basis.

3. Record wallet addresses that meet the criteria and build a candidate pool.

Thresholds can be adjusted based on the your risk preferences; the above standards are relatively conservative.

Continuous monitoring – build a tracking mechanism

We propose two tracking strategies for our affiliates:

Strategy A: Static position copying

• Best for: Medium- to long-term planning

• Logic: Buy what Smart Money wallets are holding

Strategy B: Dynamic trade copying

• Best for: Short-term trading

• Logic: Use trading bots to copy new trades made by target wallets in real time

3. Risk control and execution framework

Execution standards for static position copying

Complete two checks before buying Smart Money holdings:

Verification 1: Contract security check

| Tool |

Targets |

Risk level |

Risk mitigation |

| RugCheck |

Token contract address |

Danger / Warning / Good |

Exclude "Danger" tokens immediately |

Key risks:

• Liquidity lock-up status

• Contract permission settings (minting, trading suspension, etc.)

• Token holder address concentration

• Ratio of token allocation to developers

Verification 2: Social popularity assessment

| Tool |

Metrics |

Evaluation criteria |

| TwitterScore |

Follower base of the project's official social media accounts |

A scoring system based on X (formerly Twitter) data |

| TwitterScore |

Community activity |

Engagement rate and growth trend |

| TwitterScore |

Institutional interest |

VC attention tags |

Logic: An active community and strong institutional interest are leading indicators of a project's durability and hype potential.

Position management principles

Strictly enforce the 1% rule:

• Funds allocated to any single asset must not exceed 1% of total assets.

• Total exposure to high-risk strategies like Smart Money tracking must not exceed 5% of total assets.

• Set a stop-loss target (recommended: –30% to –50%).

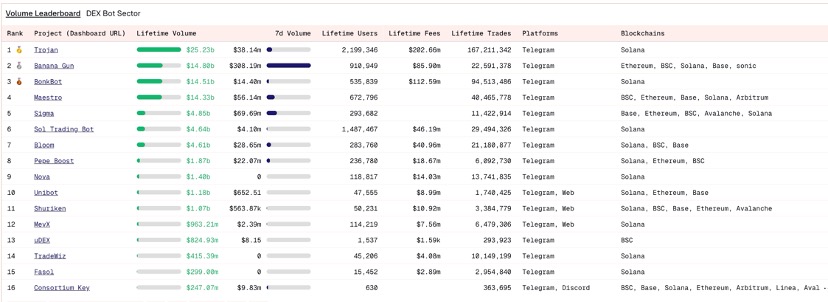

Tool selection for dynamic trade copying

Comparing mainstream trading bots

https://dune.com/whale_hunter/dex-trading-bot-wars

Functional requirements:

• Real-time monitoring of transactions from specified wallet addresses.

• Automated copying of buy orders (with customizable delay and fund allocation ratio).

• Support for TP/SL targets.

• Gas fee optimization

Risk warning: Trading bots involve wallet private key authorization. Choose audited top-tier platforms and use a dedicated copy trading wallet (avoid using your primary wallet).

1. Establish a standard operating procedure (SOP) for wallet screening.

2. Do not place any buy orders until the contract security check is completed.

3. Strictly enforce to the 1% rule — the position of any single asset must not exceed 1% of total assets.

4. Set stop-loss targets to avoid emotion-driven trading.

5. Record every transaction and regularly review and optimize the strategy.

1. Blindly follow unverified wallet addresses

2. Invest more beyond your risk tolerance

3. Skip contract security checks

4. Use this strategy as your primary investment method

Risk warning:

The strategies in this report involve very high market risk. Crypto market risks include but are not limited to:

• Complete loss of principal due to asset collapse

• Smart contract vulnerabilities

• Fraud and rug pulls

• Liquidity risk

• Changes in regulatory policies

Disclaimer:

The information in this report is for our affiliates' reference only and does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance. Bitget shall not be held liable for any losses incurred from the use of this information. Investors must comply with applicable digital-asset laws and regulations in their jurisdiction. There is no employment or agency relationship between Bitget and its affiliates.